| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Jan 08, 2020 |

referred to investigations and government operations |

| Mar 01, 2019 |

referred to investigations and government operations |

Senate Bill S4156

2019-2020 Legislative Session

Sponsored By

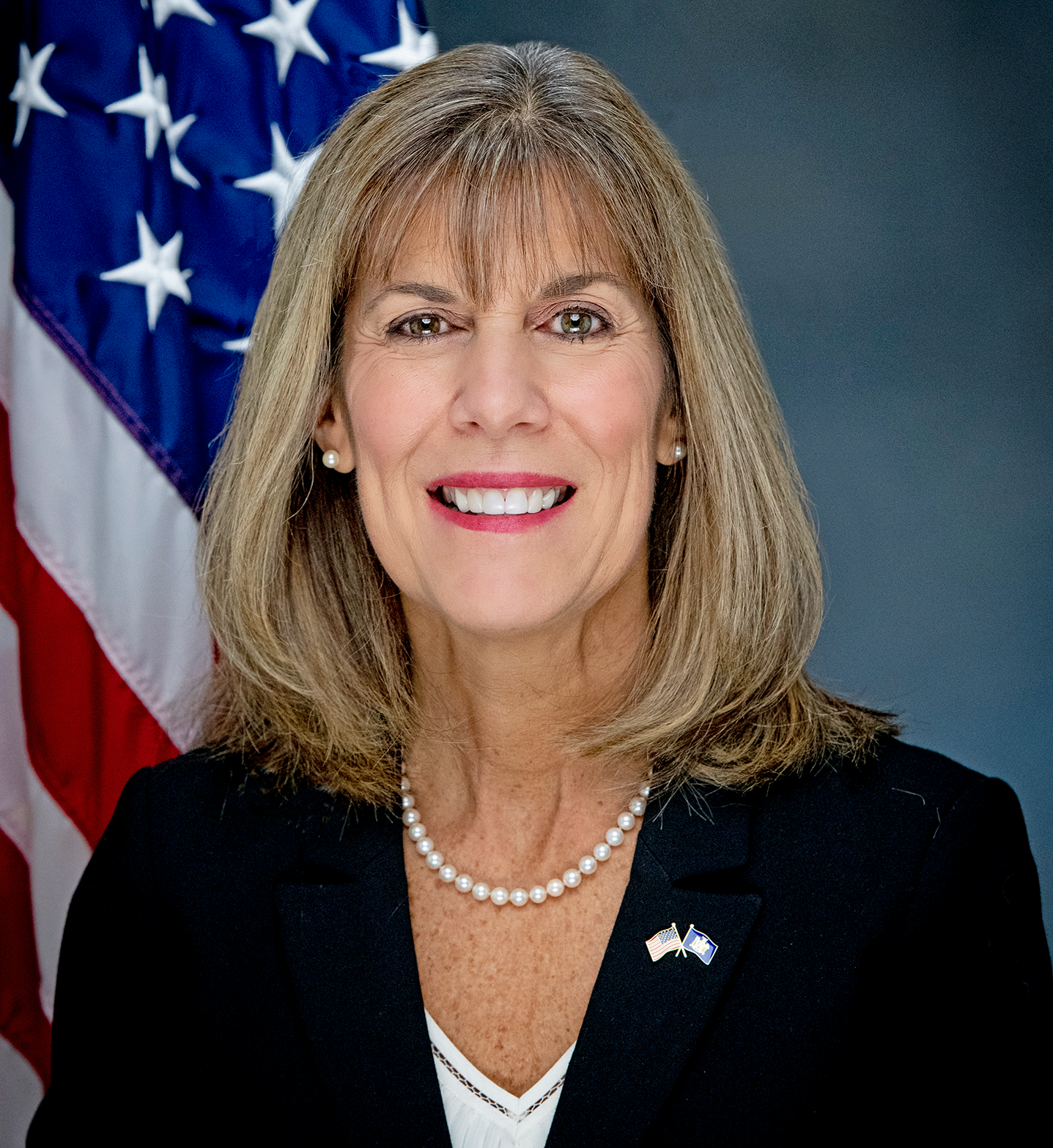

(R, C, IP) Senate District

Archive: Last Bill Status - In Senate Committee Investigations And Government Operations Committee

