Free Tax Prep and Financial Counseling with DCWP

- tax prep

- Jamaal T. Bailey

- Community Events

- Addabbo

- Elaine Phillips

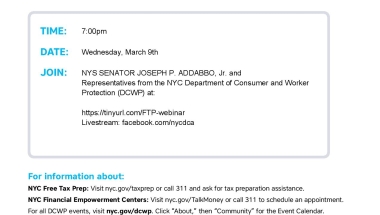

As residents prepare to file their taxes, State Senator Joseph P. Addabbo, Jr. is partnering with the Department of Consumer and Worker Protection (DCWP) to bring a free virtual webinar for a discussion about free tax prep for his constituents.

On Wednesday, March 9, from 7 p.m. to 8 p.m., representatives from DCWP will be live on the webinar to provide a Free Tax Prep presentation for all who register. During the presentation, SDCWP will discuss free filing options for New Yorkers earning $50,000 or less, as well as NYC Financial Empowerment Centers, which offer free one-on-one professional financial counseling for all New Yorkers. To join this free webinar, visit https://tinyurl.com/FTP-webinar, or to view a livestream of the webinar, visit facebook.com/nycdca.

DCWP’s City-funded NYC Free Tax Prep program offers multiple options to file for free, including in-person, drop-off, virtual and online services. Families with dependents who earned $72,000 or less in 2020 and individuals who earned $50,000 or less can use NYC Free Tax Prep. Filers should check the eligibility requirements and choose the filing option that is best for them. Anyone who lives or works in New York City can use NYC Free Tax Prep.

“Tax season is here and the deadline to file your taxes is right around the corner,” Addabbo said. “That is why I am sponsoring this Free Tax Preparation and Financial Counseling webinar in conjunction with DCWP. Your taxes may be different from what you’re used to in 2021, especially if you were impacted by the COVID pandemic by losing a job or having received unemployment benefits. If you qualify, you can have your taxes done for free through the NYC Free Tax Prep program.”

The NYC Free Tax Prep services include:

- In-Person Tax Prep: sit down with a volunteer preparer. At in-person tax prep sites, knowledgeable IRS certified Volunteer Income Tax Assistance (VITA)/Tax Counseling for the Elderly (TCE) volunteer preparers help filers complete an accurate tax return. Nearly 50 sites across the city are currently open and more will be opening in the coming weeks.

- Drop-off Service: drop off your documents and pick up your completed return later. With drop-off service, filers can drop off their tax documents and pick up the completed return later.

- Virtual Tax Prep: like in-person free filing but online. Virtual Tax Prep is an online service where an IRS certified VITA/TCE volunteer preparer will video conference with filers to help prepare their tax return using a secure digital system. Filers can submit photos or scans of tax documents to the preparer, confirm their identity, and complete their return by video call with a preparer. Filers will need access to a computer, tablet, or smartphone; a stable internet connection; and the ability to download secure video conference software.

- Assisted Self-Preparation: free online tax prep on your own or with help. Assisted Self-Preparation allows filers to complete their tax return online on their own and an IRS certified VITA/TCE volunteer preparer will be available by phone or email to answer questions. Filers will need access to a computer, tablet, or smartphone; a stable internet connection; an email address, and their 2020 adjusted gross income (AGI) or self-select PIN.

In addition to the Free Tax Prep services, attendees of the webinar will also learn about several tax credits and who can qualify for them. Claiming even one of these tax credits this tax season could equal thousands of dollars.

- Child Tax Credit (CTC): Parents and caregivers with children younger than 18 can get up to $3,000 or $3,600 per child depending on the child’s age. Filers do not need to have had income to claim the credit. Families who got advance payments in 2021, must file in 2022 to get the rest of their money. This includes families who signed up online using the IRS Non-filer Portal or GetCTC.org. Only the children being claimed need to have Social Security Numbers (SSN); the filer does not need a SSN and can file using an Individual Taxpayer Identification Number (ITIN).

- Earned Income Tax Credit (EITC): EITC is available to working families and individuals with low and moderate incomes. Now filers who are as 19 and older with or without children can claim up to $6,728 depending on the number of qualifying children.

- Child and Dependent Care Credit (CDCC): Working families who pay for childcare for children under 13 or the care of dependent adults can get back up to $4,000 in care expenses for one qualifying person and up to $8,000 for two or more people.

How a Bill Becomes Law

Learn More-

Senator has new policy idea

-

Idea is drafted into a Bill

-

Bill undergoes committee process

-

Senate and Assembly pass bill

-

Bill is signed by Governor