Ritchie Reminds Holiday Shoppers of Sales Tax Break

Patty Ritchie

November 19, 2012

No State Sales Tax on Clothing Purchases of Up to $110

In advance of the holiday shopping season, State Senator Patty Ritchie is reminding consumers of the state sales tax break on clothing purchases of up to $110.

The repeal of the sales tax—which happened last spring—is good news for holiday shoppers, who are expected to spend an average of $750 on holiday purchases this year. The sales tax break saves a typical family of four nearly $200 annually.

“For many people, the holiday season is the most expensive time of the year,” said Senator Ritchie. “From elaborate meals and decorations to buying gifts for friends and family members, it all adds up.”

“This sales tax break allows consumers to share in the holiday spirit while at the same time, helps keep more money in the pockets of hardworking New Yorkers.”

New York exempted clothing sales from the 4 percent sales tax until 2009, when the Legislature and former Governor raised over 100 taxes and fees, along with billions of dollars in new spending.

For many, the holiday shopping season kicks-off on Black Friday, but Senator Ritchie is also reminding consumers about Small Business Saturday, an event taking place on November 24th , which encourages shoppers to celebrate and support small businesses in their communities. For more information on Small Business Saturday click here.

In addition to saving in stores, consumers are also able to take advantage of the state sales tax break on clothing purchases when they shop online. While online shopping can be convenient, Senator Ritchie reminds consumers that scams and fraud are extremely common in the virtual marketplace. For tips on how you can protect yourself, view the New York State Attorney General’s “Online Purchasing Tips".

Share this Article or Press Release

Newsroom

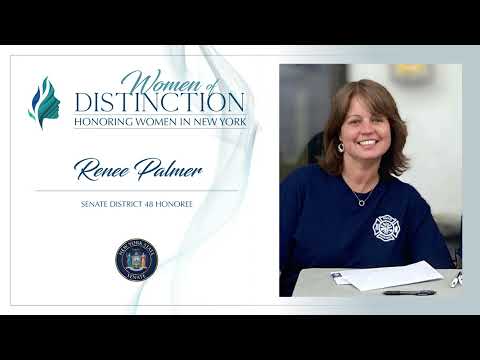

Go to NewsroomRitchie Announces Renee Palmer as 2022 "Woman of Distinction"

September 1, 2022

Senator Ritchie 2022 Woman of Distinction

August 26, 2022