| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Jan 28, 2014 |

print number 2879a |

| Jan 28, 2014 |

amend and recommit to investigations and government operations |

| Jan 08, 2014 |

referred to investigations and government operations |

| Jan 24, 2013 |

referred to investigations and government operations |

Senate Bill S2879A

2013-2014 Legislative Session

Sponsored By

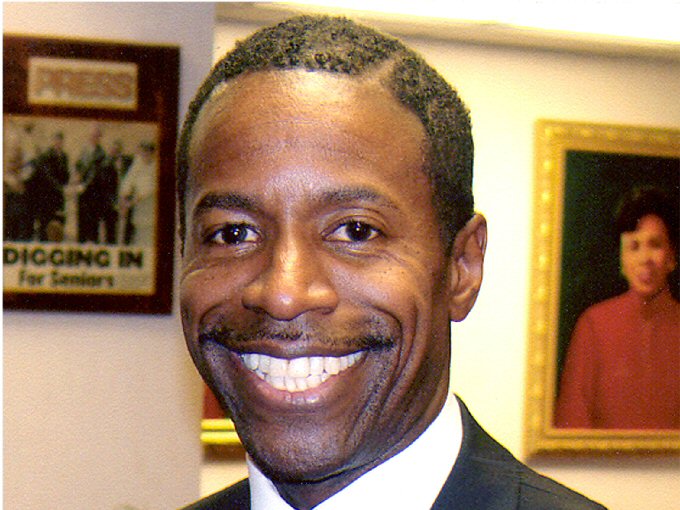

(D, WF) Senate District

Archive: Last Bill Status - In Senate Committee Investigations And Government Operations Committee

Actions

Bill Amendments

2013-S2879 - Details

- Current Committee:

- Senate Investigations And Government Operations

- Law Section:

- Tax Law

- Laws Affected:

- Amd §606, Tax L

- Versions Introduced in 2011-2012 Legislative Session:

-

S4094

2013-S2879 - Sponsor Memo

BILL NUMBER:S2879

TITLE OF BILL: An act to amend the tax law, in relation to including

the tuition of graduate students within the college tuition credit

PURPOSE OR GENERAL IDEA OF BILL: Tax tuition credit for graduate

students.

SUMMARY OF SPECIFIC PROVISIONS: Subparagraph (c) of paragraph two of

subsection (t) of section 606 of the tax law is amended to provide a tax

credit for students enrolled in a graduate program.

JUSTIFICATION: Current law provides for a college tuition tax credit to

students enrolled or attending an institution of higher education,

whether full or part-time. An institution of higher education is defined

in the statute as any institution of higher education or business,

trade, technical, or other occupational school recognized and approved

by an accrediting agency. Tuition payments required for enrollment or

attendance in course of study leading to a post-baccalaureate or other

graduate degree are specifically exempted from the tax credit.

The maximum amount of qualified tuition expenses allowed for each eligi-

ble student is $10,000. If the total qualified tuition expenses are more

than $5,000, the credit for 2004 is four-Percent of the qualified

tuition expenses up to $10,000 per student. Therefore, the maximum

tuition credit allowed for 2004 would be $400 per student. If the total

2013-S2879 - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

2879

2013-2014 Regular Sessions

I N S E N A T E

January 24, 2013

___________

Introduced by Sen. SMITH -- read twice and ordered printed, and when

printed to be committed to the Committee on Investigations and Govern-

ment Operations

AN ACT to amend the tax law, in relation to including the tuition of

graduate students within the college tuition credit

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subparagraph (C) of paragraph 2 of subsection (t) of

section 606 of the tax law, as amended by section 1 of part N of chapter

85 of the laws of 2002, is amended to read as follows:

(C) The term "qualified college tuition expenses" shall mean the

tuition required for the enrollment or attendance of an eligible student

at an institution of higher education. Provided, however, tuition

payments made pursuant to the receipt of any scholarships or financial

aid[, or tuition required for enrollment or attendance in a course of

study leading to the granting of a post baccalaureate or other graduate

degree,] shall be excluded from the definition of "qualified college

tuition expenses".

S 2. This act shall take effect immediately and shall apply to taxable

years beginning on or after January 1, 2014.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD07228-01-3

2013-S2879A (ACTIVE) - Details

- Current Committee:

- Senate Investigations And Government Operations

- Law Section:

- Tax Law

- Laws Affected:

- Amd §606, Tax L

- Versions Introduced in 2011-2012 Legislative Session:

-

S4094

2013-S2879A (ACTIVE) - Summary

Includes the tuition required for enrollment or attendance in a course of study leading to the granting of a post baccalaureate or other graduate degree within the definition of "qualified college tuition expenses" for the purposes of qualifying for the college tuition credit.

2013-S2879A (ACTIVE) - Sponsor Memo

BILL NUMBER:S2879A

TITLE OF BILL: An act to amend the tax law, in relation to including

the tuition of graduate students within the college tuition credit

PURPOSE OR GENERAL IDEA OF BILL: Tax tuition credit for graduate

students.

SUMMARY OF SPECIFIC PROVISIONS: Subparagraph (c) of paragraph two of

subsection (t) of section 606 of the tax law is amended to provide a

tax credit for students enrolled in a graduate program.

JUSTIFICATION: Current law provides for a college tuition tax credit

to students enrolled or attending an institution of higher education,

whether full or part-time. An institution of higher education is

defined in the statute as any institution of higher education or

business, trade, technical, or other occupational school recognized

and approved by an accrediting agency. Tuition payments required for

enrollment or attendance in course of study leading to a

post-baccalaureate or other graduate degree are specifically exempted

from the tax credit.

The maximum amount of qualified tuition expenses allowed for each

eligible student is $10,000. If the total qualified tuition expenses

are more than $5,000, the credit for 2004 is four-Percent of the

qualified tuition expenses up to $10,000 per student. Therefore, the

2013-S2879A (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

2879--A

2013-2014 Regular Sessions

I N S E N A T E

January 24, 2013

___________

Introduced by Sen. SMITH -- read twice and ordered printed, and when

printed to be committed to the Committee on Investigations and Govern-

ment Operations -- recommitted to the Committee on Investigations and

Government Operations in accordance with Senate Rule 6, sec. 8 --

committee discharged, bill amended, ordered reprinted as amended and

recommitted to said committee

AN ACT to amend the tax law, in relation to including the tuition of

graduate students within the college tuition credit

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subparagraph (C) of paragraph 2 of subsection (t) of

section 606 of the tax law, as amended by section 1 of part N of chapter

85 of the laws of 2002, is amended to read as follows:

(C) The term "qualified college tuition expenses" shall mean the

tuition required for the enrollment or attendance of an eligible student

at an institution of higher education. Provided, however, tuition

payments made pursuant to the receipt of any scholarships or financial

aid[, or tuition required for enrollment or attendance in a course of

study leading to the granting of a post baccalaureate or other graduate

degree,] shall be excluded from the definition of "qualified college

tuition expenses".

S 2. This act shall take effect immediately and shall apply to taxable

years beginning on or after January 1, 2015.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD07228-02-4

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.