| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Dec 03, 2025 |

print number 4057a |

| Dec 03, 2025 |

amend and recommit to budget and revenue |

| Jan 31, 2025 |

referred to budget and revenue |

Senate Bill S4057A

2025-2026 Legislative Session

Sponsored By

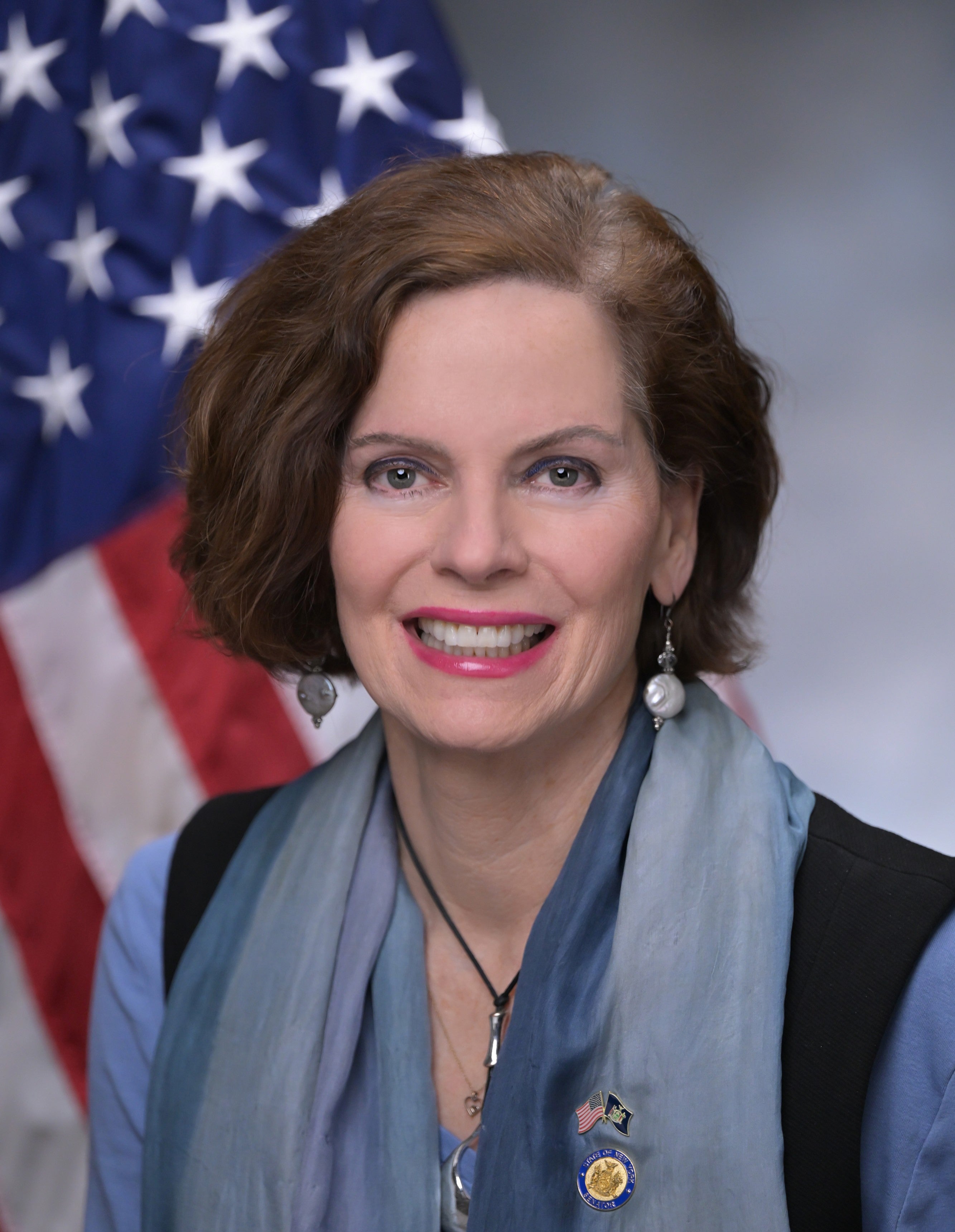

(D, WF) 46th Senate District

Current Bill Status - In Senate Committee Budget And Revenue Committee

Actions

Bill Amendments

2025-S4057 - Details

- See Assembly Version of this Bill:

- A5453

- Current Committee:

- Senate Budget And Revenue

- Law Section:

- Tax Law

- Laws Affected:

- Amd §606, Tax L; amd §14.05, Pks & Rec L

2025-S4057 - Sponsor Memo

BILL NUMBER: S4057

SPONSOR: FAHY

TITLE OF BILL:

An act to amend the tax law and the parks, recreation and historic pres-

ervation law, in relation to extending the historic homeownership reha-

bilitation tax credit and requiring additional reporting

PURPOSE OR GENERAL IDEA OF BILL:

Updates the historic homeownership rehabilitation tax credit by increas-

ing the income threshold, removing the requirement that the credit be

used for the home's exterior, and requiring the commissioner to release

an annual report on the credit.

