| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Mar 17, 2025 |

referred to local government |

Senate Bill S6544

2025-2026 Legislative Session

Sponsored By

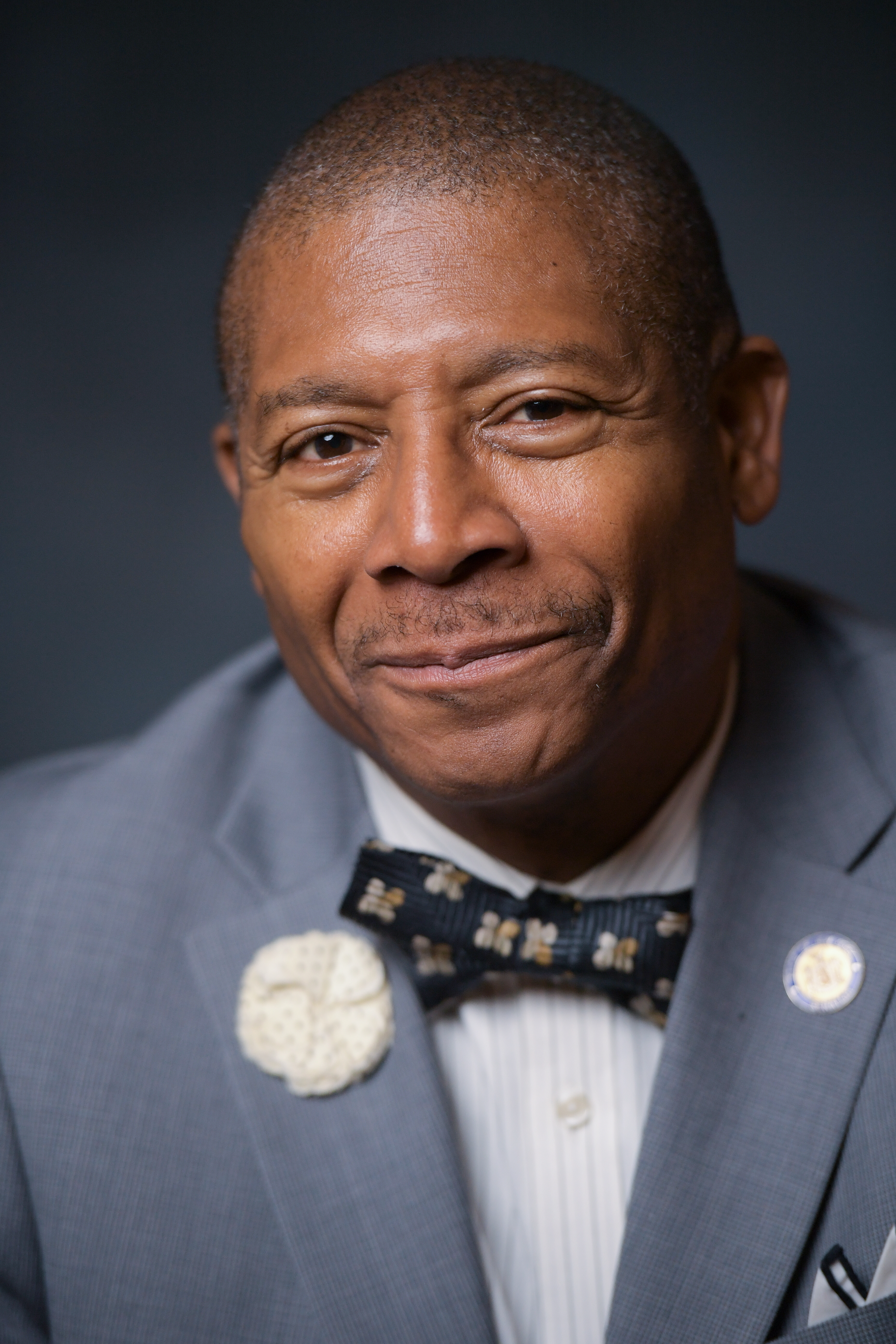

(D) 10th Senate District

Current Bill Status - In Senate Committee Local Government Committee

Actions

2025-S6544 (ACTIVE) - Details

- See Assembly Version of this Bill:

- A3811

- Current Committee:

- Senate Local Government

- Law Section:

- Real Property Tax Law

- Laws Affected:

- Add §306, RPT L

- Versions Introduced in Other Legislative Sessions:

-

2011-2012:

A9038

2013-2014: A1834

2015-2016: A4375

2017-2018: A2873

2019-2020: A2790

2021-2022: S7140, A3490

2023-2024: S6258, A1293

2025-S6544 (ACTIVE) - Sponsor Memo

BILL NUMBER: S6544

SPONSOR: SANDERS

TITLE OF BILL:

An act to amend the real property tax law, in relation to requiring

every assessing unit to conduct a revaluation of assessment at least

every eight years

PURPOSE OR GENERAL IDEA OF BILL:

The purpose of this legislation is to require every assessing unit to

conduct a revaluation of assessment at least once every eight years.

SUMMARY OF PROVISIONS:

SECTION 1. The Real Property Tax Law is amended by adding a new section

306, which states that every assessing unit shall conduct a revaluation

of assessments in its jurisdiction at least once every eight year.

SECTION 2. Establishes the effective date.

2025-S6544 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

6544

2025-2026 Regular Sessions

I N S E N A T E

March 17, 2025

___________

Introduced by Sen. SANDERS -- read twice and ordered printed, and when

printed to be committed to the Committee on Local Government

AN ACT to amend the real property tax law, in relation to requiring

every assessing unit to conduct a revaluation of assessment at least

every eight years

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. The real property tax law is amended by adding a new

section 306 to read as follows:

§ 306. ASSESSMENT CYCLE. EVERY ASSESSING UNIT SHALL CONDUCT A REVALU-

ATION OF ASSESSMENTS IN ITS JURISDICTION AT LEAST ONCE EVERY EIGHTH

YEAR.

§ 2. This act shall take effect January 1, 2030 and shall be applica-

ble to final assessment rolls filed on and after such date. Effective

immediately, the addition, amendment and/or repeal of any rule or regu-

lation necessary for the implementation of this act on its effective

date are authorized to be made and completed on or before such effective

date.

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD06426-01-5

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.