Legislation To Protect Homeowners From Losing Property Tax Exemption Passes Both Houses Of State Legislature

June 4, 2021

-

ISSUE:

- NYS Senate District 60

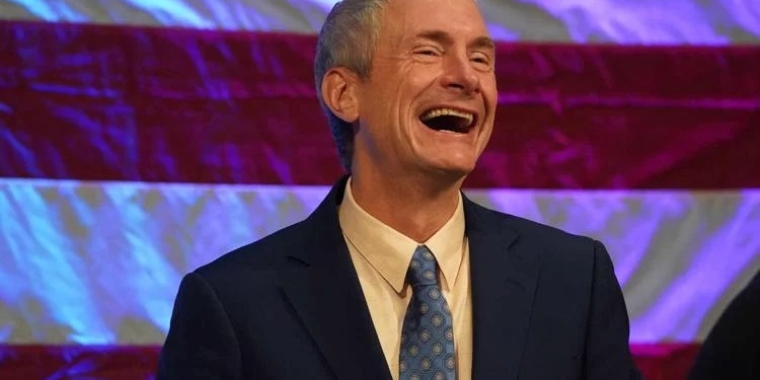

- NYS Senator Sean Ryan

- homeowner protection

- Property Tax Exemptions

- STAR (School Tax Relief Program)

LEGISLATION TO PROTECT HOMEOWNERS FROM LOSING PROPERTY TAX EXEMPTION PASSES BOTH HOUSES OF STATE LEGISLATURE

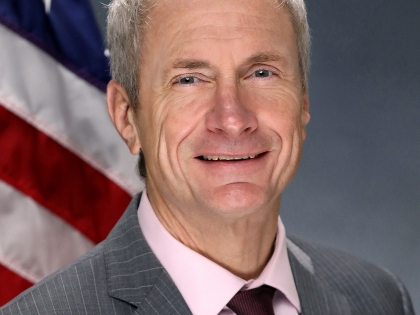

ALBANY – Today, June 4, 2021, New York State Senator Sean Ryan and Assemblymember Karen McMahon announced that legislation they sponsor, (S.5132/A.5374), which protects homeowners from losing a valuable property tax exemption during the COVID-19 pandemic, has passed both houses of the State Legislature.

State law includes over 200 real property tax exemptions. The School Tax Relief (STAR) program offers property tax relief to eligible New York State homeowners. STAR is the only exemption funded by New York State. Created in the 1990s, the STAR program is the farthest-reaching exemption program, with nearly 3.3 million exemptions. Under a new statute passed in the 2020-21 budget, a homeowner will lose their Basic STAR exemption if property taxes are past-due. The state Department of Tax and Finance has implemented this statute administratively for the 2020-21 school tax STAR cycle.

This legislation delays this disallowance until the end of the COVID-19 state disaster emergency so that homeowners delinquent in their property taxes due to the pandemic are not further penalized.

Senator Sean Ryan said, “Homeowners who are already experiencing financial troubles as a result of the pandemic should not be punished further for their misfortune. We need to help New Yorkers dig out of the financial holes created by COVID; losing access to the STAR exemption will only exacerbate the suffering for these people. On the other hand, keeping the STAR exemption intact will give them an easier path to recovery, which should be the goal of our post-pandemic legislation.”

Assemblymember Karen McMahon said, “Many homeowners have suffered financial difficulties because of the COVID-19 pandemic. Whether they’ve experienced reduced working hours or loss of income altogether, too many people are dealing with high levels of financial stress and insecurity. We need to do all we can to help those struggling as a result of the pandemic, not pull the rug out from under them. Maintaining the STAR exemption is key to helping families and homeowners recover and, in turn, will help rebuild New York State’s post-pandemic economy.”

Many homeowners struggle each year to pay their property taxes in a lump sum. COVID-19 has only exasperated this issue for hard working families. Interest on back taxes is very high and removing STAR only increases the homeowner’s tax bill and makes it harder for them to get current. Many homeowners who don’t have escrow accounts and pay their taxes in a lump sum are elderly, low income, living in homes their families have owned for generations, or are from marginalized communities that have been redlined and denied access to credit. It is important to protect homeownership especially among these communities.

Joseph Kelemen, Executive Director of the Western New York Law Center, said, “Many families are struggling financially due to the COVID-19 pandemic. Ensuring that homeowners don’t lose their owner-occupied Star exemption on their property taxes, due to falling behind, will make it easier for those families to get caught up. The Western New York Law Center is grateful for the advocacy of both Senator Sean Ryan and Assemblymember Karen McMahon for carrying this legislation to protect homeowners in Western New York and across the state.”

The legislation now heads to Governor Andrew M. Cuomo’s desk for his consideration.

###

related legislation

Share this Article or Press Release

Newsroom

Go to Newsroom