| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Feb 10, 2025 |

referred to banks |

Find your Senator and share your views on important issues.

Senate Bill S4606

2025-2026 Legislative Session

Provides for the regulation of buy-now-pay-later lenders

download bill text pdfSponsored By

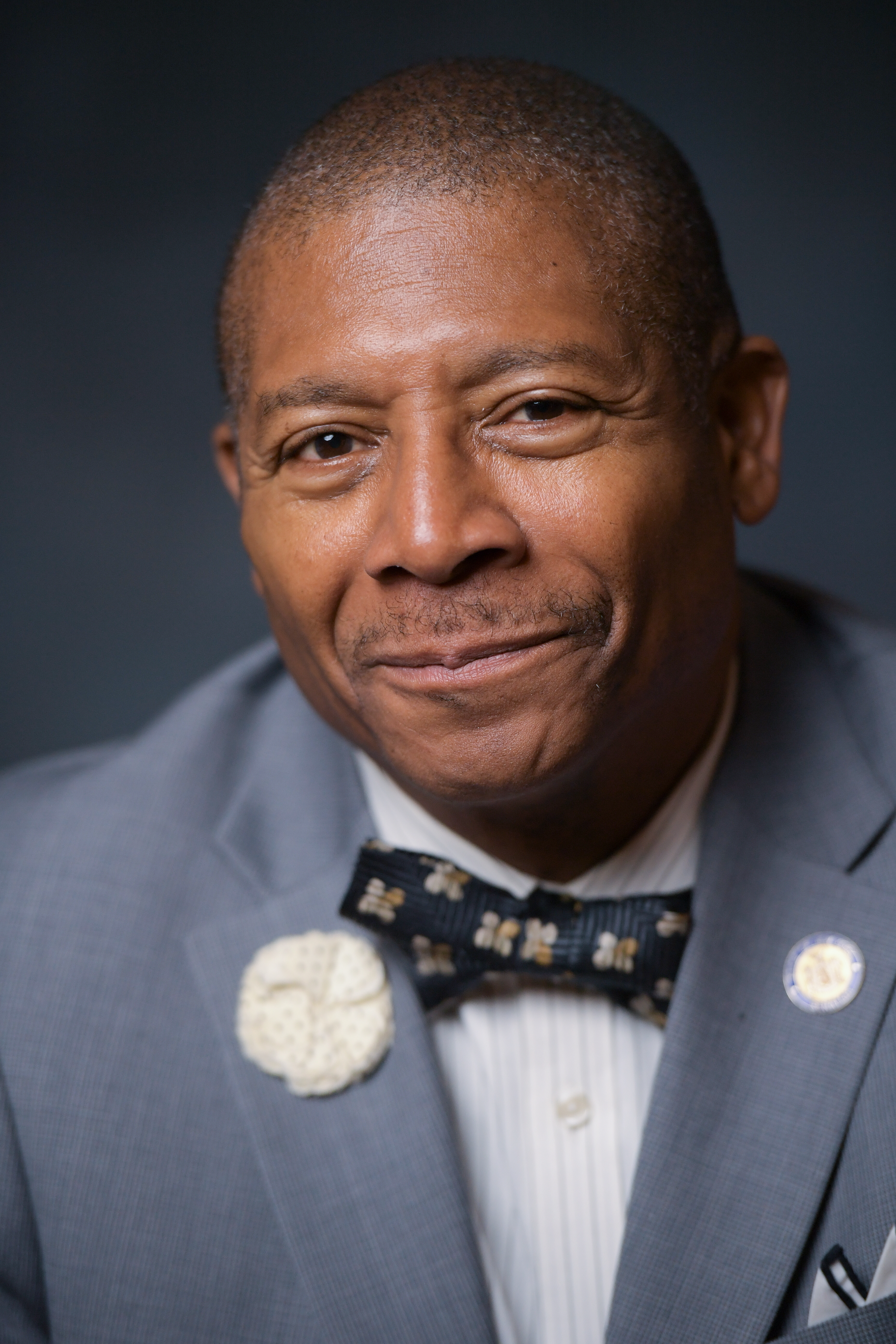

(D) 10th Senate District

Current Bill Status - In Senate Committee Banks Committee

- Introduced

-

- In Committee Assembly

- In Committee Senate

-

- On Floor Calendar Assembly

- On Floor Calendar Senate

-

- Passed Assembly

- Passed Senate

- Delivered to Governor

- Signed By Governor

Actions

2025-S4606 (ACTIVE) - Details

- Current Committee:

- Senate Banks

- Law Section:

- Banking Law

- Laws Affected:

- Add Art 14-B §§735 - 749, amd §§36, 37, 39, 42 & 44, Bank L

- Versions Introduced in 2023-2024 Legislative Session:

-

S9689

2025-S4606 (ACTIVE) - Sponsor Memo

BILL NUMBER: S4606

SPONSOR: SANDERS

TITLE OF BILL:

An act to amend the banking law, in relation to the regulation of buy-

now-pay-later lenders

PURPOSE OR GENERAL IDEA OF BILL:

The purpose of this bill is to protect consumers by amending the Banking

Law to grant DFS licensing and regulatory authority over BNPL loans and

their providers and authorizes the NYS Department of Financial Services

(DFS) to regulate the industry. This bill would provide stronger consum-

er protections around disclosure requirements, dispute resolution, cred-

it reporting standards, late fee limits, and consumer data privacy. DFS

would also review guidelines to curtail dark patterns, debt accumu-

lation, and overextension.

SUMMARY OF SPECIFIC PROVISIONS:

Section 1 of this bill gives definitions.

Section 13 provides for the effective date. JUSTIFICATION: This bill amends a proposal originally put forth in the Governor's 2024 Executive Budget, it authorizes the Department of Financial Services (DFS) to regulate lenders offering "Buy Now, Pay Later" (BNPL) loans. PRIOR LEGISLATIVE HISTORY: New bill EFFECTIVE DATE: This act shall take effect on the one hundred eightieth day after the department of financial services shall have promulgated rules and/or regulations necessary to effectuate the provisions of this act; provided that the department of financial services .shall notify the legislative bill drafting commission upon the occurrence of the promulgation of the rules and regulations necessary to effectuate and enforce the provisions of section two of this act, in order that the commission may maintain an accurate and timely effective record of the official text of the laws of the state of New York in furtherance of effectuating the provisions of section 44 of the legislative law and section 70-b of the public offi- cers law. Effective immediately, the addition, amendment and/or repeal of any rule or regulation authorized to be made by the superintendent pursuant to this act is authorized to be made and completed on or before such effective date.

2025-S4606 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

4606

2025-2026 Regular Sessions

I N S E N A T E

February 10, 2025

___________

Introduced by Sen. SANDERS -- read twice and ordered printed, and when

printed to be committed to the Committee on Banks

AN ACT to amend the banking law, in relation to the regulation of buy-

now-pay-later lenders

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. The banking law is amended by adding a new article 14-B to

read as follows:

ARTICLE XIV-B

BUY-NOW-PAY-LATER LENDERS

SECTION 735. SHORT TITLE.

736. DEFINITIONS.

737. LICENSE.

738. CONDITIONS PRECEDENT TO ISSUING A LICENSE; PROCEDURE WHERE

APPLICATION IS DENIED.

739. LICENSE PROVISIONS AND POSTING.

740. APPLICATION FOR ACQUISITION OF CONTROL OF BUY-NOW-PAY-LATER

LENDER BY PURCHASE OF STOCK.

741. GROUNDS FOR REVOCATION OR SUSPENSION OF LICENSE; PROCEDURE.

742. SUPERINTENDENT AUTHORIZED TO EXAMINE.

743. LICENSEE'S BOOKS AND RECORDS; REPORTS.

744. ACTS PROHIBITED.

745. LIMITATION ON CHARGES ON BUY-NOW-PAY-LATER LOANS.

746. CONSUMER PROTECTIONS.

747. AUTHORITY OF SUPERINTENDENT.

748. PENALTIES.

749. SEVERABILITY.

§ 735. SHORT TITLE. THIS ARTICLE SHALL BE KNOWN AND MAY BE CITED AS

THE "BUY NOW PAY LATER ACT".

