| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Mar 25, 2022 |

referred to aging |

Senate Bill S8653

2021-2022 Legislative Session

Sponsored By

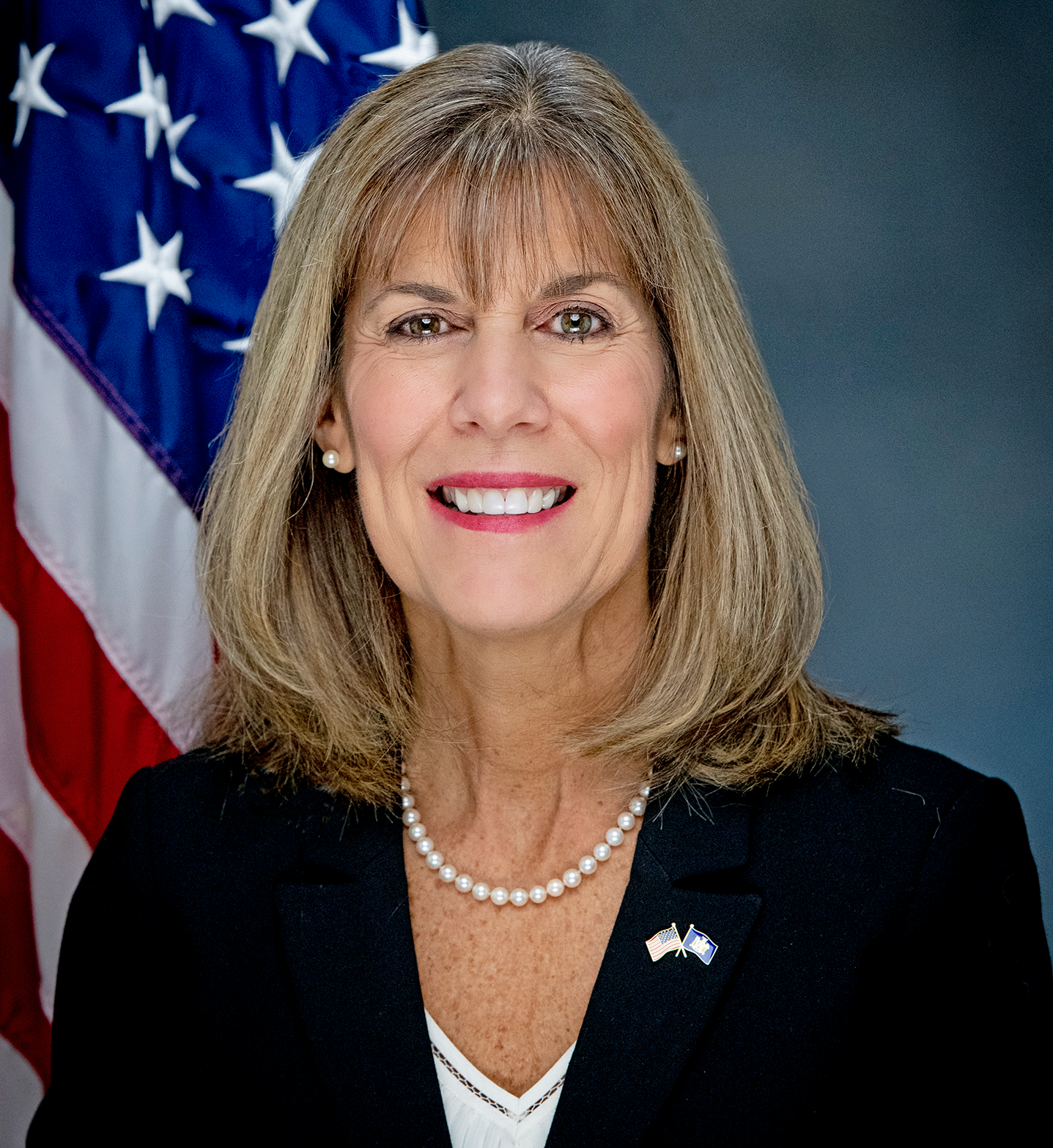

(R, C) 44th Senate District

Archive: Last Bill Status - In Senate Committee Aging Committee

Actions

co-Sponsors

(R, C) 57th Senate District

(R, C) 54th Senate District

(R, C, IP, RFM) Senate District

(R) 1st Senate District

2021-S8653 (ACTIVE) - Details

- Current Committee:

