Ritchie: Reject Bill That Taxes Recreation

Brian Dwyer

April 8, 2019

-

ISSUE:

- Recreation

- property taxes

In the wake of the new New York State budget deal—which includes $1.4 billion in new taxes and $4.6 billion in overall taxes this year—downstate legislators are now looking to tax your recreation.

Senator Patty Ritchie is calling on her colleagues to reject Senate Bill S.4420, which would allow taxing authorities to value golf courses on their “highest and best use,” rather than their actual use. Under this bill, taxing jurisdictions could assess existing golf courses as if the property was full of multi-million dollar mansions, not just fairways and greens.

“It was bad enough that this year’s budget included taxes on things such as groceries and medicine; now some of these same people who enacted those taxes, want to tax the ability of hardworking New Yorkers to relax and have fun,” said Senator Ritchie.

If this bill is enacted, the small business owners and families who operate golf courses in Central and Northern New York will, at the very least, be forced to offset the higher taxes with increased prices. Given the condensed playing season due to weather conditions, many golf courses already operate on razor thin margins. Any sizable increase in fixed costs, such as higher tax bills, could potentially force them to close up for good.

“Time and time again I have called on New York State to become a place where small businesses can succeed. It is clear when bills like this come across my desk, that the success of our small, family businesses is just not a priority for some of my colleagues. It seems they care more about squeezing every last dollar out of our already overburdened, hardworking families," Senator Ritchie added.

In addition to the possible closure of golf courses across the state, this bill could also leave hundreds of New Yorkers unemployed, and damage the bottom line of the numerous local charities that depend on golf tournaments to raise critical funding.

related legislation

Share this Article or Press Release

Newsroom

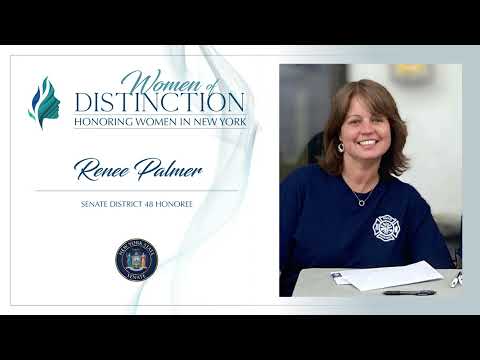

Go to NewsroomRitchie Announces Renee Palmer as 2022 "Woman of Distinction"

September 1, 2022

Senator Ritchie 2022 Woman of Distinction

August 26, 2022