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD01886-02-5

S. 4606 2 § 736. DEFINITIONS. AS USED IN THIS ARTICLE, THE FOLLOWING TERMS SHALL HAVE THE FOLLOWING MEANINGS: 1. "CONSUMER" MEANS AN INDIVIDUAL WHO IS A RESIDENT OF THE STATE OF NEW YORK. 2. "BUY-NOW-PAY-LATER LOAN" MEANS CREDIT PROVIDED TO A CONSUMER AT THE TIME OF PURCHASE IN CONNECTION WITH SUCH CONSUMER'S PARTICULAR PURCHASE OF GOODS OR SERVICES, OTHER THAN A MOTOR VEHICLE AS DEFINED UNDER SECTION ONE HUNDRED TWENTY-FIVE OF THE VEHICLE AND TRAFFIC LAW, THAT REQUIRES REPAYMENT OF THE PRINCIPAL IN A FIXED NUMBER OF SUBSTANTIALLY EQUAL INSTALLMENTS WITH NO INTEREST. 3. "BUY-NOW-PAY-LATER LENDER" MEANS A PERSON WHO OFFERS BUY-NOW-PAY- LATER LOANS IN THIS STATE. FOR PURPOSES OF THE PRECEDING SENTENCE, "OFFER" MEANS OFFERING TO EXTEND CREDIT THROUGH A BUY-NOW-PAY-LATER LOAN DIRECTLY TO A CONSUMER AT THE TIME OF PURCHASE OR OPERATING A PLATFORM, SOFTWARE, OR TO OPERATE A SYSTEM WITH WHICH A CONSUMER INTERACTS AND THE PRIMARY PURPOSE OF WHICH IS TO ALLOW THIRD PARTIES TO OFFER BUY-NOW-PAY- LATER LOANS, OR BOTH. A PERSON WHO SELLS GOODS OR SERVICES TO A CONSUMER AND EXTENDS CREDIT TO SUCH CONSUMER IN CONNECTION WITH SUCH CONSUMER'S PARTICULAR PURCHASE OF SUCH GOODS OR SERVICES SHALL NOT BE CONSIDERED A BUY-NOW-PAY-LATER LENDER WITH RESPECT TO SUCH TRANSACTIONS. A PERSON SHALL NOT BE CONSIDERED A BUY-NOW-PAY-LATER LENDER ON THE BASIS OF ISOLATED, INCIDENTAL OR OCCASIONAL TRANSACTIONS WHICH OTHERWISE MEET THE DEFINITIONS OF THIS SECTION. 4. "EXEMPT ORGANIZATION" MEANS ANY BANKING ORGANIZATION OR FOREIGN BANKING CORPORATION LICENSED BY THE SUPERINTENDENT OR THE COMPTROLLER OF THE CURRENCY TO TRANSACT BUSINESS IN THIS STATE, NATIONAL BANK, FEDERAL SAVINGS BANK, FEDERAL SAVINGS AND LOAN ASSOCIATION, OR FEDERAL CREDIT UNION ORGANIZED UNDER THE LAWS OF ANY OTHER STATE. SUBJECT TO SUCH REGULATIONS AS MAY BE PROMULGATED BY THE SUPERINTENDENT, "EXEMPT ORGAN- IZATION" MAY ALSO INCLUDE ANY SUBSIDIARY OF SUCH ENTITIES. 5. "LICENSEE" MEANS A PERSON WHO HAS BEEN ISSUED A LICENSE PURSUANT TO THIS ARTICLE. 6. "PERSON" MEANS AN INDIVIDUAL, PARTNERSHIP, CORPORATION, ASSOCIATION OR ANY OTHER BUSINESS ORGANIZATION. § 737. LICENSE. 1. NO PERSON OR OTHER ENTITY, EXCEPT AN EXEMPT ORGAN- IZATION AS DEFINED IN THIS ARTICLE, SHALL ENGAGE IN THE BUSINESS OF MAKING BUY-NOW-PAY-LATER LOANS WITHOUT FIRST OBTAINING A BUY-NOW-PAY-LA- TER LENDER LICENSE FROM THE SUPERINTENDENT. 2. AN APPLICATION FOR A LICENSE SHALL BE IN WRITING, UNDER OATH, AND IN THE FORM AND CONTAINING SUCH INFORMATION AS THE SUPERINTENDENT MAY REQUIRE. 3. AT THE TIME OF FILING AN APPLICATION FOR A LICENSE, THE APPLICANT SHALL PAY TO THE SUPERINTENDENT A FEE AS PRESCRIBED PURSUANT TO SECTION EIGHTEEN-A OF THIS CHAPTER. 4. A LICENSE GRANTED PURSUANT TO THIS ARTICLE SHALL BE VALID UNLESS REVOKED OR SUSPENDED BY THE SUPERINTENDENT OR UNLESS SURRENDERED BY THE LICENSEE AND ACCEPTED BY THE SUPERINTENDENT. 5. IN CONNECTION WITH AN APPLICATION FOR A LICENSE, THE APPLICANT SHALL SUBMIT AN AFFIDAVIT OF FINANCIAL SOLVENCY, INCLUDING FINANCIAL STATEMENTS, NOTING SUCH CAPITALIZATION REQUIREMENTS AND ACCESS TO SUCH CREDIT OR SUCH OTHER AFFIRMATION OR INFORMATION AS MAY BE PRESCRIBED BY THE REGULATIONS OF THE SUPERINTENDENT. § 738. CONDITIONS PRECEDENT TO ISSUING A LICENSE; PROCEDURE WHERE APPLICATION IS DENIED. 1. AFTER THE FILING OF AN APPLICATION FOR A LICENSE ACCOMPANIED BY PAYMENT OF THE FEE PURSUANT TO SUBDIVISION THREE OF SECTION SEVEN HUNDRED THIRTY-SEVEN OF THIS ARTICLE, IT SHALL BE S. 4606 3 SUBSTANTIVELY REVIEWED. AFTER THE APPLICATION IS DEEMED SUFFICIENT AND COMPLETE, IF THE SUPERINTENDENT FINDS THAT THE FINANCIAL RESPONSIBILITY, INCLUDING MEETING ANY CAPITAL REQUIREMENTS AS ESTABLISHED PURSUANT TO SUBDIVISION THREE OF THIS SECTION, EXPERIENCE, CHARACTER AND GENERAL FITNESS OF THE APPLICANT OR ANY PERSON ASSOCIATED WITH THE APPLICANT ARE SUCH AS TO COMMAND THE CONFIDENCE OF THE COMMUNITY AND TO WARRANT THE BELIEF THAT THE BUSINESS WILL BE CONDUCTED HONESTLY, FAIRLY AND EFFI- CIENTLY WITHIN THE PURPOSES AND INTENT OF THIS ARTICLE, THE SUPERINTEN- DENT SHALL ISSUE THE LICENSE. FOR THE PURPOSE OF THIS SUBDIVISION, THE APPLICANT SHALL BE DEEMED TO INCLUDE ALL THE MEMBERS OF THE APPLICANT IF IT IS A PARTNERSHIP OR UNINCORPORATED ASSOCIATION OR ORGANIZATION, AND ALL THE STOCKHOLDERS, OFFICERS AND DIRECTORS OF THE APPLICANT IF IT IS A CORPORATION. 2. IF THE SUPERINTENDENT REFUSES TO ISSUE A LICENSE, THE SUPERINTEN- DENT SHALL NOTIFY THE APPLICANT OF THE DENIAL AND RETAIN THE FEE PAID PURSUANT TO SUBDIVISION THREE OF SECTION SEVEN HUNDRED THIRTY-SEVEN OF THIS ARTICLE. 3. THE SUPERINTENDENT MAY ISSUE REGULATIONS SETTING CAPITAL REQUIRE- MENTS TO ENSURE THE SOLVENCY AND FINANCIAL INTEGRITY OF LICENSEES AND THEIR ONGOING OPERATIONS, TAKING INTO ACCOUNT THE RISKS, VOLUME OF BUSI- NESS, COMPLEXITY, AND OTHER RELEVANT FACTORS REGARDING SUCH LICENSEES. FURTHER, THE SUPERINTENDENT MAY ISSUE RULES AND REGULATIONS PRESCRIBING A METHODOLOGY TO CALCULATE CAPITAL REQUIREMENTS WITH RESPECT TO LICEN- SEES OR CATEGORIES THEREOF. § 739. LICENSE PROVISIONS AND POSTING. 1. A LICENSE ISSUED UNDER THIS ARTICLE SHALL STATE THE NAME AND ADDRESS OF THE LICENSEE, AND IF THE LICENSEE BE A CO-PARTNERSHIP OR ASSOCIATION, THE NAMES OF THE MEMBERS THEREOF, AND IF A CORPORATION THE DATE AND PLACE OF ITS INCORPORATION. 2. SUCH LICENSE SHALL BE KEPT CONSPICUOUSLY POSTED ON THE MOBILE APPLICATION, WEBSITE, OR OTHER CONSUMER INTERFACE OF THE LICENSEE, AS WELL AS LISTED IN THE TERMS AND CONDITIONS OF ANY BUY-NOW-PAY-LATER LOAN OFFERED OR ENTERED INTO BY THE LICENSEE. THE SUPERINTENDENT MAY PROVIDE BY REGULATION AN ALTERNATIVE FORM OF NOTICE OF LICENSURE. 3. A LICENSE ISSUED UNDER THIS ARTICLE SHALL NOT BE TRANSFERABLE OR ASSIGNABLE. § 740. APPLICATION FOR ACQUISITION OF CONTROL OF BUY-NOW-PAY-LATER LENDER BY PURCHASE OF STOCK. 