| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Aug 11, 2020 |

recommit, enacting clause stricken |

| Jan 08, 2020 |

referred to budget and revenue |

| Dec 11, 2019 |

referred to rules |

Senate Bill S6898

2019-2020 Legislative Session

Sponsored By

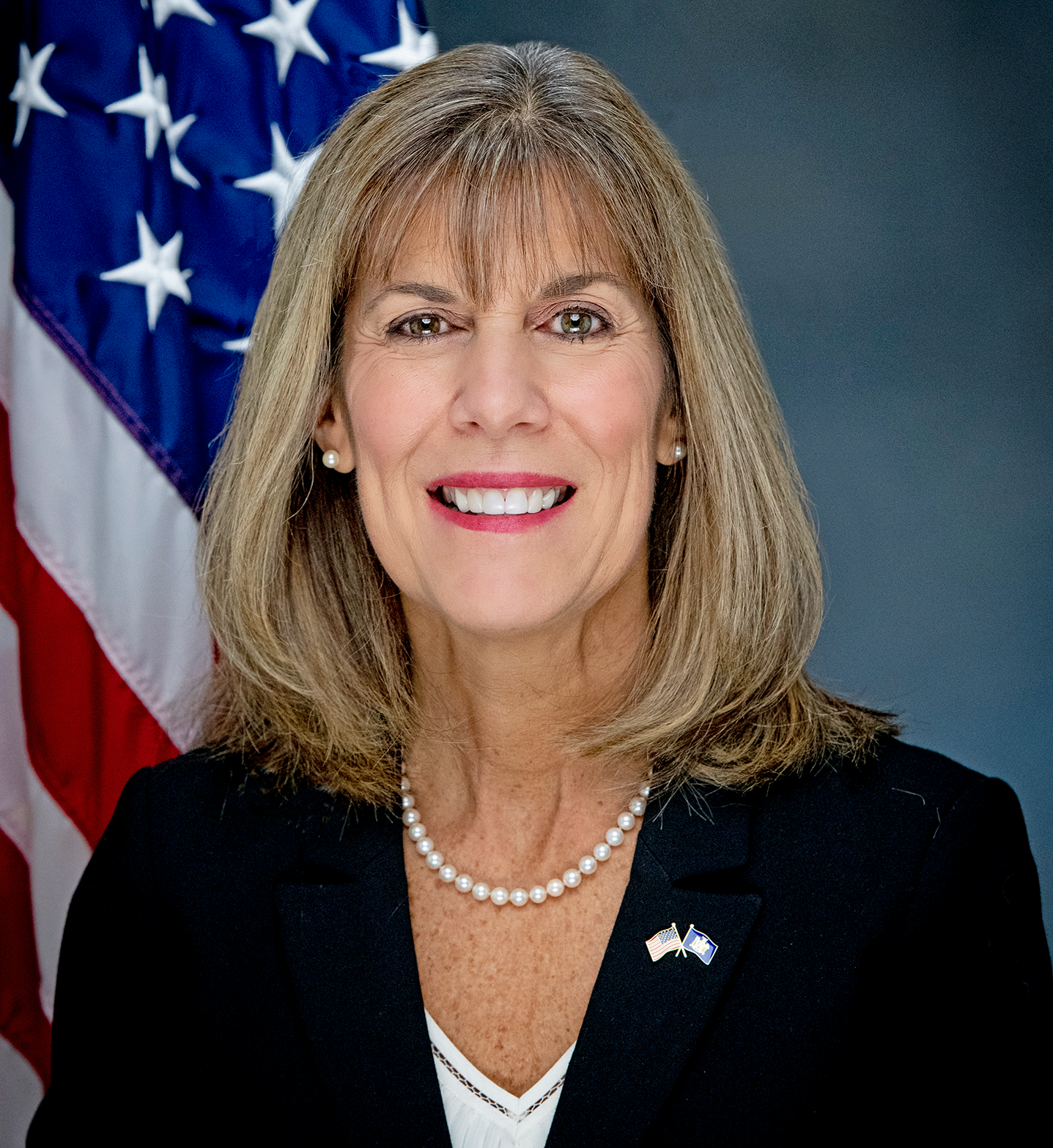

(R, C, IP) Senate District

Archive: Last Bill Status - Stricken

Actions

co-Sponsors

(R, C, IP, RFM) Senate District

2019-S6898 (ACTIVE) - Details

- Law Section:

