|

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|

|---|---|

| Jan 03, 2024 |

referred to budget and revenue |

| Jan 26, 2023 |

referred to budget and revenue |

Senate Bill S3028

2023-2024 Legislative Session

Sponsored By

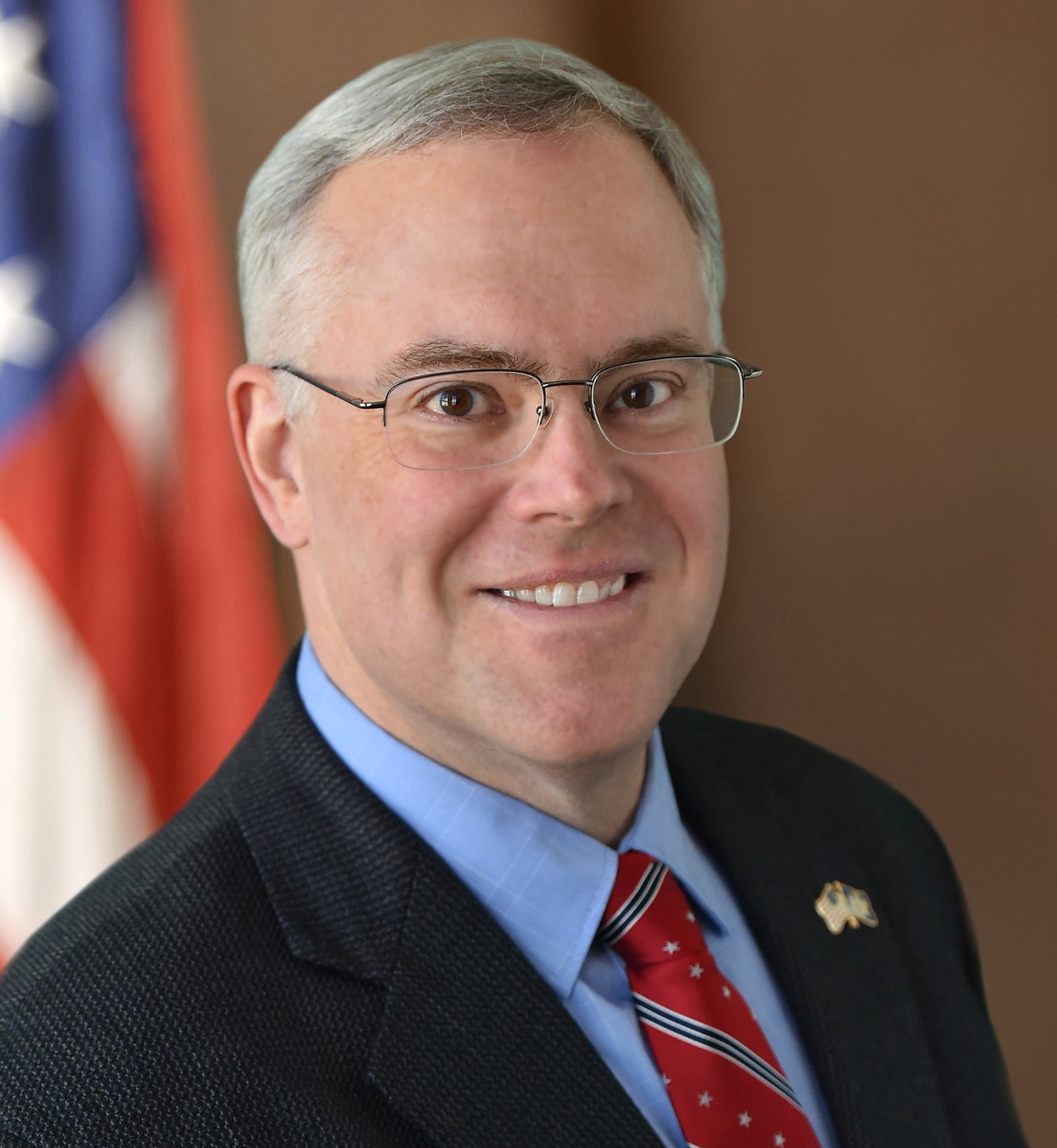

(R, C, IP) 45th Senate District

Archive: Last Bill Status - In Senate Committee Budget And Revenue Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

