|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| May 01, 2020 |

referred to local government |

Senate Bill S8267

2019-2020 Legislative Session

Sponsored By

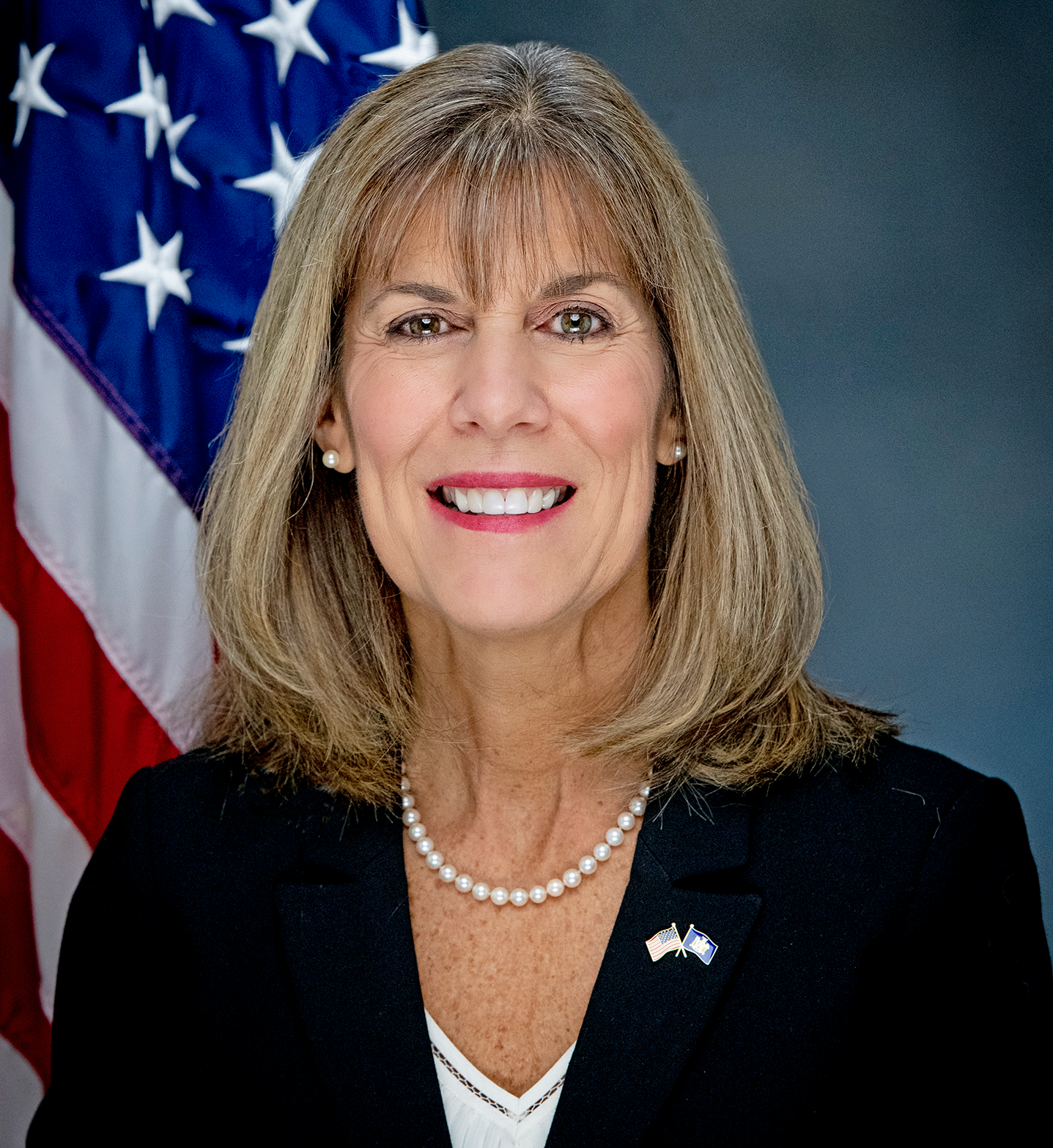

(R, C) 44th Senate District

Archive: Last Bill Status - In Senate Committee Local Government Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

co-Sponsors

(R, C, IP, RFM) Senate District

(R, C, IP) Senate District

2019-S8267 (ACTIVE) - Details

- Current Committee:

- Senate Local Government

- Law Section:

- Real Property Tax Law

- Laws Affected:

- Amd §425, RPT L; amd §606, Tax L

- Versions Introduced in 2021-2022 Legislative Session:

-

S2037

2019-S8267 (ACTIVE) - Summary

Doubles the STAR property tax deduction for qualified medical providers or first responders charged with caring for COVID-19 patients; provides a $1,000 refundable state income tax credit for qualified medical providers or first responders charged with caring for COVID-19 patients who cannot claim a STAR real property tax exemption; provides for the repeal of such provisions upon the expiration thereof.