Actions

co-Sponsors

(R, C) 54th Senate District

(R, C, IP, RFM) Senate District

(R, C, IP) 62nd Senate District

(R, C, IP, RFM) Senate District

2019-S4156 (ACTIVE) - Details

- Current Committee:

- Senate Investigations And Government Operations

- Law Section:

- Tax Law

- Laws Affected:

- Amd §171-a, Tax L; add §54-n, St Fin L

- Versions Introduced in Other Legislative Sessions:

-

2021-2022:

S5920

2023-2024: S5306

2025-2026: S4614

2019-S4156 (ACTIVE) - Sponsor Memo

BILL NUMBER: S4156

SPONSOR: FUNKE

TITLE OF BILL: An act to amend the tax law and the state finance law,

in relation to disposition of revenue from new taxes and tax increases

to reduce local real property tax levies

PURPOSE:

This bill would require New York State to use any revenue from increas-

ing or imposing new taxes towards property tax relief by establishing

the Tax Reduction Utilization Security Target or TRUST fund bringing

financial responsibility and trust back to New York State.

SUMMARY OF PROVISIONS:

Section 1. Lays out the definitions for the tax increases and new taxes

that will be captured in this legislation.

Section 2. Establishes the Tax reduction utilization security target

(TRUST) fund where the revenue from increased/ new taxes will be depos-

2019-S4156 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

4156

2019-2020 Regular Sessions

I N S E N A T E

March 1, 2019

___________

Introduced by Sen. FUNKE -- read twice and ordered printed, and when

printed to be committed to the Committee on Investigations and Govern-

ment Operations

AN ACT to amend the tax law and the state finance law, in relation to

disposition of revenue from new taxes and tax increases to reduce

local real property tax levies

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Section 171-a of the tax law, as separately amended by

chapters 481 and 484 of the laws of 1981, is amended by adding a new

subdivision 3 to read as follows:

3. ANY AMOUNTS RECEIVED FROM TAXES, INTEREST AND PENALTIES COLLECTED

OR RECEIVED BY THE COMMISSIONER OR THE COMMISSIONER'S DULY AUTHORIZED

AGENT AS SET FORTH AND PRESCRIBED BY SUBDIVISION ONE OF THIS SECTION,

WHICH ARE ATTRIBUTABLE TO AN INCREASE IN THE RATE OF SUCH TAXES OVER ANY

RATES WHICH WERE IN EFFECT ON THE EFFECTIVE DATE OF THIS SUBDIVISION, OR

THE IMPOSITION OF NEW TAXES WHICH WERE NOT IMPOSED PRIOR TO SUCH EFFEC-

TIVE DATE, SHALL BE DEPOSITED TO THE TAX REDUCTION UTILIZATION SECURITY

TARGET FUND ESTABLISHED BY SECTION FIFTY-FOUR-N OF THE STATE FINANCE

LAW. THE TAX COMMISSIONER AND THE COMPTROLLER SHALL MAINTAIN A SYSTEM OF

ACCOUNTS SHOWING THE AMOUNT OF REVENUE COLLECTED OR RECEIVED FROM EACH

OF THE TAXES IMPOSED BY THE SECTIONS ENUMERATED IN SUBDIVISION ONE OF

THIS SECTION WHICH REPRESENT SUCH INCREASED AMOUNTS OR WHICH WERE FIRST

IMPOSED AFTER THE EFFECTIVE DATE OF THIS SUBDIVISION.

§ 2. The state finance law is amended by adding a new section 54-n to

read as follows:

§ 54-N. TAX REDUCTION UTILIZATION SECURITY TARGET FUND. 1. BEGINNING

APRIL FIRST, TWO THOUSAND TWENTY, AND ANNUALLY THEREAFTER, EACH CITY,

VILLAGE AND TOWN OUTSIDE A VILLAGE SHALL RECEIVE AN APPROPRIATION OF

STATE FUNDS FROM AMOUNTS RESULTING FROM THE INCREASE OR IMPOSITION OF

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD10321-02-9

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.