| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| May 06, 2024 |

recommit, enacting clause stricken |

| Jan 03, 2024 |

referred to investigations and government operations |

| Aug 11, 2023 |

referred to rules |

Senate Bill S7630

2023-2024 Legislative Session

Sponsored By

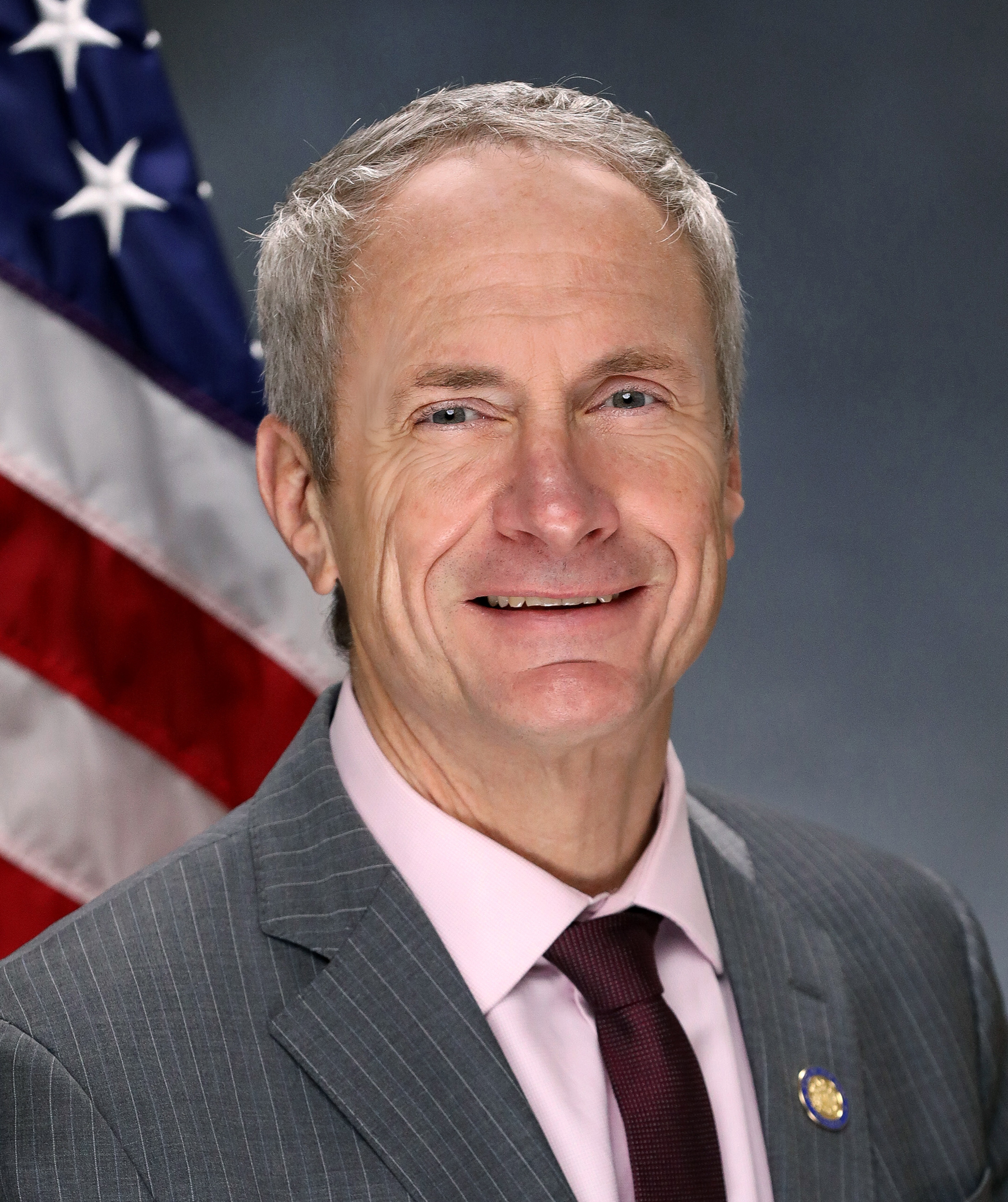

(D, WF) Senate District

Archive: Last Bill Status - Stricken

Actions

co-Sponsors

(R, C) 57th Senate District

(R, C) 60th Senate District

(D) Senate District

2023-S7630 (ACTIVE) - Details

2023-S7630 (ACTIVE) - Sponsor Memo

BILL NUMBER: S7630

SPONSOR: KENNEDY

TITLE OF BILL:

An act to extend the duration of certain brownfield redevelopment and

remediation tax credits for certain sites

PURPOSE OR GENERAL IDEA OF BILL::

This bill would extend the duration of the brownfield redevelopment and

remediation tax credits for a site in Lackawanna, Erie County to promote

economic rejuvenation and decontamination.

SUMMARY OF SPECIFIC PROVISIONS::

Section 1. grants a site in Lackawanna, Erie County with a brownfield

cleanup agreement prior to June 23, 2008, eligibility for the brownfield

redevelopment and remediation tax credits.

Section 2. establishes the effective date.

2023-S7630 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

7630

2023-2024 Regular Sessions

I N S E N A T E

August 11, 2023

___________

Introduced by Sen. KENNEDY -- read twice and ordered printed, and when

printed to be committed to the Committee on Rules

AN ACT to extend the duration of certain brownfield redevelopment and

remediation tax credits for certain sites

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. (a) Notwithstanding any provision of law, rule or regu-

lation to the contrary, any site for which (i) a brownfield cleanup

agreement with the department of environmental conservation was entered

into prior to June 23, 2008 with respect to a site located within the

Renaissance Commerce Park situate within the city of Lackawanna, Erie

county, (ii) which received a certificate of completion on or before

December 31, 2017, and (iii) that has not otherwise had property placed

in service upon such a site as of the effective date of this act, shall

be an eligible site for purposes of the brownfield redevelopment tax

credits available to such a site pursuant to section 21 of the tax law

as in effect for such a site as of the effective date of this act

provided the site preparation component shall be allowed for all appli-

cable costs incurred on such a site prior to and within the tax year in

which improvements on such a site are placed in service, and for a seven

year period following the year property is first placed in service upon

such a site, provided, such a date occurs prior to the 2036 tax year,

the on-site ground water remediation component shall be allowed for all

applicable costs incurred on such a site prior to and within the tax

year in which improvements on such a site are placed in service, and for

a seven year period following the year property is first placed in

service upon such a site, provided, such a date occurs prior to the 2036

tax year, and the tangible property credit component shall be allowed

for all applicable costs incurred on such a site prior to and within the

tax year in which improvements on such a site are placed in service, and

for a ten year period (120 months) following the year property is first

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD11878-01-3

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.