| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Dec 31, 2025 |

print number 4719a |

| Dec 31, 2025 |

amend and recommit to insurance |

| Feb 12, 2025 |

referred to insurance |

Senate Bill S4719A

2025-2026 Legislative Session

Sponsored By

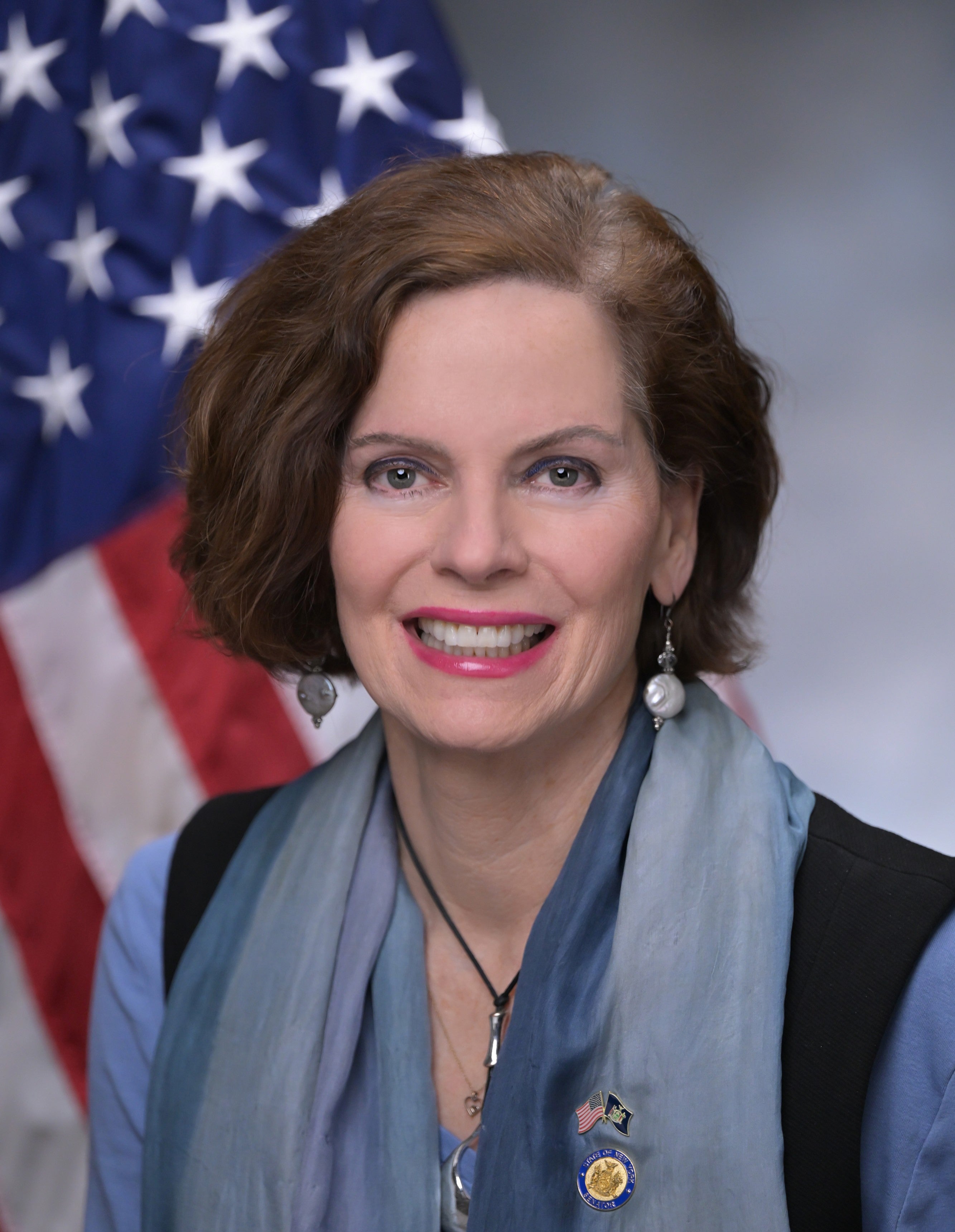

(D, WF) 46th Senate District

Current Bill Status - In Senate Committee Insurance Committee

Actions

Bill Amendments

co-Sponsors

(D, WF) 31st Senate District

2025-S4719 - Details

2025-S4719 - Sponsor Memo

BILL NUMBER: S4719

SPONSOR: FAHY

TITLE OF BILL:

An act authorizing municipalities to join a county self-funded or self-

insured health plan

PURPOSE:

Self-insurance or self-funding for health insurance is significantly

less expensive than contracting out to private health insurers but

requires a sufficient number of employees to be economically possible.

