| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Jan 04, 2012 |

referred to banks |

| Feb 28, 2011 |

referred to banks |

Senate Bill S3651

2011-2012 Legislative Session

Sponsored By

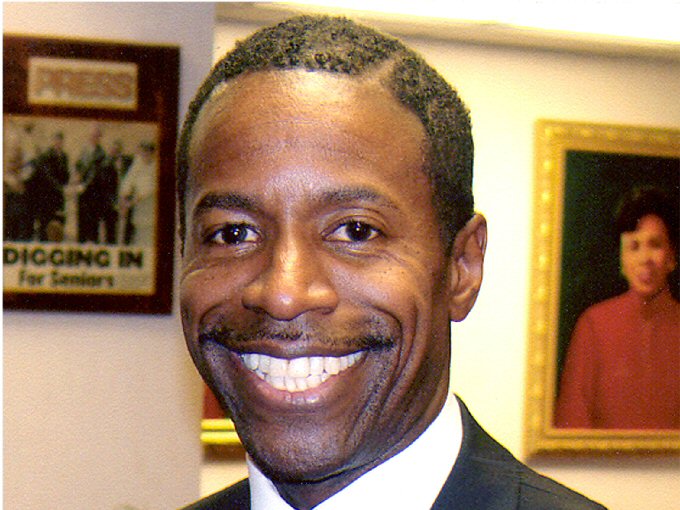

(D, WF) Senate District

Archive: Last Bill Status - In Senate Committee Banks Committee

Actions

2011-S3651 (ACTIVE) - Details

- Current Committee:

- Senate Banks

- Law Section:

- Banking Law

- Laws Affected:

- Amd §595-a, Bank L

- Versions Introduced in Other Legislative Sessions:

-

2009-2010:

S4875

2013-2014: S2867

2015-2016: S2919

2011-S3651 (ACTIVE) - Sponsor Memo

BILL NUMBER:S3651

TITLE OF BILL:

An act

to amend the banking law, in relation to refinancing of an existing

mortgage loan

PURPOSE:

To ensure that consumers are appropriately informed when refinancing a

mortgage and have the ability to compare the total monthly costs of

the previous loan with the total monthly costs of the new loan.

SUMMARY OF PROVISIONS:

Section 595-a(3) of the Banking Law is amended to require mortgage

brokers, mortgage bankers or exempt organizations to provide a

special disclosure for any mortgage refinancing where the mortgagor

will no longer be paying property tax or insurance premiums into an

escrow account. In those cases, the disclosure must compare the total

monthly payments under the previous loan with the combined monthly

payments for the new loan, real property taxes and insurance.

JUSTIFICATION:

Consumers may refinance a mortgage loan for numerous reasons. An

important consideration is the monthly cost of the new loan versus

the monthly cost of the previous loan.

2011-S3651 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

3651

2011-2012 Regular Sessions

I N S E N A T E

February 28, 2011

___________

Introduced by Sen. SMITH -- read twice and ordered printed, and when

printed to be committed to the Committee on Banks

AN ACT to amend the banking law, in relation to refinancing of an exist-

ing mortgage loan

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subdivision 3 of section 595-a of the banking law is

amended by adding a new paragraph (e) to read as follows:

(E) FOR ANY REFINANCING OF AN EXISTING MORTGAGE LOAN, WHERE THE MORT-

GAGOR WILL NO LONGER BE PAYING PROPERTY TAX OR INSURANCE PAYMENTS INTO

AN ESCROW ACCOUNT, EACH MORTGAGE BROKER, MORTGAGE BANKER AND EXEMPT

ORGANIZATION SHALL, PRIOR TO CLOSING, PROVIDE A SEPARATE DISCLOSURE

WHICH COMPARES THE TOTAL MONTHLY PAYMENTS UNDER THE PREVIOUS MORTGAGE

WITH THE COMBINED MONTHLY PAYMENTS FOR THE NEW MORTGAGE LOAN, REAL PROP-

ERTY TAXES AND INSURANCE. THE BANKING BOARD MAY SPECIFY THE FORM,

CONTENT AND TIMING OF SUCH DISCLOSURE.

S 2. This act shall take effect on the one hundred eightieth day after

it shall have become a law.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD09856-01-1

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.