1. IT SHALL BE UNLAWFUL EXCEPT WITH THE PRIOR APPROVAL OF THE SUPERINTENDENT FOR ANY ACTION TO BE TAKEN WHICH RESULTS IN A CHANGE OF CONTROL OF THE BUSINESS OF A LICENSEE. PRIOR TO ANY CHANGE OF CONTROL, THE PERSON DESIROUS OF ACQUIRING CONTROL OF THE BUSINESS OF A LICENSEE SHALL MAKE WRITTEN APPLICATION TO THE SUPERINTEN- DENT AND PAY AN INVESTIGATION FEE AS PRESCRIBED PURSUANT TO SECTION EIGHTEEN-A OF THIS CHAPTER TO THE SUPERINTENDENT. THE APPLICATION SHALL CONTAIN SUCH INFORMATION AS THE SUPERINTENDENT, BY REGULATION, MAY PRESCRIBE AS NECESSARY OR APPROPRIATE FOR THE PURPOSE OF MAKING THE DETERMINATION REQUIRED BY SUBDIVISION TWO OF THIS SECTION. 2. THE SUPERINTENDENT SHALL APPROVE OR DISAPPROVE THE PROPOSED CHANGE OF CONTROL OF A LICENSEE IN ACCORDANCE WITH THE PROVISIONS OF SECTION SEVEN HUNDRED THIRTY-EIGHT OF THIS ARTICLE. 3. FOR A PERIOD OF SIX MONTHS FROM THE DATE OF QUALIFICATION THEREOF AND FOR SUCH ADDITIONAL PERIOD OF TIME AS THE SUPERINTENDENT MAY PRESCRIBE, IN WRITING, THE PROVISIONS OF SUBDIVISIONS ONE AND TWO OF THIS SECTION SHALL NOT APPLY TO A TRANSFER OF CONTROL BY OPERATION OF LAW TO THE LEGAL REPRESENTATIVE, AS HEREINAFTER DEFINED, OF ONE WHO HAS CONTROL OF A LICENSEE. THEREAFTER, SUCH LEGAL REPRESENTATIVE SHALL COMPLY WITH THE PROVISIONS OF SUBDIVISIONS ONE AND TWO OF THIS SECTION. S. 4606 4 THE PROVISIONS OF SUBDIVISIONS ONE AND TWO OF THIS SECTION SHALL BE APPLICABLE TO AN APPLICATION MADE UNDER SUCH SECTION BY A LEGAL REPRE- SENTATIVE. 4. THE TERM "LEGAL REPRESENTATIVE," FOR THE PURPOSES OF THIS SECTION, SHALL MEAN ONE DULY APPOINTED BY A COURT OF COMPETENT JURISDICTION TO ACT AS EXECUTOR, ADMINISTRATOR, TRUSTEE, COMMITTEE, CONSERVATOR OR RECEIVER, INCLUDING ONE WHO SUCCEEDS A LEGAL REPRESENTATIVE AND ONE ACTING IN AN ANCILLARY CAPACITY THERETO IN ACCORDANCE WITH THE PROVISIONS OF SUCH COURT APPOINTMENT. 5. AS USED IN THIS SECTION, THE TERM "CONTROL" MEANS THE POSSESSION, DIRECTLY OR INDIRECTLY, OF THE POWER TO DIRECT OR CAUSE THE DIRECTION OF THE MANAGEMENT AND POLICIES OF A LICENSEE, WHETHER THROUGH THE OWNERSHIP OF VOTING STOCK OF SUCH LICENSEE, THE OWNERSHIP OF VOTING STOCK OF ANY PERSON WHICH POSSESSES SUCH POWER OR OTHERWISE. CONTROL SHALL BE PRESUMED TO EXIST IF ANY PERSON, DIRECTLY OR INDIRECTLY, OWNS, CONTROLS OR HOLDS WITH POWER TO VOTE TEN PER CENTUM OR MORE OF THE VOTING STOCK OF ANY LICENSEE OR OF ANY PERSON WHICH OWNS, CONTROLS OR HOLDS WITH POWER TO VOTE TEN PER CENTUM OR MORE OF THE VOTING STOCK OF ANY LICEN- SEE, BUT NO PERSON SHALL BE DEEMED TO CONTROL A LICENSEE SOLELY BY REASON OF BEING AN OFFICER OR DIRECTOR OF SUCH LICENSEE OR PERSON. THE SUPERINTENDENT MAY IN THE SUPERINTENDENT'S DISCRETION, UPON THE APPLICA- TION OF A LICENSEE OR ANY PERSON WHO, DIRECTLY OR INDIRECTLY, OWNS, CONTROLS OR HOLDS WITH POWER TO VOTE OR SEEKS TO OWN, CONTROL OR HOLD WITH POWER TO VOTE ANY VOTING STOCK OF SUCH LICENSEE, DETERMINE WHETHER OR NOT THE OWNERSHIP, CONTROL OR HOLDING OF SUCH VOTING STOCK CONSTI- TUTES OR WOULD CONSTITUTE CONTROL OF SUCH LICENSEE FOR PURPOSES OF THIS SECTION. § 741. GROUNDS FOR REVOCATION OR SUSPENSION OF LICENSE; PROCEDURE. 1. A LICENSE GRANTED PURSUANT TO THIS SECTION MAY BE REVOKED OR SUSPENDED BY THE SUPERINTENDENT UPON A FINDING THAT: (A) THE LICENSEE HAS VIOLATED ANY APPLICABLE LAW OR REGULATION; (B) ANY FACT OR CONDITION EXISTS WHICH, IF IT HAD EXISTED AT THE TIME OF THE ORIGINAL APPLICATION FOR SUCH LICENSE, CLEARLY WOULD HAVE WARRANTED THE SUPERINTENDENT'S REFUSAL TO ISSUE SUCH LICENSE; OR (C) THE LICENSEE HAS FAILED TO PAY ANY SUM OF MONEY LAWFULLY DEMANDED BY THE SUPERINTENDENT OR TO COMPLY WITH ANY DEMAND, RULING OR REQUIRE- MENT OF THE SUPERINTENDENT. 2. ANY LICENSEE MAY SURRENDER ANY LICENSE BY DELIVERING TO THE SUPER- INTENDENT WRITTEN NOTICE THAT THE LICENSEE THEREBY SURRENDERS SUCH LICENSE. SUCH SURRENDER SHALL BE EFFECTIVE UPON ITS ACCEPTANCE BY THE SUPERINTENDENT, AND SHALL NOT AFFECT SUCH LICENSEE'S CIVIL OR CRIMINAL LIABILITY FOR ACTS COMMITTED PRIOR TO SUCH SURRENDER. 3. EVERY LICENSE ISSUED HEREUNDER SHALL REMAIN IN FORCE AND EFFECT UNTIL THE SAME SHALL HAVE BEEN SURRENDERED, REVOKED OR SUSPENDED, IN ACCORDANCE WITH THE PROVISIONS OF THIS ARTICLE, BUT THE SUPERINTENDENT SHALL HAVE AUTHORITY TO REINSTATE SUSPENDED LICENSES OR TO ISSUE A NEW LICENSE TO A LICENSEE WHOSE LICENSE HAS BEEN REVOKED IF NO FACT OR CONDITION THEN EXISTS WHICH CLEARLY WOULD HAVE WARRANTED THE SUPERINTEN- DENT'S REFUSAL TO ISSUE SUCH LICENSE. 4. WHENEVER THE SUPERINTENDENT SHALL REVOKE OR SUSPEND A LICENSE ISSUED PURSUANT TO THIS ARTICLE, THE SUPERINTENDENT SHALL FORTHWITH EXECUTE A WRITTEN ORDER TO THAT EFFECT, WHICH ORDER MAY BE REVIEWED IN THE MANNER PROVIDED BY ARTICLE SEVENTY-EIGHT OF THE CIVIL PRACTICE LAW AND RULES. SUCH SPECIAL PROCEEDING FOR REVIEW AS AUTHORIZED BY THIS SECTION MUST BE COMMENCED WITHIN THIRTY DAYS FROM THE DATE OF SUCH ORDER OF SUSPENSION OR REVOCATION. S. 4606 5 5. THE SUPERINTENDENT MAY, FOR GOOD CAUSE, WITHOUT NOTICE AND A HEAR- ING, SUSPEND ANY LICENSE ISSUED PURSUANT TO THIS ARTICLE FOR A PERIOD NOT EXCEEDING THIRTY DAYS, PENDING INVESTIGATION. "GOOD CAUSE," AS USED IN THIS SUBDIVISION, SHALL EXIST ONLY WHEN THE LICENSEE HAS ENGAGED IN OR IS LIKELY TO ENGAGE IN A PRACTICE PROHIBITED BY THIS ARTICLE OR THE REGULATIONS PROMULGATED THEREUNDER OR ENGAGES IN DISHONEST OR INEQUITA- BLE PRACTICES WHICH MAY CAUSE SUBSTANTIAL HARM TO THE PUBLIC. 6. NO REVOCATION, SUSPENSION OR SURRENDER OF ANY LICENSE SHALL IMPAIR OR AFFECT THE OBLIGATION OF ANY PRE-EXISTING LAWFUL CONTRACTS BETWEEN THE LICENSEE AND ANY BORROWER. § 742. SUPERINTENDENT AUTHORIZED TO EXAMINE. 1. THE SUPERINTENDENT SHALL HAVE THE POWER TO MAKE SUCH INVESTIGATIONS AS THE SUPERINTENDENT SHALL DEEM NECESSARY TO DETERMINE WHETHER ANY BUY-NOW-PAY-LATER LENDER OR ANY OTHER PERSON HAS VIOLATED ANY OF THE PROVISIONS OF THIS ARTICLE OR ANY OTHER APPLICABLE LAW, OR WHETHER ANY LICENSEE HAS CONDUCTED ITSELF IN SUCH MANNER AS WOULD JUSTIFY THE REVOCATION OF ITS LICENSE, AND TO THE EXTENT NECESSARY THEREFOR, THE SUPERINTENDENT MAY REQUIRE THE ATTENDANCE OF AND EXAMINE ANY PERSON UNDER OATH, AND SHALL HAVE THE POWER TO COMPEL THE PRODUCTION OF ALL RELEVANT BOOKS, RECORDS, ACCOUNTS, AND DOCUMENTS. 