co-Sponsors

(R, C) 57th Senate District

(R, C) 3rd Senate District

(R, C) 51st Senate District

2023-S3028 (ACTIVE) - Details

2023-S3028 (ACTIVE) - Summary

Creates a tax credit for small businesses that sell a certain percentage of products produced in New York state; provides such small businesses include independently or privately-owned cafes, restaurants, eateries, bars, pubs, breweries, distilleries, orchards, food trucks, retail stores, farm stands, hotels, or motels.

2023-S3028 (ACTIVE) - Sponsor Memo

BILL NUMBER: S3028

SPONSOR: STEC

TITLE OF BILL:

An act to amend the tax law, in relation to creating a tax credit for

small businesses that sell a certain percentage of products produced in

New York state

PURPOSE:

The purpose of this bill is to incentivize venders to source New York

produced goods.

SUMMARY OF PROVISIONS:

Small Businesses shall qualify for an income tax credit ranging from

$1000 - $5000 for the sourcing of New York produced food, beverage, or

agricultural goods in an amount that meets a certain percentage of total

sales.

2023-S3028 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

3028

2023-2024 Regular Sessions

I N S E N A T E

January 26, 2023

___________

Introduced by Sen. STEC -- read twice and ordered printed, and when

printed to be committed to the Committee on Budget and Revenue

AN ACT to amend the tax law, in relation to creating a tax credit for

small businesses that sell a certain percentage of products produced

in New York state

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Section 210-B of the tax law is amended by adding a new

subdivision 59 to read as follows:

59. CREDIT FOR SMALL BUSINESSES THAT SELL NEW YORK STATE PRODUCED

PRODUCTS. (A) A SMALL BUSINESS SHALL BE ALLOWED A CREDIT AGAINST THE TAX

IMPOSED BY THIS ARTICLE IF SUCH SMALL BUSINESS SELLS A CERTAIN PERCENT-

AGE OF QUALIFIED PRODUCTS. SUCH CREDIT SHALL BE COMPUTED ACCORDING TO

THE FOLLOWING SCHEDULE:

(I) CREDIT OF ONE THOUSAND DOLLARS WHEN FIVE TO NINE PERCENT OF A

QUALIFYING SMALL BUSINESS' TOTAL SALES ARE ATTRIBUTED TO THE SALE OF

QUALIFYING PRODUCTS.

(II) CREDIT OF TWO THOUSAND DOLLARS WHEN TEN TO TWENTY-FOUR PERCENT OF

A QUALIFYING SMALL BUSINESS' TOTAL SALES ARE ATTRIBUTED TO THE SALE OF

QUALIFYING PRODUCTS.

(III) CREDIT OF FIVE THOUSAND DOLLARS WHEN TWENTY-FIVE PERCENT OR MORE

OF A QUALIFYING SMALL BUSINESS' TOTAL SALES ARE ATTRIBUTED TO THE SALE

OF QUALIFYING PRODUCTS.

(B) FOR THE PURPOSES OF THIS SUBDIVISION, THE TERM:

(I) "SMALL BUSINESS" SHALL MEAN A BUSINESS WHICH IS AN INDEPENDENTLY

OR PRIVATELY-OWNED CAFE, RESTAURANT, EATERY, BAR, PUB, BREWERY, DISTIL-

LERY, ORCHARD, FOOD TRUCK, RETAIL STORE, FARM STAND, HOTEL, OR MOTEL.

(II) "QUALIFIED PRODUCT" SHALL MEAN A PRODUCT WHICH IS GROWN, BREWED

OR DISTILLED IN NEW YORK STATE AND SUCH PRODUCTS SHALL INCLUDE:

(A) BEER, WINE, SPIRITS, AND CIDERS;

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD06721-01-3

S. 3028 2

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.