| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Mar 22, 2022 |

referred to civil service and pensions |

Senate Bill S8610

2021-2022 Legislative Session

Sponsored By

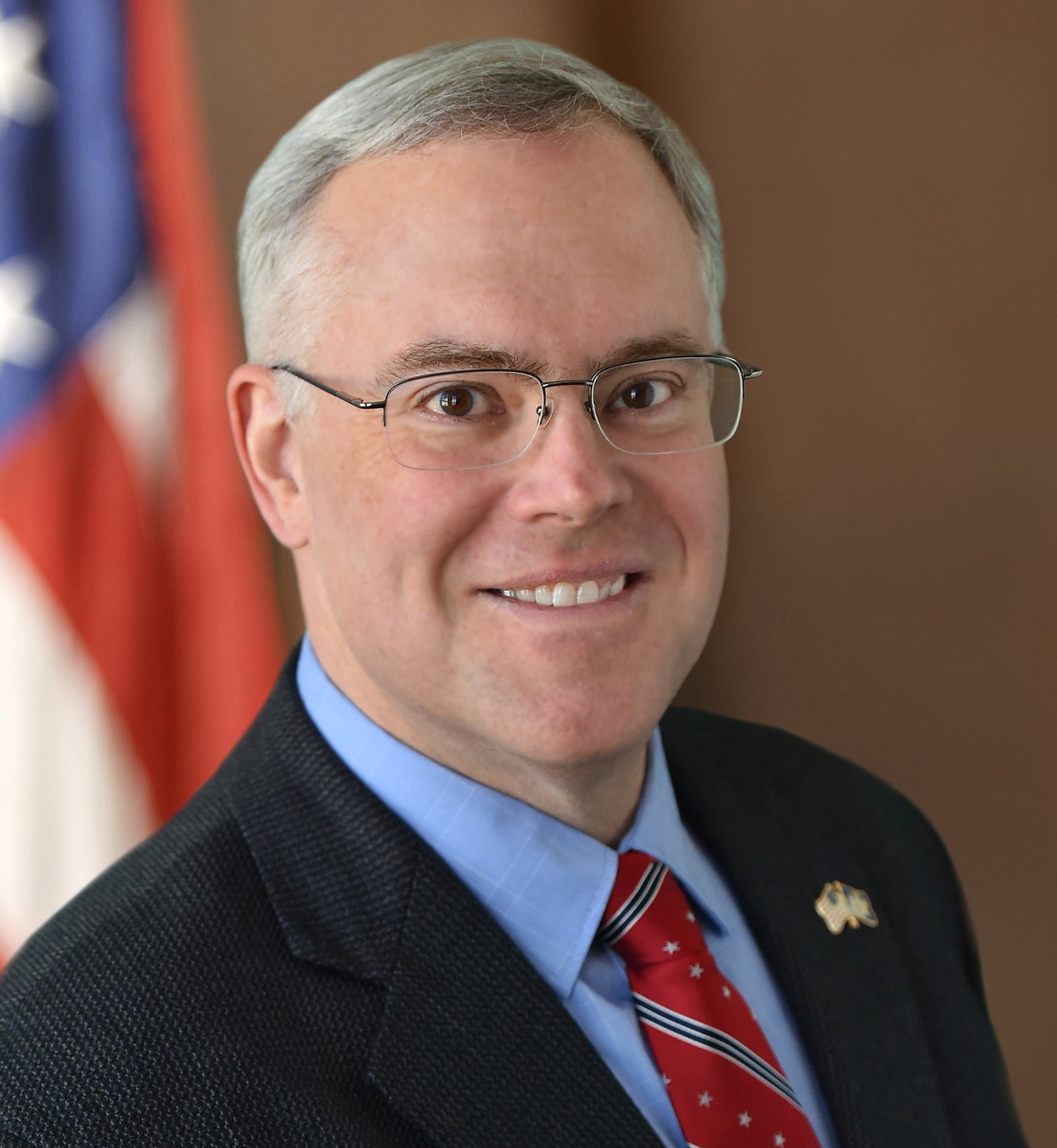

(R, C, IP) 45th Senate District

Archive: Last Bill Status - In Senate Committee Civil Service And Pensions Committee

Actions

2021-S8610 (ACTIVE) - Details

- Current Committee:

- Senate Civil Service And Pensions

- Law Section:

- Retirement

- Versions Introduced in Other Legislative Sessions:

-

2023-2024:

S4884

2025-2026: S6720

2021-S8610 (ACTIVE) - Sponsor Memo

BILL NUMBER: S8610

SPONSOR: STEC

TITLE OF BILL:

An act in relation to granting Barbara Juh Tier 5 status in the New York

state and local employees' retirement system

PURPOSE:

Deems Barbara Juh a member, with Tier 5 status, of the New York state

and local retirement systems on September 16, 2010

SUMMARY OF PROVISIONS:

Section 1 - Section 1- Grants Barbara Juh, a nurse at Adirondack Correc-

tional Facil- ity, Tier 5 status within the state and local retirement

systems as of September 16, 2010 if she files a written request with the

state comp- troller within 6 months of the effective date of this legis-

lation. This bill further provides the state shall not grant a refund of

any employee contributions made by her to such systems.

2021-S8610 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

8610

I N S E N A T E

March 22, 2022

___________

Introduced by Sen. STEC -- read twice and ordered printed, and when

printed to be committed to the Committee on Civil Service and Pensions

AN ACT in relation to granting Barbara Juh Tier 5 status in the New York

state and local employees' retirement system

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Notwithstanding any other provision of law, Barbara Juh,

who is a retiree of the New York state and local employees' retirement

system, with Tier 6 status, and who was employed part-time as a regis-

tered nurse at the Adirondack Correctional Facility for the period

beginning September 16, 2010 and ending December 16, 2012, and who has

been employed full-time by the department of corrections and community

supervision beginning December 17, 2012 and ending December 31, 2021,

and who, for reasons not ascribable to her own negligence, failed to

become a member of the New York state and local employees' retirement

system on September 16, 2010, shall be deemed to have been a member of

such retirement system with Tier 5 status on and after September 16,

2010, if on or before 6 months after the effective date of this act, she

shall file a written request to that effect with the state comptroller.

Upon the granting of such retroactive membership, Barbara Juh shall not

be granted a refund of any employee contributions made by her to the New

York state and local employees' retirement system.

§ 2. Any past service costs incurred in implementing the provisions of

this act shall be borne by the state of New York.

§ 3. This act shall take effect immediately.

FISCAL NOTE.--Pursuant to Legislative Law, Section 50:

This bill would grant Tier 5 status in the New York State and Local

Employees' Retirement System to Barbara Juh, a current Tier 6 retiree

formerly employed by the New York State Department of Corrections and

Community Supervision, by changing her date of membership to September

16, 2010. There will be no refund of member contributions.

If this bill is enacted during the 2022 legislative session, there

will be an immediate past service cost of approximately $14,400, which

will be borne by the State of New York as a one-time payment. This esti-

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.