- Tax Law

- Laws Affected:

- Add §630-h, amd §612, Tax L; add §99-hh, St Fin L

2019-S6898 (ACTIVE) - Sponsor Memo

BILL NUMBER: S6898

SPONSOR: JACOBS

TITLE OF BILL:

An act to amend the tax law and the state finance law, in relation to

allowing taxpayers to make a gift to the adoption access fund on their

personal income tax returns

PURPOSE:

To amend the tax law and the state finance law, in relation to allowing

taxpayers to make a gift to the Adoption Access Fund on their personal

income tax returns

SUMMARY OF PROVISIONS:

Section 1 of the bill amends the tax law by adding new section 630-h to

create the "Adoption Access Fund" and require that an option be included

on all New York State personal income tax forms, enabling taxpayers to

contribute all or a portion of their tax refunds to the Adoption Access

Fund.

2019-S6898 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

6898

2019-2020 Regular Sessions

I N S E N A T E

December 11, 2019

___________

Introduced by Sen. JACOBS -- read twice and ordered printed, and when

printed to be committed to the Committee on Rules

AN ACT to amend the tax law and the state finance law, in relation to

allowing taxpayers to make a gift to the adoption access fund on their

personal income tax returns

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. The tax law is amended by adding a new section 630-h to

read as follows:

§ 630-H. GIFT TO THE ADOPTION ACCESS FUND. EFFECTIVE FOR ANY TAX YEAR

COMMENCING ON OR AFTER JANUARY FIRST, TWO THOUSAND TWENTY-ONE, AN INDI-

VIDUAL IN ANY TAXABLE YEAR MAY ELECT TO CONTRIBUTE TO THE ADOPTION

ACCESS FUND. SUCH CONTRIBUTION SHALL BE IN ANY WHOLE DOLLAR AMOUNT. THE

COMMISSIONER SHALL INCLUDE SPACE ON THE PERSONAL INCOME TAX RETURN TO

ENABLE A TAXPAYER TO MAKE SUCH CONTRIBUTION. THE COMMISSIONER SHALL ALSO

ENSURE THAT A DESCRIPTION OF THE ADOPTION ACCESS FUND IS INCLUDED WITHIN

THE TAX FORM PREPARATION INSTRUCTION BOOKLET. NOTWITHSTANDING ANY OTHER

PROVISION OF LAW, ALL REVENUES COLLECTED PURSUANT TO THIS SECTION SHALL

BE CREDITED TO THE ADOPTION ACCESS FUND AND SHALL BE USED ONLY FOR THOSE

PURPOSES ENUMERATED IN SECTION NINETY-NINE-HH OF THE STATE FINANCE LAW.

§ 2. The state finance law is amended by adding a new section 99-hh to

read as follows:

§ 99-HH. ADOPTION ACCESS FUND. 1. THERE IS HEREBY ESTABLISHED IN THE

JOINT CUSTODY OF THE COMPTROLLER AND THE COMMISSIONER OF THE OFFICE OF

CHILDREN AND FAMILY SERVICES A SPECIAL FUND TO BE KNOWN AS THE "ADOPTION

ACCESS FUND".

2. SUCH FUND SHALL CONSIST OF ALL REVENUES RECEIVED PURSUANT TO THE

PROVISIONS OF SECTION SIX HUNDRED THIRTY-H OF THE TAX LAW, AND ALL OTHER

MONIES APPROPRIATED, CREDITED, OR TRANSFERRED THERETO FROM ANY OTHER

FUND OR SOURCE PURSUANT TO LAW. NOTHING CONTAINED HEREIN SHALL PREVENT

THE STATE FROM RECEIVING GRANTS, GIFTS OR BEQUESTS FOR THE PURPOSES OF

THE FUND AS DEFINED IN THIS SECTION AND DEPOSITING THEM INTO THE FUND

ACCORDING TO LAW.

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.