| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Jan 08, 2020 |

referred to investigations and government operations |

| May 29, 2019 |

reported and committed to finance |

| Jan 15, 2019 |

referred to investigations and government operations |

Senate Bill S1659

2019-2020 Legislative Session

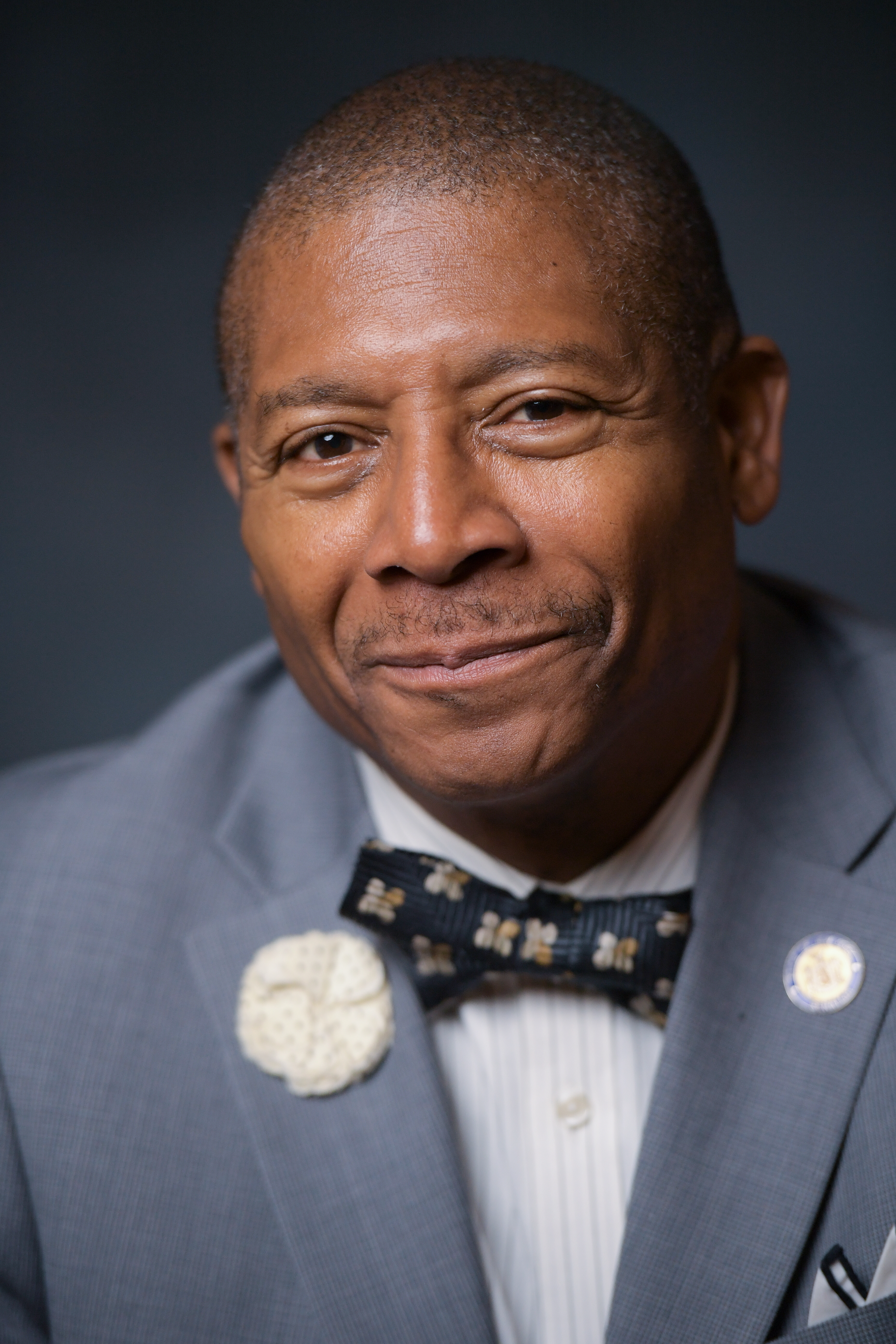

Sponsored By

(D) 42nd Senate District

Archive: Last Bill Status - In Senate Committee Investigations And Government Operations Committee

Actions

Votes

co-Sponsors

(D, WF) Senate District

(D, WF) 31st Senate District

(D, WF) 28th Senate District

(D, WF) 33rd Senate District

2019-S1659 (ACTIVE) - Details

2019-S1659 (ACTIVE) - Sponsor Memo

BILL NUMBER: S1659

SPONSOR: SKOUFIS

TITLE OF BILL: An act to amend the tax law, in relation to imposing a

tax related to executive compensation

PURPOSE OR GENERAL IDEA OF BILL:

Establishes a 10% tax on companies where CEOs make more than one hundred

times the company's median pay and a 25% tax on companies where CEOs

make more than two hundred fifty times the company's median pay.

SUMMARY OF PROVISIONS:

Creates a tax on companies subject to United States Securities and

Exchange Commission pay ratio reporting requirements section 229.402 of

title 17 of the code of federal regulations, at the rate of 10% if the

company reports that the CEO makes one hundred times the median pay of

all their workers, and at the rate of 25% if the company reports that

the CEO makes two hundred fifty times the median pay of all their work-

ers.

2019-S1659 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

1659

2019-2020 Regular Sessions

I N S E N A T E

January 15, 2019

___________

Introduced by Sen. SKOUFIS -- read twice and ordered printed, and when

printed to be committed to the Committee on Investigations and Govern-

ment Operations

AN ACT to amend the tax law, in relation to imposing a tax related to

executive compensation

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. The tax law is amended by adding a new section 183-b to

read as follows:

§ 183-B. TAX ON COMPANIES SUBJECT TO UNITED STATES SECURITIES AND

EXCHANGE COMMISSION PAY RATIO REPORTING REQUIREMENTS. NOTWITHSTANDING

ANY OTHER PROVISION OF THIS CHAPTER, OR OF ANY OTHER LAW, FOR THE PERIOD

BEGINNING WITH THE TAXABLE YEARS COMMENCING ON OR AFTER THE FIRST DAY OF

JANUARY, TWO THOUSAND TWENTY, AN ANNUAL TAX IS HEREBY IMPOSED UPON EVERY

COMPANY SUBJECT TO THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION

PAY RATIO REPORTING REQUIREMENTS, PURSUANT TO SECTION 229.402 OF TITLE

17 OF THE CODE OF FEDERAL REGULATIONS, AT THE RATE OF TEN PERCENT OF

BASE TAX LIABILITY IF SUCH COMPANY REPORTS TO THE UNITED STATES SECURI-

TIES AND EXCHANGE COMMISSION A PAY RATIO OF AT LEAST ONE HUNDRED TO ONE

BUT LESS THAN TWO HUNDRED FIFTY TO ONE ON UNITED STATES SECURITIES AND

EXCHANGE COMMISSION DISCLOSURES; OR AT THE RATE OF TWENTY-FIVE PERCENT

OF BASE TAX LIABILITY IF SUCH COMPANY REPORTS TO THE UNITED STATES SECU-

RITIES AND EXCHANGE COMMISSION A PAY RATIO OF TWO HUNDRED FIFTY TO ONE

OR GREATER ON UNITED STATES SECURITIES AND EXCHANGE COMMISSION DISCLO-

SURES.

§ 2. This act shall take effect January 1, 2020 and shall apply to all

tax years commencing on or after such date.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD04324-01-9

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.