2. THE SUPERINTENDENT SHALL HAVE THE POWER TO MAKE SUCH EXAMINATIONS OF THE BOOKS, RECORDS, ACCOUNTS AND DOCUMENTS USED IN THE BUSINESS OF ANY LICENSEE AS THE SUPERINTENDENT SHALL DEEM NECESSARY TO DETERMINE WHETHER ANY SUCH LICENSEE HAS VIOLATED ANY OF THE PROVISIONS OF THIS CHAPTER OR ANY OTHER APPLICABLE LAW OR TO SECURE INFORMATION LAWFULLY REQUIRED BY THE SUPERINTENDENT. § 743. LICENSEE'S BOOKS AND RECORDS; REPORTS. 1. A BUY-NOW-PAY-LATER LENDER SHALL KEEP AND USE IN ITS BUSINESS SUCH BOOKS, ACCOUNTS AND RECORDS AS WILL ENABLE THE SUPERINTENDENT TO DETERMINE WHETHER SUCH BUY-NOW-PAY-LATER LENDER IS COMPLYING WITH THE PROVISIONS OF THIS ARTI- CLE AND WITH THE RULES AND REGULATIONS LAWFULLY MADE BY THE SUPERINTEN- DENT HEREUNDER. EVERY BUY-NOW-PAY-LATER LENDER SHALL PRESERVE SUCH BOOKS, ACCOUNTS AND RECORDS FOR AT LEAST SIX YEARS AFTER MAKING THE FINAL ENTRY IN RESPECT TO ANY BUY-NOW-PAY-LATER LOAN RECORDED THEREIN; PROVIDED, HOWEVER, THE PRESERVATION OF PHOTOGRAPHIC OR DIGITAL REPROD- UCTIONS THEREOF OR RECORDS IN PHOTOGRAPHIC OR DIGITAL FORM SHALL CONSTI- TUTE COMPLIANCE WITH THIS REQUIREMENT. 2. BY A DATE TO BE SET BY THE SUPERINTENDENT, EACH LICENSEE SHALL ANNUALLY FILE A REPORT WITH THE SUPERINTENDENT GIVING SUCH INFORMATION AS THE SUPERINTENDENT MAY REQUIRE CONCERNING THE LICENSEE'S BUSINESS AND OPERATIONS DURING THE PRECEDING CALENDAR YEAR WITHIN THE STATE UNDER THE AUTHORITY OF THIS ARTICLE. SUCH REPORT SHALL BE SUBSCRIBED AND AFFIRMED AS TRUE BY THE LICENSEE UNDER THE PENALTIES OF PERJURY AND BE IN THE FORM PRESCRIBED BY THE SUPERINTENDENT. IN ADDITION TO SUCH ANNUAL REPORTS, THE SUPERINTENDENT MAY REQUIRE OF LICENSEES SUCH ADDITIONAL REGULAR OR SPECIAL REPORTS AS THE SUPERINTENDENT MAY DEEM NECESSARY TO THE PROPER SUPERVISION OF LICENSEES UNDER THIS ARTICLE. SUCH ADDITIONAL REPORTS SHALL BE IN THE FORM PRESCRIBED BY THE SUPERINTENDENT AND SHALL BE SUBSCRIBED AND AFFIRMED AS TRUE UNDER THE PENALTIES OF PERJURY. § 744. ACTS PROHIBITED. 1. NO BUY-NOW-PAY-LATER LENDER SHALL TAKE OR CAUSE TO BE TAKEN ANY CONFESSION OF JUDGMENT OR ANY POWER OF ATTORNEY TO CONFESS JUDGMENT OR TO APPEAR FOR THE CONSUMER IN A JUDICIAL PROCEEDING. 2. NO BUY-NOW-PAY-LATER LENDER SHALL: (A) EMPLOY ANY SCHEME, DEVICE, OR ARTIFICE TO DEFRAUD OR MISLEAD A BORROWER; S. 4606 6 (B) ENGAGE IN ANY UNFAIR, DECEPTIVE OR PREDATORY ACT OR PRACTICE TOWARD ANY PERSON OR MISREPRESENT OR OMIT ANY MATERIAL INFORMATION IN CONNECTION WITH THE BUY-NOW-PAY-LATER LOANS, INCLUDING, BUT NOT LIMITED TO, MISREPRESENTING THE AMOUNT, NATURE OR TERMS OF ANY FEE OR PAYMENT DUE OR CLAIMED TO BE DUE ON THE LOAN, THE TERMS AND CONDITIONS OF THE LOAN AGREEMENT OR THE BORROWER'S OBLIGATIONS UNDER THE LOAN; (C) MISAPPLY PAYMENTS TO THE OUTSTANDING BALANCE OF ANY BUY-NOW-PAY- LATER LOAN OR TO ANY RELATED FEES; (D) PROVIDE INACCURATE INFORMATION TO A CONSUMER REPORTING AGENCY; OR (E) MAKE ANY FALSE STATEMENT OR MAKE ANY OMISSION OF A MATERIAL FACT IN CONNECTION WITH ANY INFORMATION OR REPORTS FILED WITH A GOVERNMENTAL AGENCY OR IN CONNECTION WITH ANY INVESTIGATION CONDUCTED BY THE SUPER- INTENDENT OR ANOTHER GOVERNMENTAL AGENCY. § 745. LIMITATION ON CHARGES ON BUY-NOW-PAY-LATER LOANS. 1. NOTWITH- STANDING ANY OTHER PROVISION OF LAW TO THE CONTRARY, NO BUY-NOW-PAY-LA- TER LENDER SHALL CHARGE, CONTRACT FOR, OR OTHERWISE RECEIVE FROM A CONSUMER ANY INTEREST, PENALTY, LATE FEE, DISCOUNT OR OTHER CONSIDER- ATION IN CONNECTION TO A BUY-NOW-PAY-LATER LOAN, WHETHER DIRECTLY OR INDIRECTLY, EXCEPT AS PROVIDED IN THIS SECTION. 2. THE SUPERINTENDENT SHALL ESTABLISH A STANDARD AMOUNT OR PERCENTAGE FOR TOTAL MAXIMUM CHARGE OR FEE IN CONNECTION WITH LATE PAYMENT, DEFAULT OR ANY OTHER VIOLATION OF THE BUY-NOW-PAY-LATER LOAN AGREEMENT THAT A BUY-NOW-PAY-LATER LENDER CAN CHARGE A CONSUMER. SUCH FEE OR CHARGE SHALL NOT BE COLLECTED MORE THAN ONCE FOR THE SAME VIOLATION. 3. ANY TRANSACTION FEE CHARGED TO THE CONSUMER BY OR ON BEHALF OF A BUY-NOW-PAY-LATER LENDER SHALL BE LIMITED TO REASONABLE AND ACTUAL COSTS OF PROCESSING AND EXECUTING THE TRANSACTION. § 746. CONSUMER PROTECTIONS. 1. DISCLOSURES. A BUY-NOW-PAY-LATER LEND- ER SHALL DISCLOSE OR CAUSE TO BE DISCLOSED TO CONSUMERS THE TERMS OF BUY-NOW-PAY-LATER LOANS, INCLUDING THE COST, REPAYMENT SCHEDULE, WHETHER THE TRANSACTION WILL OR WILL NOT BE REPORTED TO A CREDIT REPORTING AGEN- CY, AND OTHER MATERIAL CONDITIONS, IN A CLEAR AND CONSPICUOUS MANNER. DISCLOSURES SHALL COMPLY WITH APPLICABLE FEDERAL REGULATIONS, INCLUDING BUT NOT LIMITED TO REGULATION Z OF TITLE I OF THE CONSUMER CREDIT PROTECTION ACT. 2. ABILITY TO REPAY. SUBJECT TO REGULATIONS TO BE PROMULGATED BY THE SUPERINTENDENT, A BUY-NOW-PAY-LATER LENDER SHALL, BEFORE PROVIDING OR CAUSING TO BE PROVIDED A BUY-NOW-PAY-LATER LOAN TO A CONSUMER, MAKE, OR CAUSE TO BE MADE, A REASONABLE DETERMINATION THAT SUCH CONSUMER HAS THE ABILITY TO REPAY THE BUY-NOW-PAY-LATER LOAN. 3. CREDIT REPORTING. A BUY-NOW-PAY-LATER LENDER SHALL NOT REPORT ANY CONSUMER DATA OBTAINED THROUGH A BUY-NOW-PAY-LATER LOAN TO ANY CREDIT REPORTING AGENCY EXCEPT AS AUTHORIZED IN REGULATIONS PROMULGATED BY THE SUPERINTENDENT AND IN THE FORM AND MANNER PRESCRIBED THEREIN. THE SUPER- INTENDENT, IN CONSULTATION WITH THE DIRECTOR OF THE DIVISION OF CONSUMER PROTECTION, SHALL ESTABLISH PROVISIONS REGARDING THE USE OF SUCH DATA BY THE CREDIT REPORTING AGENCIES. NO LICENSEE SHALL COLLECT, EVALUATE, REPORT, OR MAINTAIN IN THE FILE ON A BORROWER THE CREDIT WORTHINESS, CREDIT STANDING, OR CREDIT CAPACITY OF MEMBERS OF THE BORROWER'S SOCIAL NETWORK FOR PURPOSES OF DETERMINING THE CREDIT WORTHINESS OF THE BORROW- ER; THE AVERAGE CREDIT WORTHINESS, CREDIT STANDING, OR CREDIT CAPACITY OF MEMBERS OF THE BORROWER'S SOCIAL NETWORK; OR ANY GROUP SCORE THAT IS NOT THE BORROWER'S OWN CREDIT WORTHINESS, CREDIT STANDING, OR CREDIT CAPACITY. 