| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Jan 08, 2014 |

referred to civil service and pensions |

| Jan 09, 2013 |

referred to civil service and pensions |

Senate Bill S1158

2013-2014 Legislative Session

Sponsored By

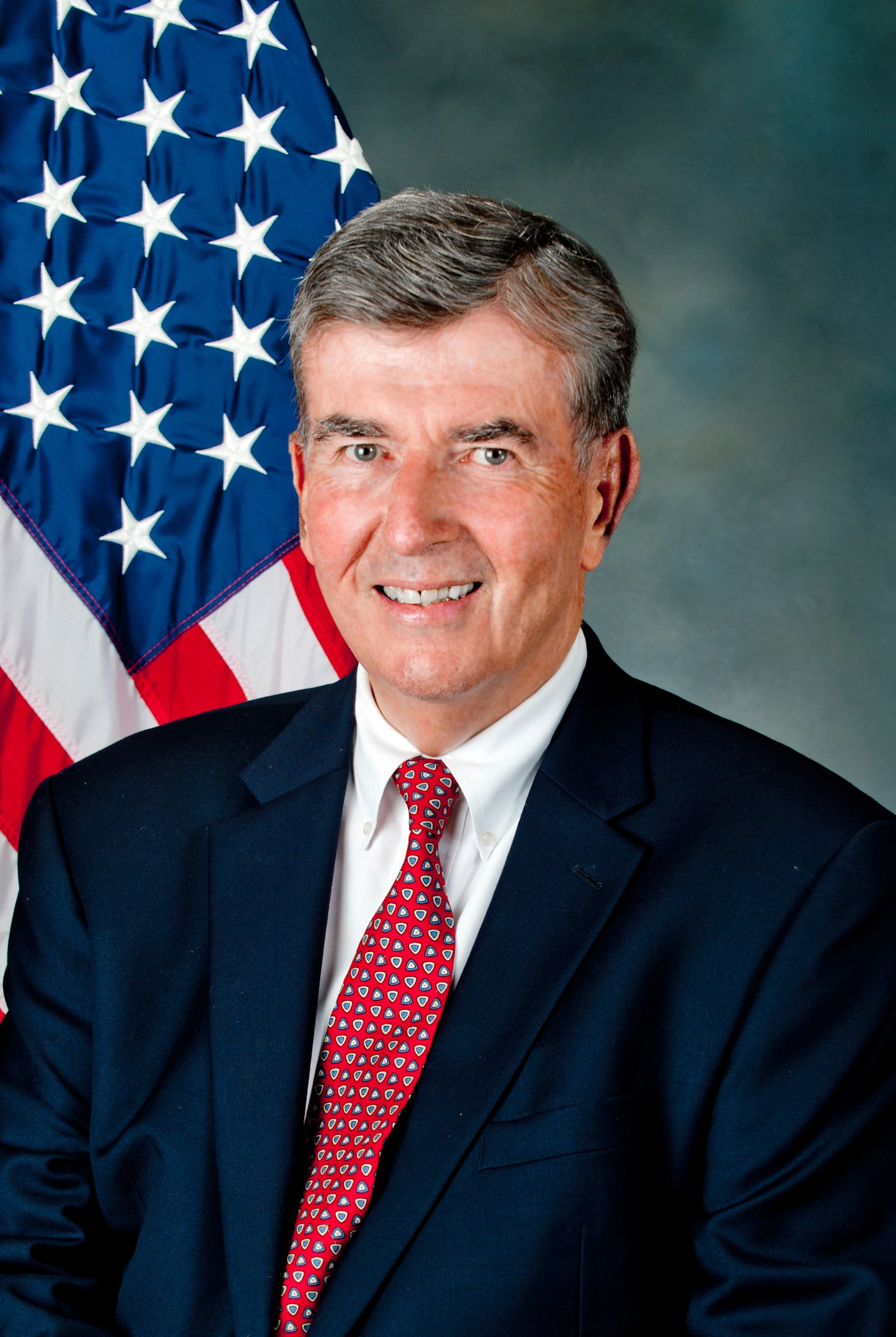

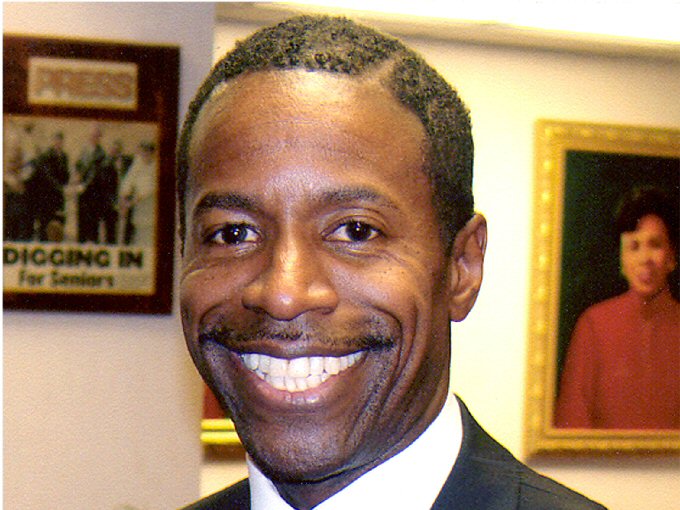

(D, WF) Senate District

Archive: Last Bill Status - In Senate Committee Civil Service And Pensions Committee

Actions

co-Sponsors

(D) Senate District

(D, WF) Senate District

(D) Senate District

(D) Senate District

2013-S1158 (ACTIVE) - Details

2013-S1158 (ACTIVE) - Summary

Prohibits the diminution of health insurance benefits of public employee retirees and their dependents or reducing the employer's contributions for such insurance from May 15, 2013 until May 15, 2014; defines public employers to include the state, municipalities, school districts, and public authorities and commissions.

2013-S1158 (ACTIVE) - Sponsor Memo

BILL NUMBER:S1158 REVISED 1/8/13

TITLE OF BILL: An act in relation to affecting the health insurance

benefits and contributions of certain retired public employees

PURPOSE: To protect all public employee retirees from decreases in

health insurance benefits.

SUMMARY OF PROVISIONS: The bill would prohibit a public employer from

diminishing the health insurance benefits or contributions provided on

behalf of retirees and their dependents unless there is a

corresponding decrease for active employees during the period between

May 15, 2013 and May 15, 2014. A public employer is defined as: (i)

the state; (ii) a county, city, town, village; (iii) a school

district, a board of cooperative educational services, vocational

education and extension board or school district; (iv) any

governmental entity operating a college or university; (v) a public

improvement or special district; (vi) a public authority, commission

or public benefit corporation; or, (vii) any other public corporation,

agency, or unit of government which exercises governmental power.

JUSTIFICATION: Public retirees are not represented in the collective

bargaining process. As a result, they have no control over a public

employer's decision to decrease their health insurance benefits. The

