|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| May 03, 2022 |

referred to veterans' affairs delivered to assembly passed senate |

| Apr 27, 2022 |

advanced to third reading |

| Apr 26, 2022 |

2nd report cal. |

| Apr 25, 2022 |

1st report cal.803 |

| Jan 05, 2022 |

referred to veterans, homeland security and military affairs returned to senate died in assembly |

| Mar 18, 2021 |

referred to veterans' affairs delivered to assembly passed senate |

| Feb 10, 2021 |

amended on third reading 1378a |

| Feb 01, 2021 |

advanced to third reading |

| Jan 26, 2021 |

2nd report cal. |

| Jan 25, 2021 |

1st report cal.153 |

| Jan 11, 2021 |

referred to veterans, homeland security and military affairs |

Senate Bill S1378

2021-2022 Legislative Session

Sponsored By

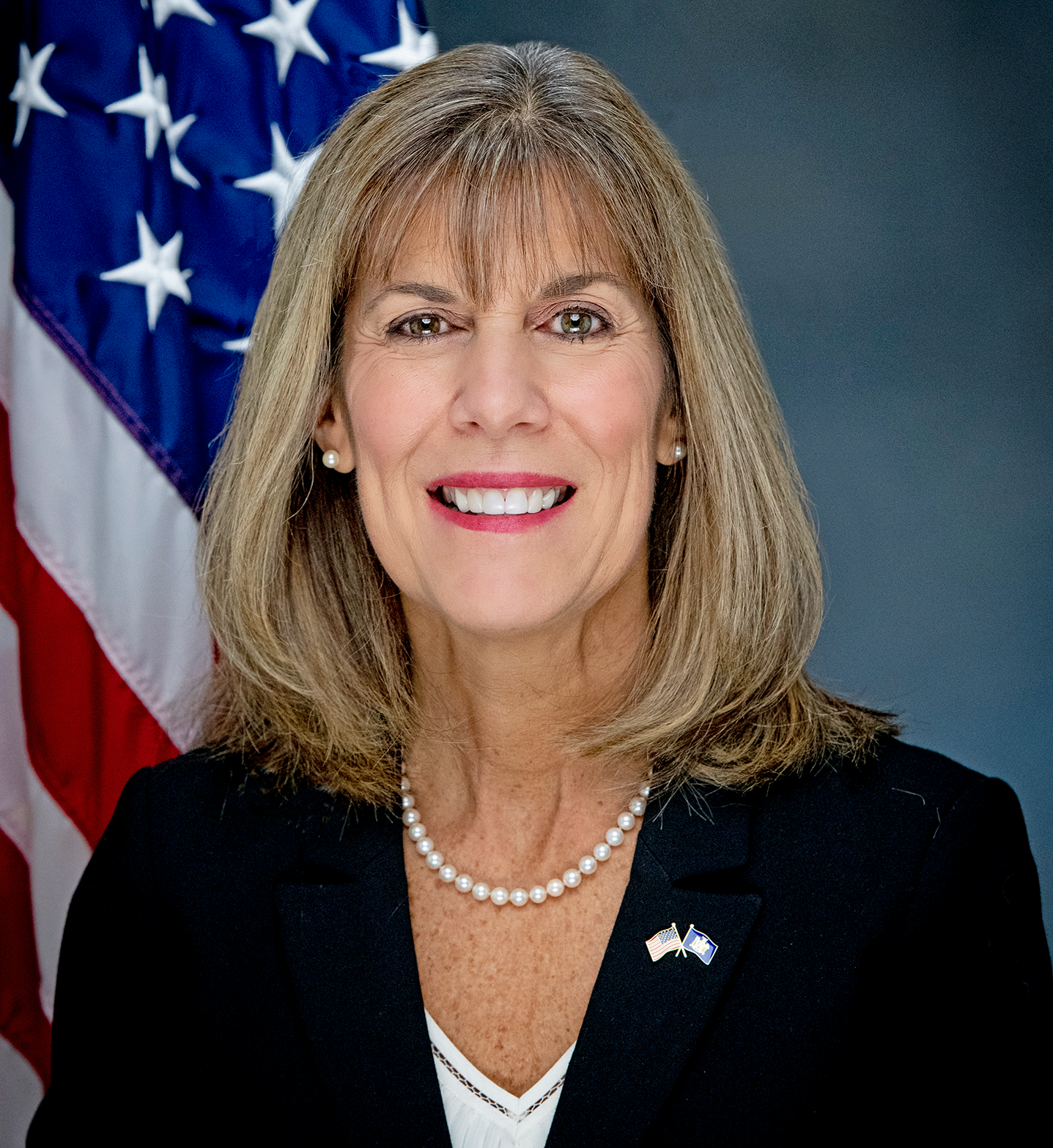

(D) Senate District

Archive: Last Bill Status - In Assembly Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

Votes

Bill Amendments

co-Sponsors

(D, WF) 40th Senate District

(D, WF) 41st Senate District

(R, C, IP, RFM) Senate District

(D, IP, WF) Senate District

2021-S1378 - Details

2021-S1378 - Sponsor Memo

BILL NUMBER: S1378

SPONSOR: BROOKS

TITLE OF BILL:

An act to amend the real property tax law, in relation to a real proper-

ty tax exemption for property owned by certain persons performing active

duty in a combat zone

PURPOSE:

The purpose of this bill is provide a property tax exemption for active

duty military personnel

SUMMARY OF PROVISIONS:

Section 1. amends the real property tax law by adding a new section

458-c which provides the authority for municipalities to enact a tax

exemption equal to 15% of the assessed value of a residential property

owned by a full-time active duty member of the United States armed forc-