4. REFUNDS AND CREDITS. A BUY-NOW-PAY-LATER LENDER SHALL PROVIDE OR CAUSE TO BE PROVIDED REFUNDS OR CREDITS FOR GOODS OR SERVICES PURCHASED S. 4606 7 IN CONNECTION WITH A BUY-NOW-PAY-LATER LOAN, UPON CONSUMER REQUEST, AS NECESSARY. A BUY-NOW-PAY-LATER LENDER SHALL MAINTAIN OR CAUSE TO BE MAINTAINED POLICIES AND PROCEDURES TO PROVIDE SUCH REFUNDS OR CREDITS. SUCH POLICIES AND PROCEDURES SHALL BE FAIR, TRANSPARENT, AND NOT UNDULY BURDENSOME TO THE CONSUMER. A BUY-NOW-PAY-LATER LENDER SHALL DISCLOSE OR CAUSE TO BE DISCLOSED, IN A CLEAR AND CONSPICUOUS MANNER, SUCH POLI- CIES AND PROCEDURES. 5. CONSUMER DISPUTES. A BUY-NOW-PAY-LATER LENDER SHALL RESOLVE OR CAUSE TO BE RESOLVED DISPUTES IN A MANNER THAT IS FAIR AND TRANSPARENT TO CONSUMERS. A BUY-NOW-PAY-LATER LENDER SHALL CREATE OR CAUSE TO BE CREATED A READILY AVAILABLE AND PROMINENTLY DISCLOSED METHOD FOR CONSUM- ERS TO BRING A DISPUTE TO THE BUY-NOW-PAY-LATER LENDER. A BUY-NOW-PAY- LATER LENDER SHALL MAINTAIN POLICIES AND PROCEDURES FOR HANDLING CONSUM- ER DISPUTES. 6. USE OF CONSUMER DATA. A BUY-NOW-PAY-LATER LENDER SHALL CLEARLY AND CONSPICUOUSLY DISCLOSE OR CAUSE TO BE DISCLOSED TO A CONSUMER TO WHICH IT PROVIDES A LOAN HOW SUCH CONSUMER'S DATA MAY BE USED, SHARED OR SOLD BY THE BUY-NOW-PAY-LATER LENDER. IN ADDITION TO ANY OTHER CONSENT OR PRIVACY REQUIREMENTS IN LAW, THE BUY-NOW-PAY-LATER LENDER SHALL PROVIDE THE CONSUMER THE OPPORTUNITY TO PROVIDE AFFIRMATIVE CONSENT TO SUCH COLLECTION, SALE, SHARING, AND USE OF CONSUMER DATA, PROVIDED THAT WITH- OUT SUCH CONSENT THE BUY-NOW-PAY-LATER LENDER SHALL NOT COLLECT, SELL, SHARE, OR USE SUCH CONSUMER DATA. THE SUPERINTENDENT, IN THEIR DISCRETION, MAY BY REGULATION PROHIBIT CERTAIN USES OF CONSUMER DATA. 7. UNAUTHORIZED USE. THE SUPERINTENDENT MAY ISSUE RULES AND REGU- LATIONS REGARDING TREATMENT OF UNAUTHORIZED USE, SO THAT CONSUMERS ARE LIABLE FOR USE OF BUY-NOW-PAY-LATER LOANS IN THEIR NAME ONLY UNDER CIRCUMSTANCES WHERE SUCH LIABILITY WOULD BE FAIR AND REASONABLE. 8. VOID BUY-NOW-PAY-LATER LOANS. ANY BUY-NOW-PAY-LATER LOAN MADE BY A PERSON NOT LICENSED UNDER THIS ARTICLE, OTHER THAN AN EXEMPT ORGANIZA- TION, SHALL BE VOID, AND SUCH PERSON SHALL HAVE NO RIGHT TO COLLECT OR RECEIVE ANY PRINCIPAL, INTEREST OR CHARGE WHATSOEVER. § 747. AUTHORITY OF SUPERINTENDENT. 1. THE SUPERINTENDENT IS AUTHOR- IZED TO PROMULGATE SUCH GENERAL RULES AND REGULATIONS AS MAY BE APPRO- PRIATE TO IMPLEMENT THE PROVISIONS OF THIS ARTICLE, PROTECT CONSUMERS, AND ENSURE THE SOLVENCY AND FINANCIAL INTEGRITY OF BUY-NOW-PAY-LATER LENDERS. THE SUPERINTENDENT IS FURTHER AUTHORIZED TO MAKE SUCH SPECIFIC RULINGS, DEMANDS, AND FINDINGS AS MAY BE NECESSARY FOR THE PROPER CONDUCT OF THE BUSINESS AUTHORIZED AND LICENSED UNDER AND FOR THE ENFORCEMENT OF THIS ARTICLE, IN ADDITION HERETO AND NOT INCONSISTENT HEREWITH. 2. IN ADDITION TO SUCH POWERS AS MAY OTHERWISE BE PRESCRIBED BY LAW, THE SUPERINTENDENT IS HEREBY AUTHORIZED AND EMPOWERED TO PROMULGATE SUCH RULES AND REGULATIONS AS MAY IN THE JUDGMENT OF THE SUPERINTENDENT BE CONSISTENT WITH THE PURPOSES OF THIS ARTICLE, OR APPROPRIATE FOR THE EFFECTIVE ADMINISTRATION OF THIS ARTICLE, INCLUDING, BUT NOT LIMITED TO: (A) SUCH RULES AND REGULATIONS IN CONNECTION WITH THE ACTIVITIES OF BUY-NOW-PAY-LATER LENDERS AS MAY BE NECESSARY AND APPROPRIATE FOR THE PROTECTION OF BORROWERS IN THIS STATE; (B) SUCH RULES AND REGULATIONS AS MAY BE NECESSARY AND APPROPRIATE TO DEFINE UNFAIR, DECEPTIVE, OR ABUSIVE ACTS OR PRACTICES IN CONNECTION WITH THE ACTIVITIES OF BUY-NOW-PAY-LATER LENDERS; (C) SUCH RULES AND REGULATIONS AS MAY DEFINE THE TERMS USED IN THIS ARTICLE AND AS MAY BE NECESSARY AND APPROPRIATE TO INTERPRET AND IMPLE- MENT THE PROVISIONS OF THIS ARTICLE; AND S. 4606 8 (D) SUCH RULES AND REGULATIONS AS MAY BE NECESSARY FOR THE ENFORCEMENT OF THIS ARTICLE. § 748. PENALTIES. 1. ANY PERSON, INCLUDING ANY MEMBER, OFFICER, DIREC- TOR OR EMPLOYEE OF A BUY-NOW-PAY-LATER LENDER, WHO VIOLATES OR PARTIC- IPATES IN THE VIOLATION OF SECTION SEVEN HUNDRED THIRTY-SEVEN OF THIS ARTICLE, OR WHO KNOWINGLY MAKES ANY INCORRECT STATEMENT OF A MATERIAL FACT IN ANY APPLICATION, REPORT OR STATEMENT FILED PURSUANT TO THIS ARTICLE, OR WHO KNOWINGLY OMITS TO STATE ANY MATERIAL FACT NECESSARY TO GIVE THE SUPERINTENDENT ANY INFORMATION LAWFULLY REQUIRED BY THE SUPER- INTENDENT OR REFUSES TO PERMIT ANY LAWFUL INVESTIGATION OR EXAMINATION, SHALL BE GUILTY OF A MISDEMEANOR AND, UPON CONVICTION, SHALL BE FINED NOT MORE THAN FIVE HUNDRED DOLLARS OR IMPRISONED FOR NOT MORE THAN SIX MONTHS OR BOTH, IN THE DISCRETION OF THE COURT. 2. WITHOUT LIMITING ANY POWER GRANTED TO THE SUPERINTENDENT UNDER ANY OTHER PROVISION OF THIS CHAPTER, THE SUPERINTENDENT MAY, IN A PROCEEDING AFTER NOTICE AND A HEARING REQUIRE A BUY-NOW-PAY-LATER LENDER, WHETHER OR NOT A LICENSEE, TO PAY TO THE PEOPLE OF THIS STATE A PENALTY FOR ANY VIOLATION OF THIS CHAPTER, ANY REGULATION PROMULGATED THEREUNDER, ANY FINAL OR TEMPORARY ORDER ISSUED PURSUANT TO SECTION THIRTY-NINE OF THIS CHAPTER, ANY CONDITION IMPOSED IN WRITING BY THE SUPERINTENDENT IN CONNECTION WITH THE GRANT OF ANY APPLICATION OR REQUEST, OR ANY WRITTEN AGREEMENT ENTERED INTO WITH THE SUPERINTENDENT, AND FOR KNOWINGLY MAKING ANY INCORRECT STATEMENT OF A MATERIAL FACT IN ANY APPLICATION, REPORT OR STATEMENT FILED PURSUANT TO THIS ARTICLE, OR KNOWINGLY OMITTING TO STATE ANY MATERIAL FACT NECESSARY TO GIVE THE SUPERINTENDENT ANY INFORMATION LAWFULLY REQUIRED BY THE SUPERINTENDENT OR REFUSING TO PERMIT ANY LAWFUL INVESTIGATION OR EXAMINATION. AS TO ANY BUY-NOW-PAY-LATER LENDER THAT IS NOT A LICENSEE OR AN EXEMPT ORGANIZATION, THE SUPERINTENDENT IS AUTHOR- IZED TO IMPOSE A PENALTY IN THE SAME AMOUNT AUTHORIZED IN SECTION FORTY-FOUR OF THIS CHAPTER FOR A VIOLATION OF THIS CHAPTER BY ANY PERSON LICENSED, CERTIFIED, REGISTERED, AUTHORIZED, CHARTERED, ACCREDITED, INCORPORATED OR OTHERWISE APPROVED BY THE SUPERINTENDENT PURSUANT TO THIS CHAPTER. 