| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Jan 03, 2024 |

referred to banks |

| Mar 20, 2023 |

referred to banks |

Senate Bill S5838

2023-2024 Legislative Session

Sponsored By

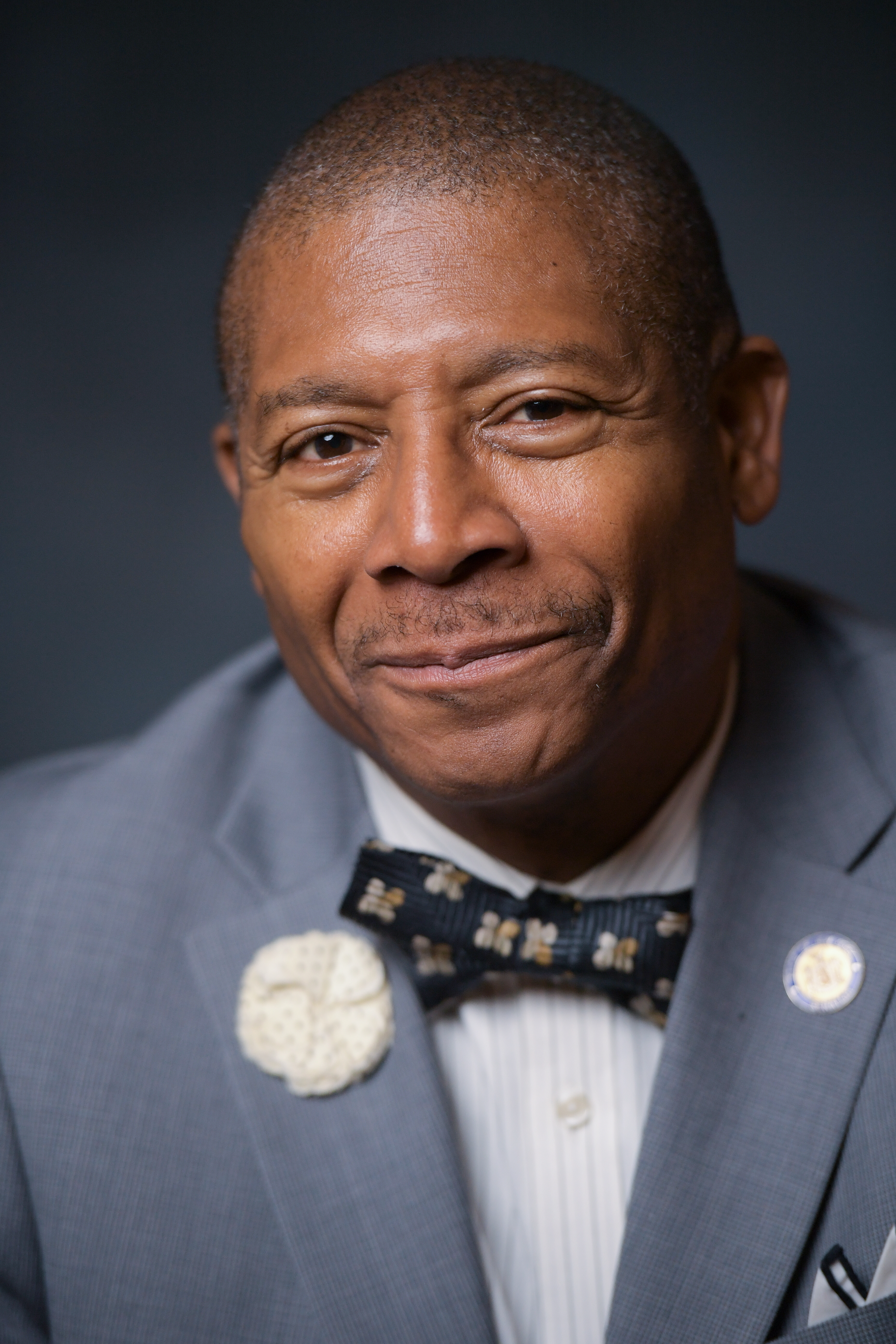

(D) 10th Senate District

Archive: Last Bill Status - In Senate Committee Banks Committee

Actions

2023-S5838 (ACTIVE) - Details

2023-S5838 (ACTIVE) - Sponsor Memo

BILL NUMBER: S5838

SPONSOR: SANDERS

TITLE OF BILL:

An act authorizing certain state regulated institutions to offer disas-

ter forbearance agreements to qualified mortgagors

PURPOSE OR GENERAL IDEA OF BILL:

This bill would provide relief to mortgagors (homeowners, etc.) by

authorizing certain state regulated institutions to automatically offer

disaster forbearance agreements to qualified mortgagors.

SUMMARY OF SPECIFIC PROVISIONS:

Section 1:

1. Definitions. "Disaster forbearance agreements" means a deferment of

all mortgage arrears including escrow advances to the back end of the

loan interest free or extend the term of the loan to reduce the borrow-

er's mortgage payments. qualified mortgagor are those residential or

2023-S5838 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

5838

2023-2024 Regular Sessions

I N S E N A T E

March 20, 2023

___________

Introduced by Sen. SANDERS -- read twice and ordered printed, and when

printed to be committed to the Committee on Banks

AN ACT authorizing certain state regulated institutions to offer disas-

ter forbearance agreements to qualified mortgagors

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. 1. As used in this act the following terms shall have the

following meanings:

(a) "Disaster forbearance agreement" means (i) the deferment of total

arrearages, including any escrow advances, to the end of the existing

term of the loan, without charging or collection of any additional

interest on the deferred amount; or (ii) the extension of the term of

the mortgage loan, and capitalization, deferral or forgiveness of all

escrow advances and other arrearages, provided this loss mitigation

option reduces the principal and interest payment on the loan if the

lender or servicer has information indicating that the borrower cannot

resume the pre-forbearance mortgage payments or if the borrower is

unable to make the payments under payment subparagraph (i) of this para-

graph.

(b) "Qualified mortgagor" means a residential or commercial borrower

whose mortgage loan became delinquent 60 days or more due directly or

indirectly to the COVID-19 emergency or between March 7, 2020 and the

effective date of this act.

(c) "Regulated institution" means any state regulated banking organ-

ization as defined in section 2 of the banking law and any state regu-

lated mortgage servicer entity subject to the authority of the depart-

ment of financial services.

2. Notwithstanding any provision of law to the contrary, every regu-

lated institution is authorized to automatically offer a disaster

forbearance agreement that begins on the effective date of this act for

a period of 60 days. No documents will be required from the qualified

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD06396-01-3

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.