es. Further, this section provides an additional 10% property tax

2021-S1378 - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

1378

2021-2022 Regular Sessions

I N S E N A T E

January 11, 2021

___________

Introduced by Sens. BROOKS, HARCKHAM, KAPLAN, LIU -- read twice and

ordered printed, and when printed to be committed to the Committee on

Veterans, Homeland Security and Military Affairs

AN ACT to amend the real property tax law, in relation to a real proper-

ty tax exemption for property owned by certain persons performing

active duty in a combat zone

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. The real property tax law is amended by adding a new

section 458-d to read as follows:

§ 458-D. ACTIVE DUTY SERVICE. 1. AS USED IN THIS SECTION:

(A) "ACTIVE MILITARY SERVICE OF THE UNITED STATES" AND "IN THE ARMED

FORCES OF THE UNITED STATES" SHALL MEAN FULL-TIME DUTY IN THE ARMY,

NAVY, MARINE CORPS, AIR FORCE OR COAST GUARD OF THE UNITED STATES.

(B) "COMBAT ZONE" SHALL MEAN AREAS DESIGNATED BY AN EXECUTIVE ORDER

FROM THE PRESIDENT OF THE UNITED STATES IN WHICH THE UNITED STATES ARMED

FORCES ARE ENGAGING OR HAVE ENGAGED IN COMBAT.

(C) "QUALIFIED OWNER" MEANS AN ACTIVE MILITARY SERVICE MEMBER WHOSE

MILITARY DUTY STATION PLACES HIS OR HER RESIDENCE WITHIN THE BOUNDARIES

OF NEW YORK STATE.

(D) "QUALIFIED RESIDENTIAL REAL PROPERTY" MEANS PROPERTY OWNED BY A

QUALIFIED OWNER WHICH IS USED EXCLUSIVELY FOR RESIDENTIAL PURPOSES;

PROVIDED, HOWEVER, THAT IN THE EVENT THAT ANY PORTION OF SUCH PROPERTY

IS NOT USED EXCLUSIVELY FOR RESIDENTIAL PURPOSES, BUT IS USED FOR OTHER

PURPOSES, SUCH PORTION SHALL BE SUBJECT TO TAXATION AND ONLY THE REMAIN-

ING PORTION USED EXCLUSIVELY FOR RESIDENTIAL PURPOSES SHALL BE SUBJECT

TO THE EXEMPTION PROVIDED BY THIS SECTION.