3. NO PERSON SHALL MAKE, DIRECTLY OR INDIRECTLY, ORALLY OR IN WRITING, OR BY ANY METHOD, PRACTICE OR DEVICE, A REPRESENTATION THAT SUCH PERSON IS LICENSED UNDER THE BANKING LAW EXCEPT THAT A LICENSEE UNDER THIS CHAPTER MAY MAKE A REPRESENTATION THAT THE LICENSEE IS LICENSED AS A BUY-NOW-PAY-LATER LENDER UNDER THIS CHAPTER. § 749. SEVERABILITY. IF ANY PROVISION OF THIS ARTICLE OR THE APPLICA- TION THEREOF TO ANY PERSON OR CIRCUMSTANCES IS HELD TO BE INVALID, SUCH INVALIDITY SHALL NOT AFFECT OTHER PROVISIONS OR APPLICATIONS OF THIS ARTICLE WHICH CAN BE GIVEN EFFECT WITHOUT THE INVALID PROVISION OR APPLICATION, AND TO THIS END THE PROVISIONS OF THIS ARTICLE ARE SEVERA- BLE. § 2. Subdivision 1 of section 36 of the banking law, as amended by chapter 146 of the laws of 1961, is amended to read as follows: 1. The superintendent shall have the power to examine every banking organization, every bank holding company and any non-banking subsidiary thereof (as such terms "bank holding company" and "non-banking subsid- iary" are defined in article three-A of this chapter) and every licensed lender AND LICENSED BUY-NOW-PAY-LATER LENDER at any time prior to its dissolution whenever in [his] SUCH SUPERINTENDENT'S judgment such exam- ination is necessary or advisable. § 3. Subdivision 10 of section 36 of the banking law, as amended by section 2 of part L of chapter 58 of the laws of 2019, is amended to read as follows: S. 4606 9 10. All reports of examinations and investigations, correspondence and memoranda concerning or arising out of such examination and investi- gations, including any duly authenticated copy or copies thereof in the possession of any banking organization, bank holding company or any subsidiary thereof (as such terms "bank holding company" and "subsid- iary" are defined in article three-A of this chapter), any corporation or any other entity affiliated with a banking organization within the meaning of subdivision six of this section and any non-banking subsid- iary of a corporation or any other entity which is an affiliate of a banking organization within the meaning of subdivision six-a of this section, foreign banking corporation, licensed lender, LICENSED BUY-NOW- PAY-LATER LENDER, licensed casher of checks, licensed mortgage banker, registered mortgage broker, licensed mortgage loan originator, licensed sales finance company, registered mortgage loan servicer, licensed student loan servicer, licensed insurance premium finance agency, licensed transmitter of money, licensed budget planner, any other person or entity subject to supervision under this chapter, or the department, shall be confidential communications, shall not be subject to subpoena and shall not be made public unless, in the judgment of the superinten- dent, the ends of justice and the public advantage will be subserved by the publication thereof, in which event the superintendent may publish or authorize the publication of a copy of any such report or any part thereof in such manner as may be deemed proper or unless such laws specifically authorize such disclosure. For the purposes of this subdi- vision, "reports of examinations and investigations, and any correspond- ence and memoranda concerning or arising out of such examinations and investigations", includes any such materials of a bank, insurance or securities regulatory agency or any unit of the federal government or that of this state any other state or that of any foreign government which are considered confidential by such agency or unit and which are in the possession of the department or which are otherwise confidential materials that have been shared by the department with any such agency or unit and are in the possession of such agency or unit. § 4. Subdivisions 3 and 5 of section 37 of the banking law, as amended by chapter 360 of the laws of 1984, are amended to read as follows: 3. In addition to any reports expressly required by this chapter to be made, the superintendent may require any banking organization, licensed lender, LICENSED BUY-NOW-PAY-LATER LENDER, licensed casher of checks, licensed mortgage banker, foreign banking corporation licensed by the superintendent to do business in this state, bank holding company and any non-banking subsidiary thereof, corporate affiliate of a corporate banking organization within the meaning of subdivision six of section thirty-six of this article and any non-banking subsidiary of a corpo- ration which is an affiliate of a corporate banking organization within the meaning of subdivision six-a of section thirty-six of this article to make special reports to [him] THE SUPERINTENDENT at such times as [he] THE SUPERINTENDENT may prescribe. 5. The superintendent may extend at [his] THE SUPERINTENDENT'S discretion the time within which a banking organization, foreign banking corporation licensed by the superintendent to do business in this state, bank holding company or any non-banking subsidiary thereof, licensed casher of checks, licensed mortgage banker, private banker, LICENSED BUY-NOW-PAY-LATER LENDER or licensed lender is required to make and file any report to the superintendent. § 5. Section 39 of the banking law, as amended by section 3 of part L of chapter 58 of the laws of 2019, is amended to read as follows: S. 4606 10 § 39. Orders of superintendent. 1. To appear and explain an apparent violation. Whenever it shall appear to the superintendent that any bank- ing organization, bank holding company, registered mortgage broker, licensed mortgage banker, licensed student loan servicer, registered mortgage loan servicer, licensed mortgage loan originator, licensed lender, LICENSED BUY-NOW-PAY-LATER LENDER, licensed casher of checks, licensed sales finance company, licensed insurance premium finance agen- cy, licensed transmitter of money, licensed budget planner, out-of-state state bank that maintains a branch or branches or representative or other offices in this state, or foreign banking corporation licensed by the superintendent to do business or maintain a representative office in this state has violated any law or regulation, [he or she] THE SUPER- INTENDENT may, in [his or her] THE SUPERINTENDENT'S discretion, issue an order describing such apparent violation and requiring such banking organization, bank holding company, registered mortgage broker, licensed mortgage banker, licensed student loan servicer, licensed mortgage loan originator, licensed lender, LICENSED BUY-NOW-PAY-LATER LENDER, licensed casher of checks, licensed sales finance company, licensed insurance premium finance agency, licensed transmitter of money, licensed budget planner, out-of-state state bank that maintains a branch or branches or representative or other offices in this state, or foreign banking corpo- ration to appear before [him or her] THE SUPERINTENDENT, at a time and place fixed in said order, to present an explanation of such apparent violation. 