SUMMARY OF PROVISIONS:

Section one amends paragraphs 2 and 3 of subsection (pp) of section 606

of the tax law to make the residential historic rehabilitation tax cred-

it of up to fifty thousand dollars permanent, to increase the threshold

adjusted gross income needed to potentially qualify for a tax refund to

2025-S4057 - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

4057

2025-2026 Regular Sessions

I N S E N A T E

January 31, 2025

___________

Introduced by Sen. FAHY -- read twice and ordered printed, and when

printed to be committed to the Committee on Budget and Revenue

AN ACT to amend the tax law and the parks, recreation and historic pres-

ervation law, in relation to extending the historic homeownership

rehabilitation tax credit and requiring additional reporting

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Paragraphs 2 and 3 of subsection (pp) of section 606 of the

tax law, paragraph 2 as amended by section 4 of part RR of chapter 59 of

the laws of 2018 and paragraph 3 as added by chapter 547 of the laws of

2006, are amended and a new paragraph 13 is added to read as follows:

(2) (A) With respect to any particular residence of a taxpayer, the

credit allowed under paragraph one of this subsection shall not exceed

fifty thousand dollars for taxable years beginning on or after January

first, two thousand ten [and before January first, two thousand twenty-

five and twenty-five thousand dollars for taxable years beginning on or

after January first, two thousand twenty-five]. In the case of a

[husband and wife] MARRIED COUPLE, the amount of the credit shall be

divided between them equally or in such other manner as they may both

elect. If a taxpayer incurs qualified rehabilitation expenditures in

relation to more than one residence in the same year, the total amount

of credit allowed under paragraph one of this subsection for all such

expenditures shall not exceed fifty thousand dollars for taxable years

beginning on or after January first, two thousand ten [and before Janu-

ary first, two thousand twenty-five and twenty-five thousand dollars for

taxable years beginning on or after January first, two thousand twenty-

five].

(B) For taxable years beginning on or after January first, two thou-

sand ten [and before January first, two thousand twenty-five], if the

amount of credit allowable under this subsection shall exceed the

taxpayer's tax for such year, and the taxpayer's New York adjusted gross

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD08172-02-5

2025-S4057A (ACTIVE) - Details

- See Assembly Version of this Bill:

- A5453

- Current Committee:

- Senate Budget And Revenue

- Law Section:

- Tax Law

- Laws Affected:

- Amd §606, Tax L; amd §14.05, Pks & Rec L

2025-S4057A (ACTIVE) - Sponsor Memo

BILL NUMBER: S4057A

SPONSOR: FAHY

TITLE OF BILL:

An act to amend the tax law and the parks, recreation and historic pres-

ervation law, in relation to extending the historic homeownership reha-

bilitation tax credit and requiring additional reporting

PURPOSE OR GENERAL IDEA OF BILL:

To permanently reinstate the maximum allowable amount of the residential

historic rehabilitation credit to fifty thousand dollars, eliminate the

requirement for a minimum percentage of exterior rehabilitation expendi-

tures and add reporting requirements.

SUMMARY OF PROVISIONS:

Section one amends paragraphs 2 and 3 of subsection (pp) of section 606

of the tax law to make the residential historic rehabilitation tax cred-

it of up to fifty thousand dollars permanent and remove the requirement

that at least 5% of total rehabilitation expenditures be allocable to

2025-S4057A (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

4057--A

2025-2026 Regular Sessions

I N S E N A T E

January 31, 2025

___________

Introduced by Sen. FAHY -- read twice and ordered printed, and when

printed to be committed to the Committee on Budget and Revenue --

committee discharged, bill amended, ordered reprinted as amended and

recommitted to said committee

AN ACT to amend the tax law and the parks, recreation and historic pres-

ervation law, in relation to extending the historic homeownership

rehabilitation tax credit and requiring additional reporting

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Paragraphs 2 and 3 of subsection (pp) of section 606 of the

tax law, paragraph 2 as amended by section 4 of part RR of chapter 59 of

the laws of 2018 and paragraph 3 as added by chapter 547 of the laws of

2006, are amended and a new paragraph 13 is added to read as follows:

(2) (A) With respect to any particular residence of a taxpayer, the

credit allowed under paragraph one of this subsection shall not exceed

fifty thousand dollars for taxable years beginning on or after January

first, two thousand ten [and before January first, two thousand twenty-

five and twenty-five thousand dollars for taxable years beginning on or

after January first, two thousand twenty-five]. In the case of a

[husband and wife] MARRIED COUPLE, the amount of the credit shall be

divided between them equally or in such other manner as they may both

elect. If a taxpayer incurs qualified rehabilitation expenditures in

relation to more than one residence in the same year, the total amount

of credit allowed under paragraph one of this subsection for all such

expenditures shall not exceed fifty thousand dollars for taxable years

beginning on or after January first, two thousand ten [and before Janu-

ary first, two thousand twenty-five and twenty-five thousand dollars for

taxable years beginning on or after January first, two thousand twenty-

five].

(B) For taxable years beginning on or after January first, two thou-

sand ten [and before January first, two thousand twenty-five], if the

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD08172-04-5

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.