2019-S8267 (ACTIVE) - Sponsor Memo

BILL NUMBER: S8267

SPONSOR: TEDISCO

TITLE OF BILL:

An act to amend the real property tax law, in relation to doubling the

STAR property tax deduction for qualified medical providers or first

responders charged with caring for COVID-19 patients; to amend the tax

law, in relation to providing a $1,000 refundable state income tax cred-

it for qualified medical providers or first responders charged with

caring for COVID-19 patients who cannot claim a STAR real property tax

exemption; and to provide for the repeal of such provisions upon the

expiration thereof

PURPOSE OR GENERAL IDEA OF BILL:

To double the STAR property tax deduction and provide a $1,000 refunda-

ble state income tax credit for qualified medical providers or first

responders charged with caring for COVID-19 patients.

SUMMARY OF PROVISIONS:

2019-S8267 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

8267

I N S E N A T E

May 1, 2020

___________

Introduced by Sen. TEDISCO -- read twice and ordered printed, and when

printed to be committed to the Committee on Local Government

AN ACT to amend the real property tax law, in relation to doubling the

STAR property tax deduction for qualified medical providers or first

responders charged with caring for COVID-19 patients; to amend the tax

law, in relation to providing a $1,000 refundable state income tax

credit for qualified medical providers or first responders charged

with caring for COVID-19 patients who cannot claim a STAR real proper-

ty tax exemption; and to provide for the repeal of such provisions

upon the expiration thereof

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subdivision 2 of section 425 of the real property tax law

is amended by adding a new paragraph (m) to read as follows:

(M) COVID-19 QUALIFIED MEDICAL PROVIDER OR FIRST RESPONDERS STAR

AMOUNT INCREASE. NOTWITHSTANDING ANY OTHER PROVISION OF THIS SECTION OR

OF ANY OTHER LAW, RULE OR REGULATION TO THE CONTRARY, FOR THE TWO THOU-

SAND TWENTY--TWO THOUSAND TWENTY-ONE SCHOOL YEAR ONLY, THE ALLOWABLE

STAR EXEMPTION UNDER THIS SUBDIVISION CLAIMED BY A QUALIFIED MEDICAL

PROVIDER OR FIRST RESPONDER SHALL BE DOUBLE THE AMOUNT NORMALLY CALCU-

LATED FOR SUCH CLAIMANT PURSUANT TO THIS SUBDIVISION. FOR PURPOSES OF

THIS PARAGRAPH, "QUALIFIED MEDICAL PROVIDER OR FIRST RESPONDER" MEANS

ANY PHYSICIAN, PHYSICIAN ASSISTANT, NURSE PRACTITIONER, NURSE, PHARMA-

CIST, RESPIRATORY THERAPIST, LAW ENFORCEMENT OFFICER, EMERGENCY MEDICAL

TECHNICIAN, PARAMEDIC, AMBULANCE DRIVER, FIREFIGHTER OR GENERAL EMPLOYEE

OF A HOSPITAL, NURSING HOME OR OTHER MEDICAL CARE FACILITY, CHARGED WITH

CARING FOR OR PROVIDING SERVICES WITH RESPECT TO AND WHO HAS DIRECT

CONTACT WITH DIAGNOSED COVID-19 PATIENTS IN THE COURSE OF HIS OR HER

EMPLOYMENT DURING THE NOVEL CORONAVIRUS PUBLIC HEALTH EMERGENCY DECLARED

BY THE SECRETARY OF HEALTH AND HUMAN SERVICES ON JANUARY THIRTY-FIRST,

TWO THOUSAND TWENTY, UNDER SECTION 319 OF THE PUBLIC HEALTH SERVICE ACT

(42 U.S.C. 247D). THE COMMISSIONER SHALL PROMULGATE AND IMPLEMENT ALL

RULES AND REGULATIONS ESTABLISHING ELIGIBILITY AND OTHER REQUIREMENTS TO

IMPLEMENT THE PROVISIONS OF THIS PARAGRAPH. NOTHING IN THIS PARAGRAPH

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.