2. To discontinue unauthorized or unsafe and unsound practices. When- ever it shall appear to the superintendent that any banking organiza- tion, bank holding company, registered mortgage broker, licensed mort- gage banker, licensed student loan servicer, registered mortgage loan servicer, licensed mortgage loan originator, licensed lender, LICENSED BUY-NOW-PAY-LATER LENDER, licensed casher of checks, licensed sales finance company, licensed insurance premium finance agency, licensed transmitter of money, licensed budget planner, out-of-state state bank that maintains a branch or branches or representative or other offices in this state, or foreign banking corporation licensed by the super- intendent to do business in this state is conducting business in an unauthorized or unsafe and unsound manner, [he or she] THE SUPERINTEN- DENT may, in [his or her] THE SUPERINTENDENT'S discretion, issue an order directing the discontinuance of such unauthorized or unsafe and unsound practices, and fixing a time and place at which such banking organization, bank holding company, registered mortgage broker, licensed mortgage banker, licensed student loan servicer, registered mortgage loan servicer, licensed mortgage loan originator, licensed lender, LICENSED BUY-NOW-PAY-LATER LENDER, licensed casher of checks, licensed sales finance company, licensed insurance premium finance agency, licensed transmitter of money, licensed budget planner, out-of-state state bank that maintains a branch or branches or representative or other offices in this state, or foreign banking corporation may volun- tarily appear before [him or her] THE SUPERINTENDENT to present any explanation in defense of the practices directed in said order to be discontinued. 3. To make good impairment of capital or to ensure compliance with financial requirements. Whenever it shall appear to the superintendent that the capital or capital stock of any banking organization, bank holding company or any subsidiary thereof which is organized, licensed or registered pursuant to this chapter, is impaired, or the financial requirements imposed by subdivision one of section two hundred two-b of S. 4606 11 this chapter or any regulation of the superintendent on any branch or agency of a foreign banking corporation or the financial requirements imposed by this chapter or any regulation of the superintendent on any licensed lender, LICENSED BUY-NOW-PAY-LATER LENDER, registered mortgage broker, licensed mortgage banker, licensed student loan servicer, licensed casher of checks, licensed sales finance company, licensed insurance premium finance agency, licensed transmitter of money, licensed budget planner or private banker are not satisfied, the super- intendent may, in the superintendent's discretion, issue an order directing that such banking organization, bank holding company, branch or agency of a foreign banking corporation, registered mortgage broker, licensed mortgage banker, licensed student loan servicer, licensed lend- er, LICENSED BUY-NOW-PAY-LATER LENDER, licensed casher of checks, licensed sales finance company, licensed insurance premium finance agen- cy, licensed transmitter of money, licensed budget planner, or private banker make good such deficiency forthwith or within a time specified in such order. 4. To make good encroachments on reserves. Whenever it shall appear to the superintendent that either the total reserves or reserves on hand of any banking organization, branch or agency of a foreign banking corpo- ration are below the amount required by or pursuant to this chapter or any other applicable provision of law or regulation to be maintained, or that such banking organization, branch or agency of a foreign banking corporation is not keeping its reserves on hand as required by this chapter or any other applicable provision of law or regulation, [he or she] THE SUPERINTENDENT may, in [his or her] THE SUPERINTENDENT'S discretion, issue an order directing that such banking organization, branch or agency of a foreign banking corporation make good such reserves forthwith or within a time specified in such order, or that it keep its reserves on hand as required by this chapter. 5. To keep books and accounts as prescribed. Whenever it shall appear to the superintendent that any banking organization, bank holding compa- ny, registered mortgage broker, licensed mortgage banker, licensed student loan servicer, registered mortgage loan servicer, licensed mort- gage loan originator, licensed lender, LICENSED BUY-NOW-PAY-LATER LEND- ER, licensed casher of checks, licensed sales finance company, licensed insurance premium finance agency, licensed transmitter of money, licensed budget planner, agency or branch of a foreign banking corpo- ration licensed by the superintendent to do business in this state, does not keep its books and accounts in such manner as to enable [him or her] THE SUPERINTENDENT to readily ascertain its true condition, [he or she] THE SUPERINTENDENT may, in [his or her] THE SUPERINTENDENT'S discretion, issue an order requiring such banking organization, bank holding compa- ny, registered mortgage broker, licensed mortgage banker, licensed student loan servicer, registered mortgage loan servicer, licensed mort- gage loan originator, licensed lender, LICENSED BUY-NOW-PAY-LATER LEND- ER, licensed casher of checks, licensed sales finance company, licensed insurance premium finance agency, licensed transmitter of money, licensed