Senate Passes Measures To Ease The Tax Burden For Small Businesses and Farmers

April 21, 2016

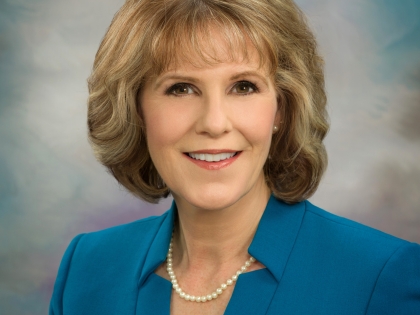

ALBANY – Providing tax relief for hardworking New Yorkers remains at the forefront of the agenda for Senator Catharine Young (R,C,I- 57th District), Chair of the Senate Finance Committee. She continued this mission recently by passing several measures that would provide relief for small businesses and farmers.

Cosponsored by Senator Young, Senate Bill 7235 expands the Personal Income Tax exemptions to provide small businesses with costs savings.

The bill would increase the Personal Income Tax (PIT) exemption from 5 percent to 20 percent for farm income beginning on or after January 1, 2017; increases the PIT exemption from 5 percent to 15 percent for small businesses; eliminates the employee qualification; raises the income eligibility threshold from $250,000 to $500,000; and expands small business eligibility to include any business that files under PIT, regardless of how the business is structured. The bill also reduces the Corporate Franchise Tax business income rate for small businesses from 6.5 percent to 2.5 percent, and increases the threshold for corporations to be considered small corporations from $290,000 to $400,000 and allows businesses with incomes between $400,000 and $500,000 to have a blended rate between 6.5 percent and 2.5 percent.

“Our hardworking, overburdened taxpayers and businesses need more tax relief. While we were successful in finding ways to assist small business owners and manufacturers in the recently enacted budget, we can and should do more. By expanding the PIT credit, and allowing additional businesses to file under the PIT exemption, we can help them provide more jobs and opportunities for all New Yorkers,” Senator Young said.

The Senate also passed a bill to substantially increase the Farm Workforce Retention Credit to help provide additional relief to support New York’s critically important agriculture industry. Under the new legislation, the Farm Workforce Retention Credit included in the 2016-17 state budget would be doubled as it phases in, providing up to $1,200 per employee when fully implemented.

“Family farming is a cornerstone of our region and state’s economy, but the cost of operating a farm can be substantial and difficult. During the budget negotiations, the Senate secured this important tax credit to help area farms offset New York’s high cost of doing business. By increasing this important tax credit, we will make it easier for farmers to expand their bottom line and keep their operations running locally for years to come,” said Senator Young.

related legislation

Share this Article or Press Release

Newsroom

Go to NewsroomStatement from NYS Senator Catharine M. Young (R,C,I-57th District)

February 28, 2019

Town of Mansfield Slated to Receive $300,000 State Grant

February 27, 2019

Senator Young Secures $125,000 for Town of Ripley

February 27, 2019