2015-16 State Budget Supports Important Programs

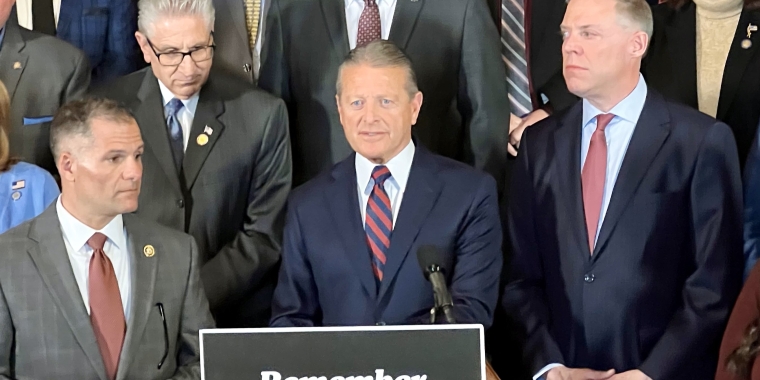

Patrick M. Gallivan

April 1, 2015

Senator Patrick M. Gallivan (R-C-I, Elma) says the $142-billion 2015-16 state budget provides critical funding to important state programs while controlling the size and cost of government. The state’s fifth consecutive on-time budget keeps spending within a two-percent cap, increases aid to education, rejects tax increases and provides property tax relief for homeowners. The spending plan also includes funding for regional assets such as Roswell Park Cancer Institute, the NFTA and Shea’s Performing Arts Center.

Public schools in New York will see a substantial increase in funding. The budget provides an additional $1.4 billion for education, hundreds of millions of dollars over what the governor proposed.

“This budget includes good financial news for our public schools,” Gallivan said. “The increased aid will help districts maintain, and in some cases, restore important programs. It will also help control local property taxes.”

The new state budget also dramatically reduces what remains of the Gap Elimination Adjustment (GEA), which was first imposed on schools in 2010. GEA cuts are being reduced by nearly 60 percent and the Senate will continue to work towards the full elimination of the GEA next year. Gallivan sponsored legislation (S.2473) to eliminate the GEA and will continue to push for passage of the bill.

“I believe the GEA should be eliminated once and for all,” Gallivan said. “While that didn’t happen this year, I am pleased that we took a major step forward in limiting the negative impact the GEA has on our school districts, both urban and rural.”

The final budget also includes a blueprint for reforms designed by the State Education Department to improve performance in the classroom, reduce over-testing and promote excellence in teaching.

"State Education officials will seek input from teachers and parents and make recommendations for final approval to the Board of Regents, consistent with current law," Gallivan said.

Homeowners will see meaningful property tax relief this year with $3.2 billion designated to fully fund the STAR and Enhanced STAR programs. Ongoing pension and Medicaid reforms will provide savings to local governments and will help reduce local property taxes.

The budget also provides funding to help rebuild New York’s infrastructure, including an additional $1-billion to repair and replace roads and bridges. The budget makes a record investment of $488 million to support local highway, road and bridge projects through the Consolidated Local Street and Highway Program (CHIPS). This includes $50-million to address damage caused by this year’s severe winter weather.

“This investment in our infrastructure will not only improve the safety of our roads, it will help create jobs and support continued growth of our economy,” Gallivan said.

Agriculture will receive an additional $12-million in funding for programs that support farmers, agriculture technology and research, including the “Grown in New York” plan to better connect farmers and consumers and promote locally produced foods. The budget also supports programs to assist beginning farmers and to encourage the next generation of farmers.

Several regional programs and institutions are also receiving critical funding in the budget:

· $15.5 million restored to Roswell Park Institute

· $10 million for the Niagara Frontier Transportation Authority

· $250,000 for Shea’s Performing Arts Center

· $265,000 for flood mitigation in Livingston County

· Allows West Seneca Children’s Psychiatric Center to remain open for one year

The budget also includes an agreement to strengthen the state’s ethics and disclosure laws, improve transparency and restore public trust. The legislative and executive branch will now be required to disclose more information about the sources of outside income than has ever before been required in state history.

-30-

Share this Article or Press Release

Newsroom

Go to NewsroomHighway Funding Must Be a Priority

April 4, 2024