budget planner, or foreign banking corporation, or the officers or agents thereof, or any of them, to open and keep such books or accounts as [he or she] THE SUPERINTENDENT may, in [his or her] THE SUPERINTENDENT'S discretion, determine and prescribe for the purpose of keeping accurate and convenient records of its transactions and accounts. S. 4606 12 6. As used in this section, "bank holding company" shall have the same meaning as that term is defined in section one hundred forty-one of this chapter. § 6. Subdivision 1 of section 42 of the banking law, as amended by chapter 65 of the laws of 1948, is amended to read as follows: 1. The name and the location of the principal office of every proposed corporation, private banker, licensed lender, LICENSED BUY-NOW-PAY-LATER LENDER and licensed casher of checks, the organization certificate, private banker's certificate or application for license of which has been filed for examination, and the date of such filing. § 7. Subdivision 2 of section 42 of the banking law, as amended by chapter 553 of the laws of 1960, is amended to read as follows: 2. The name and location of every licensed lender, LICENSED BUY-NOW- PAY-LATER LENDER and licensed casher of checks, and the name, location, amount of capital stock or permanent capital and amount of surplus of every corporation and private banker and the minimum assets required of every branch of a foreign banking corporation authorized to commence business, and the date of authorization or licensing. § 8. Subdivision 3 of section 42 of the banking law, as amended by chapter 553 of the laws of 1960, is amended to read as follows: 3. The name of every proposed corporation, private banker, branch of a foreign banking corporation, licensed lender, LICENSED BUY-NOW-PAY-LATER LENDER and licensed casher of checks to which a certificate of authori- zation or a license has been refused and the date of notice of refusal. § 9. Subdivision 4 of section 42 of the banking law, as amended by chapter 60 of the laws of 1957, is amended to read as follows: 4. The name and location of every private banker, licensed lender, licensed casher of checks, sales finance company, LICENSED BUY-NOW-PAY- LATER LENDER and foreign corporation the authorization certificate or license of which has been revoked, and the date of such revocation. § 10. Subdivision 5 of section 42 of the banking law, as amended by chapter 249 of the laws of 1968, is amended to read as follows: 5. The name of every banking organization, licensed lender, licensed casher of checks, LICENSED BUY-NOW-PAY-LATER LENDER and foreign corpo- ration which has applied for leave to change its place or one of its places of business and the places from and to which the change is proposed to be made; the name of every banking organization which has applied to change the designation of its principal office to a branch office and to change the designation of one of its branch offices to its principal office, and the location of the principal office which is proposed to be redesignated as a branch office and of the branch office which is proposed to be redesignated as the principal office. § 11. Subdivision 6 of section 42 of the banking law, as amended by chapter 249 of the laws of 1968, is amended to read as follows: 6. The name of every banking organization, licensed lender, licensed casher of checks, LICENSED BUY-NOW-PAY-LATER LENDER and foreign corpo- ration authorized to change its place or one of its places of business and the date when and the places from and to which the change is author- ized to be made; the name of every banking organization authorized to change the designation of its principal office to a branch office and to change the designation of a branch office to its principal office, the location of the redesignated principal office and of the redesignated branch office, and the date of such change. § 12. Paragraph (a) of subdivision 1 of section 44 of the banking law, as amended by section 4 of part L of chapter 58 of the laws of 2019, is amended to read as follows: S. 4606 13 (a) Without limiting any power granted to the superintendent under any other provision of this chapter, the superintendent may, in a proceeding after notice and a hearing, require any safe deposit company, licensed lender, LICENSED BUY-NOW-PAY-LATER LENDER, licensed casher of checks, licensed sales finance company, licensed insurance premium finance agen- cy, licensed transmitter of money, licensed mortgage banker, licensed student loan servicer, registered mortgage broker, licensed mortgage loan originator, registered mortgage loan servicer or licensed budget planner to pay to the people of this state a penalty for any violation of this chapter, any regulation promulgated thereunder, any final or temporary order issued pursuant to section thirty-nine of this article, any condition imposed in writing by the superintendent in connection with the grant of any application or request, or any written agreement entered into with the superintendent. § 13. This act shall take effect on the one hundred eightieth day after the department of financial services shall have promulgated rules and/or regulations necessary to effectuate the provisions of this act; provided that the department of financial services shall notify the legislative bill drafting commission upon the occurrence of the promul- gation of the rules and regulations necessary to effectuate and enforce the provisions of section two of this act, in order that the commission may maintain an accurate and timely effective record of the official text of the laws of the state of New York in furtherance of effectuating the provisions of section 44 of the legislative law and section 70-b of the public officers law. Effective immediately, the addition, amendment and/or repeal of any rule or regulation authorized to be made by the superintendent pursuant to this act is authorized to be made and completed on or before such effective date.

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.