| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Jan 03, 2024 |

referred to budget and revenue |

| Jan 19, 2023 |

referred to budget and revenue |

Senate Bill S2184

2023-2024 Legislative Session

Sponsored By

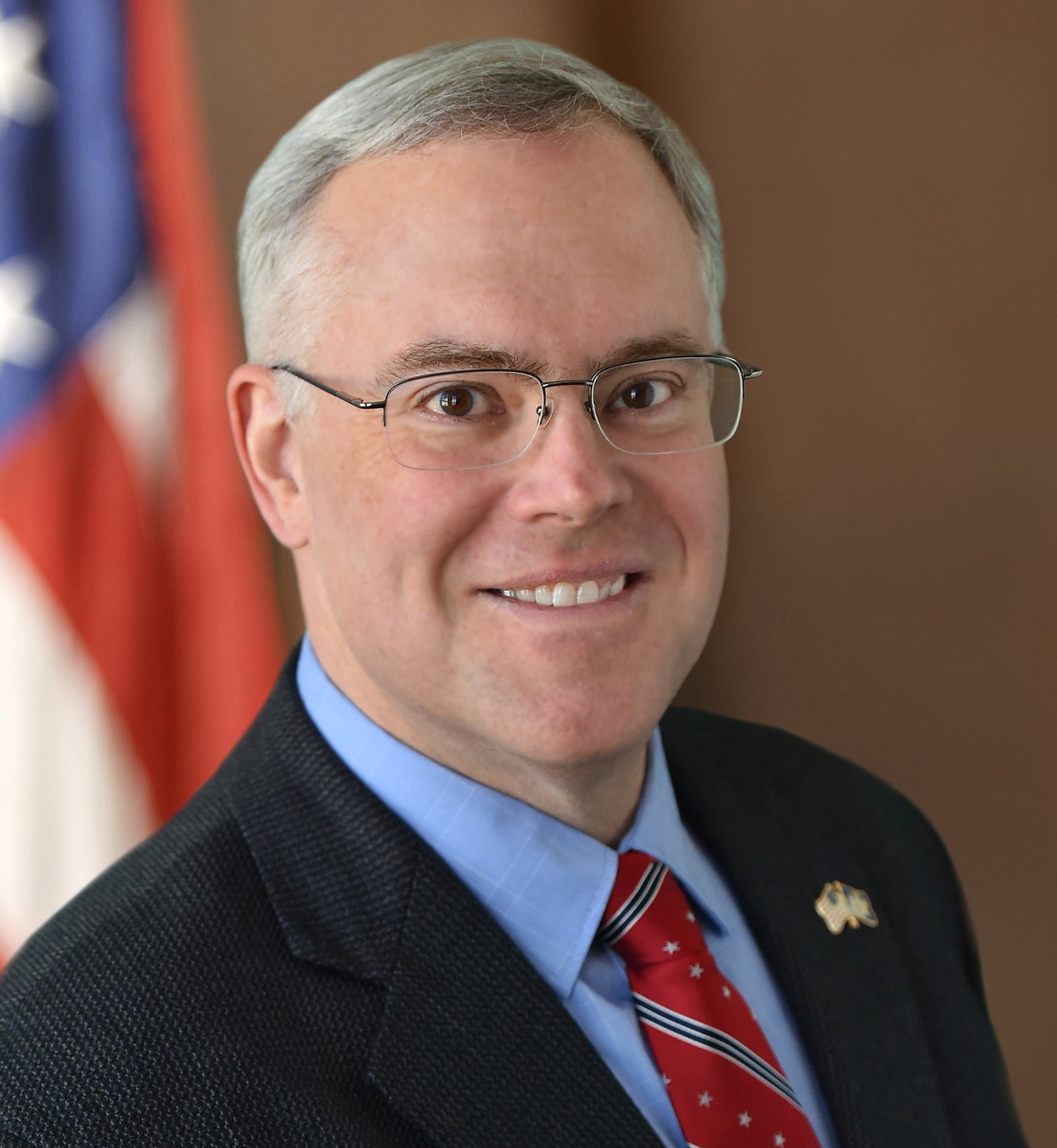

(R, C) 58th Senate District

Archive: Last Bill Status - In Senate Committee Budget And Revenue Committee

Actions

co-Sponsors

(R) 43rd Senate District

(R, C) 57th Senate District

(R, C) 9th Senate District

(R, C) 53rd Senate District

2023-S2184 (ACTIVE) - Details

- Current Committee:

