|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| May 11, 2020 |

referred to commerce, economic development and small business |

Senate Bill S8319

2019-2020 Legislative Session

Sponsored By

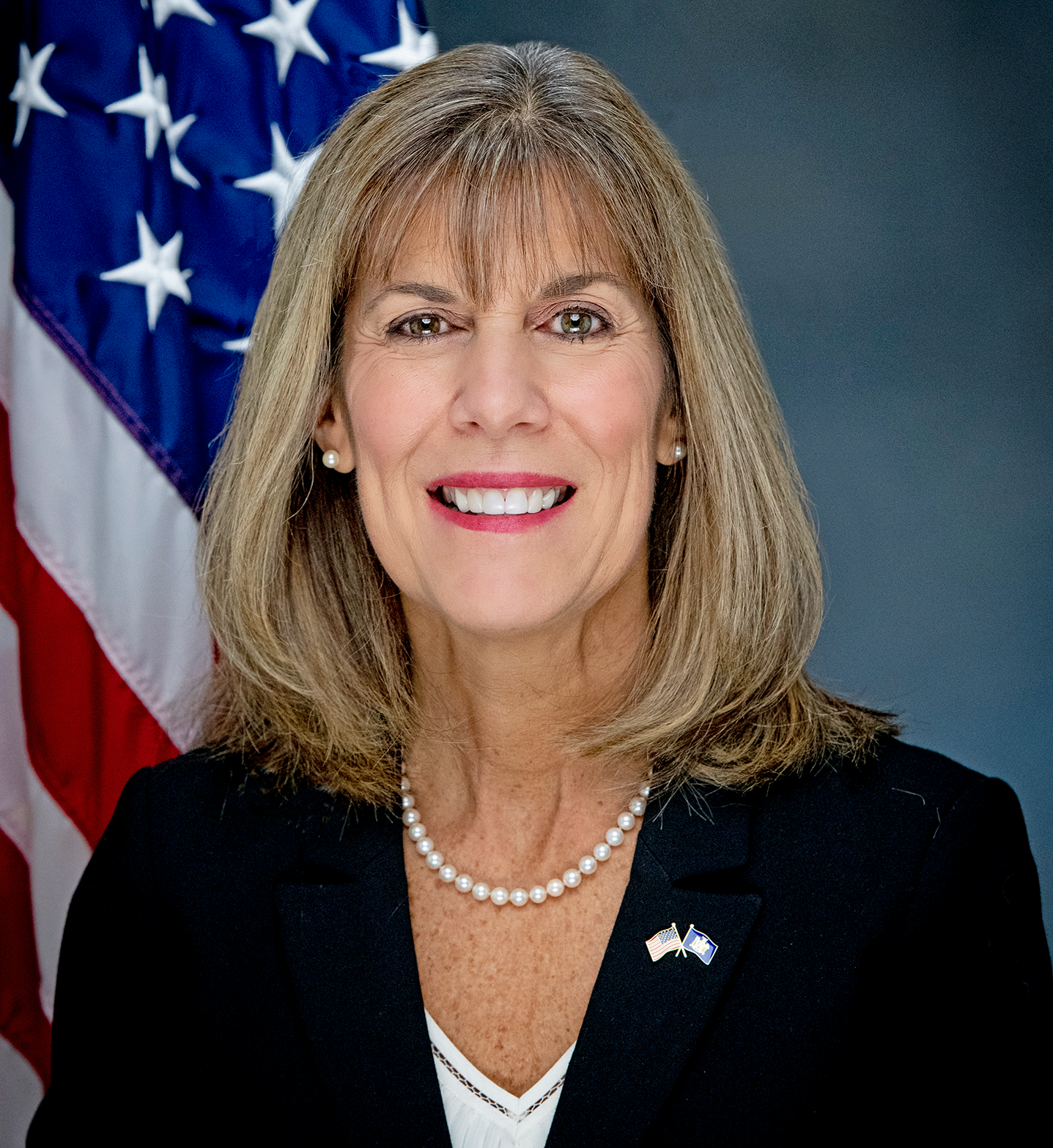

(R, C, IP, RFM) Senate District

Archive: Last Bill Status - In Senate Committee Commerce, Economic Development And Small Business Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

co-Sponsors

(R, C, IP) Senate District

(R, C) 57th Senate District

(R) Senate District

(R, C, IP) Senate District

2019-S8319 (ACTIVE) - Details

- Current Committee:

- Senate Commerce, Economic Development And Small Business

- Law Section:

- Economic Development

- Versions Introduced in 2021-2022 Legislative Session:

-

S2028

2019-S8319 (ACTIVE) - Summary

Creates the coronavirus business interruption and municipal recovery program to provide grants through the empire state development corporation to businesses and municipalities which sustain economic losses as a result of the COVID-19 emergency; authorizes the issuance of bonds to fund the grants.

2019-S8319 (ACTIVE) - Sponsor Memo

BILL NUMBER: S8319

SPONSOR: AKSHAR

TITLE OF BILL:

An act to create the coronavirus business interruption and municipal

recovery program to provide grants to businesses and municipalities

which sustain economic losses as a result of the COVID-19 emergency

PURPOSE OR GENERAL IDEA OF BILL:

This bill would establish a Coronavirus Business Interruption and Munic-

ipal Recovery Program, for businesses and municipalities, to provide

grants for income and/or revenue loss, during the coronavirus outbreak,

from the Empire State Development Corporation.

SUMMARY OF SPECIFIC PROVISIONS:

Section One of this Bill would establish the Coronavirus Business Inter-

ruption and Municipal Recovery Program. Subdivision 1 of Section One of

this bill would establish the definitions for the Coronavirus Business

2019-S8319 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

8319

I N S E N A T E

May 11, 2020

___________

Introduced by Sens. AKSHAR, AMEDORE, BORRELLO, BOYLE, FLANAGAN, FUNKE,

GALLIVAN, GRIFFO, HELMING, JACOBS, JORDAN, LANZA, LAVALLE, LITTLE,

O'MARA, ORTT, RANZENHOFER, RITCHIE, ROBACH, SERINO, SEWARD, TEDISCO --

read twice and ordered printed, and when printed to be committed to

the Committee on Commerce, Economic Development and Small Business

AN ACT to create the coronavirus business interruption and municipal

recovery program to provide grants to businesses and municipalities

which sustain economic losses as a result of the COVID-19 emergency

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. There is hereby created the coronavirus business inter-

ruption and municipal recovery program.

1. Definitions. The following terms shall have the following meanings:

(a) The term "for profit business" shall mean any sole proprietorship,

partnership, limited liability company or corporation operating as a

business for profit in New York State.

(b) The term "not-for-profit corporation" shall mean any not-for-pro-

fit corporation operating or providing services in New York State.

(c) The term "authority" shall mean the urban development corporation,

operating as the empire state development corporation.

(d) The term "municipality" shall mean any county, city, town,

village, school district, fire district or special district.

(e) The term "direct economic loss" shall mean the amount of the

reduction of revenue or income sustained by a for profit business or

not-for-profit corporation, as a result of a coronavirus event, for any

month during the coronavirus period, as determined in accordance with

the private sector loss formula.

(f) The term "municipal loss" shall mean the amount of the reduction

of revenue, or increase in municipal expenses sustained by a munici-

pality, as a result of a coronavirus event, for any month during the

coronavirus period, as determined in accordance with the government

sector loss formula.

(g) The term "coronavirus period" shall mean the period between Janu-

ary 1, 2020 through April 30, 2021.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.