Accordingly, at least 24 counties currently self-insure. On the other

hand, most municipalities, including many smaller school districts, do

not have enough employees to self-insure. This bill allows them to do so

by giving them the potential to join county self-insurance plans.

SUMMARY OF PROVISIONS:,

Section 1. A municipality is permitted to join a county self-funded or

self-insured health plan in any county in which such municipality is

2025-S4719 - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

4719

2025-2026 Regular Sessions

I N S E N A T E

February 12, 2025

___________

Introduced by Sen. FAHY -- read twice and ordered printed, and when

printed to be committed to the Committee on Insurance

AN ACT authorizing municipalities to join a county self-funded or self-

insured health plan

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Notwithstanding article 44 or 47 of the insurance law or

any other provision of law to the contrary, and subject to the require-

ments set forth in this section, a municipality is permitted, with the

consent of the county and the governing body of such municipality, to

join a county self-funded or self-insured health plan in any county in

which such municipality is located in whole or in part. Municipality is

defined as any city, town, village or any other municipal corporation, a

school district or any governmental entity operating a public school,

college or university, a public improvement or special district, a

public authority, commission, or public benefit corporation, or any

other public corporation, agency or instrumentality or unit of govern-

ment which exercises governmental powers under the laws of the state but

is not a part of, nor a department of, nor an agency of the state. In

order for a municipality or municipalities to join the county self-fund-

ed or self-insured health plan, the county shall file with the super-

intendent of financial services certification that, with inclusion of

the lives to be covered in the plan following admission of the munici-

pality or municipalities, the county self-funded or self-insured health

plan meets the following six requirements:

(a) That the county and any municipality or municipalities joining

such plan have mutually consented to join such plan.

(b) That it maintain a reserve fund, calculated as a percentage of

total annual incurred claims, of a minimum of 12% of claims.

(c) That it has a surplus account, established and maintained for the

sole purpose of satisfying unexpected obligations of the benefit plan in

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD04716-01-5

co-Sponsors

(D, WF) 31st Senate District

2025-S4719A (ACTIVE) - Details

2025-S4719A (ACTIVE) - Sponsor Memo

BILL NUMBER: S4719A

SPONSOR: FAHY

TITLE OF BILL:

An act authorizing municipalities to join a county self-funded or self-

insured health plan

PURPOSE:

Self-insurance, or self-funding, for health insurance is significantly

less expensive than contracting with private health insurers but

requires a sufficient number of employees to be economically feasible.

Accordingly, at least 24 counties currently self-insure. On the other

hand, most municipalities, including many smaller school districts, lack

sufficient employees to self-insure. This bill allows them to do so by

joining county self-insurance plans, provided both the County and the

municipality consent and specific financial requirements are met.

SUMMARY OF PROVISIONS:

Section 1. Establishes who can join a self-insured plan

2025-S4719A (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

4719--A

2025-2026 Regular Sessions

I N S E N A T E

February 12, 2025

___________

Introduced by Sens. FAHY, JACKSON -- read twice and ordered printed, and

when printed to be committed to the Committee on Insurance -- commit-

tee discharged, bill amended, ordered reprinted as amended and recom-

mitted to said committee

AN ACT authorizing municipalities to join a county self-funded or self-

insured health plan

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. A municipality is permitted, with the consent of the county

and the governing body of such municipality, to join a county self-fund-

ed or self-insured health plan in any county in which such municipality

is located in whole or in part. Municipality is defined as any city,

town, village or any other municipal corporation, that is not a part of,

nor a department of, nor an agency of the state. In order for a munici-

pality or municipalities to join the county self-funded or self-insured

health plan, the county shall file with the superintendent of financial

services certification that, with inclusion of the lives to be covered

in the plan, prior to the admission of the municipality or munici-

palities, that the county self-funded or self-insured health plan meets

the following six requirements:

(a) That the county and any municipality or municipalities joining

such plan have mutually consented to join such plan.

(b) That it maintain a reserve fund, calculated as a percentage of

total annual incurred claims, of a minimum of 12% of claims.

(c) That it has a surplus account, established and maintained for the

sole purpose of satisfying unexpected obligations of the benefit plan in

the event of termination or abandonment of the plan, which shall not be

less than 5% of the annualized earned premium equivalents during the

current fiscal year of the plan.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD04716-03-5

S. 4719--A 2

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.