- Senate Budget And Revenue

- Law Section:

- Tax Law

- Laws Affected:

- Amd §606, Tax L

- Versions Introduced in Other Legislative Sessions:

-

2021-2022:

S8522

2025-2026: S1479

2023-S2184 (ACTIVE) - Sponsor Memo

BILL NUMBER: S2184

SPONSOR: O'MARA

TITLE OF BILL:

An act to amend the tax law, in relation to establishing a home heating

tax credit; and providing for the repeal of such provisions upon expira-

tion thereof

PURPOSE OR GENERAL IDEA OF BILL:

This bill would provide a home heating tax credit.

SUMMARY OF SPECIFIC PROVISIONS:

This bill would provide a home heating tax credit for individuals with

incomes of up to $125,000 and married couples with income up to

$250,000.

The tax credit would be for $300 for single individuals and $600 for

married couples.

2023-S2184 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

2184

2023-2024 Regular Sessions

I N S E N A T E

January 19, 2023

___________

Introduced by Sen. O'MARA -- read twice and ordered printed, and when

printed to be committed to the Committee on Budget and Revenue

AN ACT to amend the tax law, in relation to establishing a home heating

tax credit; and providing for the repeal of such provisions upon expi-

ration thereof

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Section 606 of the tax law is amended by adding a new

subsection (11-1) to read as follows:

(11-1) HOME HEATING TAX CREDIT. (1) FOR PURPOSES OF THIS SUBSECTION

THE TERM "QUALIFIED TAXPAYER" SHALL MEAN A RESIDENT INDIVIDUAL OF THE

STATE, WHO MAINTAINED HIS OR HER PRIMARY RESIDENCE IN THIS STATE ON

DECEMBER THIRTY-FIRST OF THE TAXABLE YEAR, AND WHO WAS AN OWNER OF SUCH

PROPERTY ON SUCH DATE OR RENTERS WHO ARE RESPONSIBLE FOR PAYING FOR

THEIR OWN HEAT, AND WHO ARE NOT ELIGIBLE FOR THE HOME ENERGY ASSISTANCE

PROGRAM. AN INDIVIDUAL SHALL BE CONSIDERED A QUALIFIED TAXPAYER WITH

RESPECT TO NO MORE THAN ONE PRIMARY RESIDENCE DURING ANY GIVEN TAXABLE

YEAR.

(2) THE TAX CREDIT UNDER THIS SUBSECTION SHALL BE DETERMINED AS

FOLLOWS:

(A) FOR SINGLE INDIVIDUALS THAT ARE QUALIFIED TAXPAYERS, A CREDIT OF

THREE HUNDRED DOLLARS FOR THOSE WITH INCOME OF ONE HUNDRED TWENTY-FIVE

THOUSAND DOLLARS OR LESS.

(B) FOR MARRIED INDIVIDUALS THAT ARE QUALIFIED TAXPAYERS AND FILE

JOINTLY, A CREDIT OF SIX HUNDRED DOLLARS FOR THOSE WITH INCOME OF TWO

HUNDRED FIFTY THOUSAND DOLLARS OR LESS.

(3) IF THE AMOUNT OF THE CREDIT ALLOWED UNDER THIS SUBSECTION SHALL

EXCEED THE TAXPAYER'S TAX FOR THE TAXABLE YEAR, THE EXCESS SHALL BE

TREATED AS AN OVERPAYMENT OF TAX TO BE CREDITED OR REFUNDED IN ACCORD-

ANCE WITH THE PROVISIONS OF SECTION SIX HUNDRED EIGHTY-SIX OF THIS ARTI-

CLE, PROVIDED, HOWEVER, THAT NO INTEREST SHALL BE PAID THEREON. FOR EACH

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD05440-01-3

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.