- Senate Aging

- Law Section:

- Real Property Tax Law

- Laws Affected:

- Amd §425, RPT L

- Versions Introduced in Other Legislative Sessions:

-

2023-2024:

S1639

2025-2026: S26

2021-S8653 (ACTIVE) - Sponsor Memo

BILL NUMBER: S8653

SPONSOR: TEDISCO

TITLE OF BILL:

An act to amend the real property tax law, in relation to increasing the

enhanced STAR property tax deduction and to providing a total exemption

for school taxes for certain persons eighty years of age and older

PURPOSE OR GENERAL IDEA OF BILL:

Increases the enhanced STAR property tax deduction for tax for final

assessment rolls to be completed after two thousand twenty-two and elim-

inates school taxes persons eighty and older

SUMMARY OF SPECIFIC PROVISIONS:

§ 1. This act shall be known and may be cited as the "Two STAR Act".

§ 2. Clause (C) of subparagraph (i) of paragraph (b) of subdivision 4 of

section 425 of the real property tax law, as amended by section 3 of

part E of chapter 83 of the laws of 2002, is amended to read as follows:

2021-S8653 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

8653

I N S E N A T E

March 25, 2022

___________

Introduced by Sens. TEDISCO, BORRELLO, JORDAN, PALUMBO -- read twice and

ordered printed, and when printed to be committed to the Committee on

Aging

AN ACT to amend the real property tax law, in relation to increasing the

enhanced STAR property tax deduction and to providing a total

exemption for school taxes for certain persons eighty years of age and

older

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. This act shall be known and may be cited as the "Two STAR

Act".

§ 2. Clause (C) of subparagraph (i) of paragraph (b) of subdivision 4

of section 425 of the real property tax law, as amended by section 3 of

part E of chapter 83 of the laws of 2002, is amended to read as follows:

(C) For final assessment rolls to be completed [in each ensuing year]

BETWEEN TWO THOUSAND FOUR AND TWO THOUSAND TWENTY-TWO, the applicable

income tax year, cost-of-living-adjustment percentage and applicable

increase percentage shall all be advanced by one year, and the income

standard shall be the previously-applicable income standard increased by

the new cost-of-living-adjustment percentage. If there should be a year

for which there is no applicable increase percentage due to a general

benefit increase as defined by subdivision three of subsection (i) of

section four hundred fifteen of title forty-two of the United States

code, the applicable increase percentage for purposes of this computa-

tion shall be deemed to be the percentage which would have yielded that

general benefit increase.

§ 3. Clause (C-1) of subparagraph (i) of paragraph (b) of subdivision

4 of section 425 of the real property tax law is relettered clause (C-2)

and a new clause (C-1) is added to read as follows:

(C-1) FOR FINAL ASSESSMENT ROLLS TO BE COMPLETED AFTER TWO THOUSAND

TWENTY-TWO, THE APPLICABLE INCOME TAX YEAR, COST-OF-LIVING-ADJUSTMENT

PERCENTAGE AND APPLICABLE INCREASE PERCENTAGE SHALL ALL BE ADVANCED BY

ONE YEAR, AND THE INCOME STANDARD SHALL BE TWICE THE PREVIOUSLY-APPLICA-

BLE INCOME STANDARD INCREASED BY THE NEW COST-OF-LIVING-ADJUSTMENT

PERCENTAGE. IF THERE SHOULD BE A YEAR FOR WHICH THERE IS NO APPLICABLE

INCREASE PERCENTAGE DUE TO A GENERAL BENEFIT INCREASE AS DEFINED BY

SUBDIVISION THREE OF SUBSECTION (I) OF SECTION FOUR HUNDRED FIFTEEN OF

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.