Forum/Town Hall: To gather information regarding the Administration of the National Flood Insurance Program (NFIP) in New York State and to explore ways to ensure adequate flood insurance coverage for homeowners

181 State Street, Van Buren Hearing Room A, 2nd Floor

Albany,

NY

12247

- Insurance

SUBJECT: Flood Insurance

PURPOSE: To gather information regarding the administration of the National Flood Insurance Program (NFIP) in New York State and to explore ways to ensure adequate flood insurance coverage for homeowners.

Monday, March 12

10:30AM

Hearing Room A

Legislative Office Building

Albany, NY

Hurricane Irene and Tropical Storm Lee caused significant and devastating damage to properties across a large swath of New York State, particularly upstate, leading to the loss of homes, properties, public infrastructure, businesses and income. Individuals and families are still, to this day, struggling to recover after having lost everything they own.

As many individuals unfortunately discovered, traditional homeowners’ policies generally do not cover any losses associated with flooding. Homeowners who live in a designated flood zone and hold a federally backed mortgage are required to purchase a separate flood insurance policy through the National Flood Insurance Program (NFIP). Flood insurance may also be purchased voluntarily by homeowners living outside of a designated flood zone, as long as their municipality participates in the NFIP.

The NFIP, which falls under the auspices of the Federal Emergency Management Agency (FEMA), relies on private insurance companies to administer flood insurance policies. NFIP policies can be purchased through property and casualty insurance agents.

For many homeowners who had flood insurance policies, the claims process has been extremely difficult and oftentimes traumatic. The purpose of this roundtable is to gather information about the NFIP guidelines and the manner in which insurance companies administer the program in New York. The committee will also explore any possible legislative remedies to address the concerns raised by homeowners.

Oral testimony will be accepted by invitation only. The committee would appreciate advance receipt of any prepared statements. Written comments will also be accepted and may be sent to the attention of the chairman in 430 Capital.

In order to further publicize this roundtable, please inform interested parties and organizations of the committee’s interest in hearing testimony from all sources.

In order to meet the needs of those who may have a disability, the legislature, in accordance with its policy of non-discrimination on the basis of disability, as well as the 1990 Americans with Disabilities Act (ADA), has made its facilities and services available to all individuals with disabilities. For individuals with disabilities, accommodations will be provided, upon reasonable request, to afford such individuals access and admission to legislative facilities and activities.

New York State Senate Standing Committee on Insurance

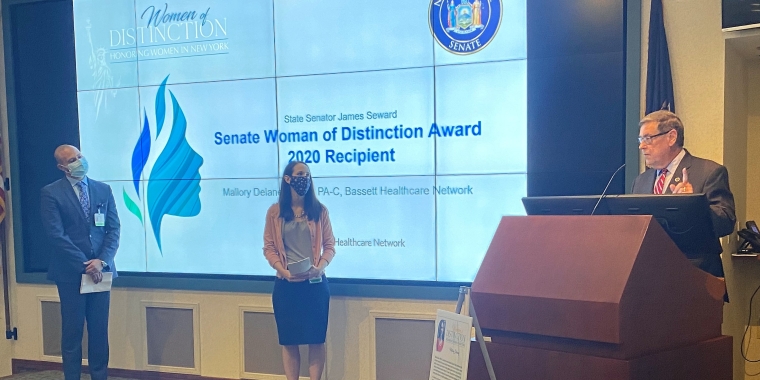

Senator James L. Seward, Chairman

Senator John J. Bonacic

42nd Senate District

How a Bill Becomes Law

Learn More-

Senator has new policy idea

-

Idea is drafted into a Bill

-

Bill undergoes committee process

-

Senate and Assembly pass bill

-

Bill is signed by Governor