(E) "LATEST STATE EQUALIZATION RATE" MEANS THE LATEST FINAL EQUALIZA-

TION RATE ESTABLISHED BY THE STATE BOARD PURSUANT TO ARTICLE TWELVE OF

THIS CHAPTER.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD01238-01-1

co-Sponsors

(D) Senate District

(D, WF) 40th Senate District

(R, C, IP) 54th Senate District

(D, WF) 41st Senate District

2021-S1378A (ACTIVE) - Details

2021-S1378A (ACTIVE) - Summary

Authorizes municipalities to offer a real property tax exemption for property owned by certain persons performing active duty in a combat zone in an amount to the extent of fifteen percent of the assessed value of the real property, but shall not exceed twelve thousand dollars.

2021-S1378A (ACTIVE) - Sponsor Memo

BILL NUMBER: S1378A

SPONSOR: BROOKS

TITLE OF BILL:

An act to amend the real property tax law, in relation to a real proper-

ty tax exemption for property owned by certain persons performing active

duty in a combat zone

PURPOSE:

The purpose of this bill is provide a property tax exemption for active

duty military personnel

SUMMARY OF PROVISIONS:

Section 1. amends the real property tax law by adding a new section

458-c which provides the authority for municipalities to enact a tax

exemption equal to 15% of the assessed value of a residential property

owned by a full-time active duty member of the United States armed forc-

es. Further, this section provides an additional 10% property tax

2021-S1378A (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

1378--A

Cal. No. 153

2021-2022 Regular Sessions

I N S E N A T E

January 11, 2021

___________

Introduced by Sens. BROOKS, HARCKHAM, HINCHEY, JORDAN, KAPLAN, LIU,

REICHLIN-MELNICK -- read twice and ordered printed, and when printed

to be committed to the Committee on Veterans, Homeland Security and

Military Affairs -- reported favorably from said committee, ordered to

first and second report, ordered to a third reading, amended and

ordered reprinted, retaining its place in the order of third reading

AN ACT to amend the real property tax law, in relation to a real proper-

ty tax exemption for property owned by certain persons performing

active duty in a combat zone

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. The real property tax law is amended by adding a new

section 458-d to read as follows:

§ 458-D. ACTIVE DUTY SERVICE. 1. AS USED IN THIS SECTION:

(A) "ACTIVE MILITARY SERVICE OF THE UNITED STATES" AND "IN THE ARMED

FORCES OF THE UNITED STATES" SHALL MEAN FULL-TIME DUTY IN THE ARMY,

NAVY, MARINE CORPS, AIR FORCE, COAST GUARD, OR ARMY, AIR, AND NAVY

NATIONAL GUARD OF THE UNITED STATES.

(B) "COMBAT ZONE" SHALL MEAN AREAS DESIGNATED BY AN EXECUTIVE ORDER

FROM THE PRESIDENT OF THE UNITED STATES IN WHICH THE UNITED STATES ARMED

FORCES ARE ENGAGING OR HAVE ENGAGED IN COMBAT.

(C) "QUALIFIED OWNER" MEANS AN ACTIVE MILITARY SERVICE MEMBER WHOSE

MILITARY DUTY STATION PLACES HIS OR HER RESIDENCE WITHIN THE BOUNDARIES

OF NEW YORK STATE.

(D) "QUALIFIED RESIDENTIAL REAL PROPERTY" MEANS PROPERTY OWNED BY A

QUALIFIED OWNER WHICH IS USED EXCLUSIVELY FOR RESIDENTIAL PURPOSES;

PROVIDED, HOWEVER, THAT IN THE EVENT THAT ANY PORTION OF SUCH PROPERTY

IS NOT USED EXCLUSIVELY FOR RESIDENTIAL PURPOSES, BUT IS USED FOR OTHER

PURPOSES, SUCH PORTION SHALL BE SUBJECT TO TAXATION AND ONLY THE REMAIN-

ING PORTION USED EXCLUSIVELY FOR RESIDENTIAL PURPOSES SHALL BE SUBJECT

TO THE EXEMPTION PROVIDED BY THIS SECTION.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.