impact of such a unilateral decision can be devastating for a retired

person living on a fixed income. The law already provides such

2013-S1158 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

1158

2013-2014 Regular Sessions

I N S E N A T E

(PREFILED)

January 9, 2013

___________

Introduced by Sens. BRESLIN, ADAMS, DILAN, HASSELL-THOMPSON, KLEIN,

MONTGOMERY, PARKER, SAMPSON, SAVINO, SMITH, STAVISKY -- read twice and

ordered printed, and when printed to be committed to the Committee on

Civil Service and Pensions

AN ACT in relation to affecting the health insurance benefits and

contributions of certain retired public employees

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. From on and after May 15, 2013 until May 15, 2014, a public

employer shall be prohibited from diminishing the health insurance bene-

fits provided to retirees and their dependents or the contributions such

employer makes for such health insurance coverage below the level of

such benefits or contributions made on behalf of such retirees and their

dependents by such employer unless a corresponding diminution of bene-

fits or contributions is effected from the appropriate level as of May

15, 2013 during this period by such employer from the corresponding

group of active employees for such retirees. For the purpose of this

act, "public employer" shall mean the following: (i) the state; (ii) a

county, city, town or village; (iii) a school district, board of cooper-

ative educational services, vocational education and extension board or

a school district as enumerated in section 1 of chapter 566 of the laws

of 1967, as amended; (iv) any governmental entity operating a college or

university; (v) a public improvement or special district; (vi) a public

authority, commission or public benefit corporation; or (vii) any other

public corporation, agency, instrumentality or unit of government which

exercises governmental power under the laws of this state.

S 2. This act shall take effect immediately and shall be deemed to

have been in full force and effect on and after May 15, 2013.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD01549-01-3

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.