| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Jan 07, 2026 |

referred to investigations and government operations |

| Aug 20, 2025 |

referred to rules |

Senate Bill S8482

2025-2026 Legislative Session

Sponsored By

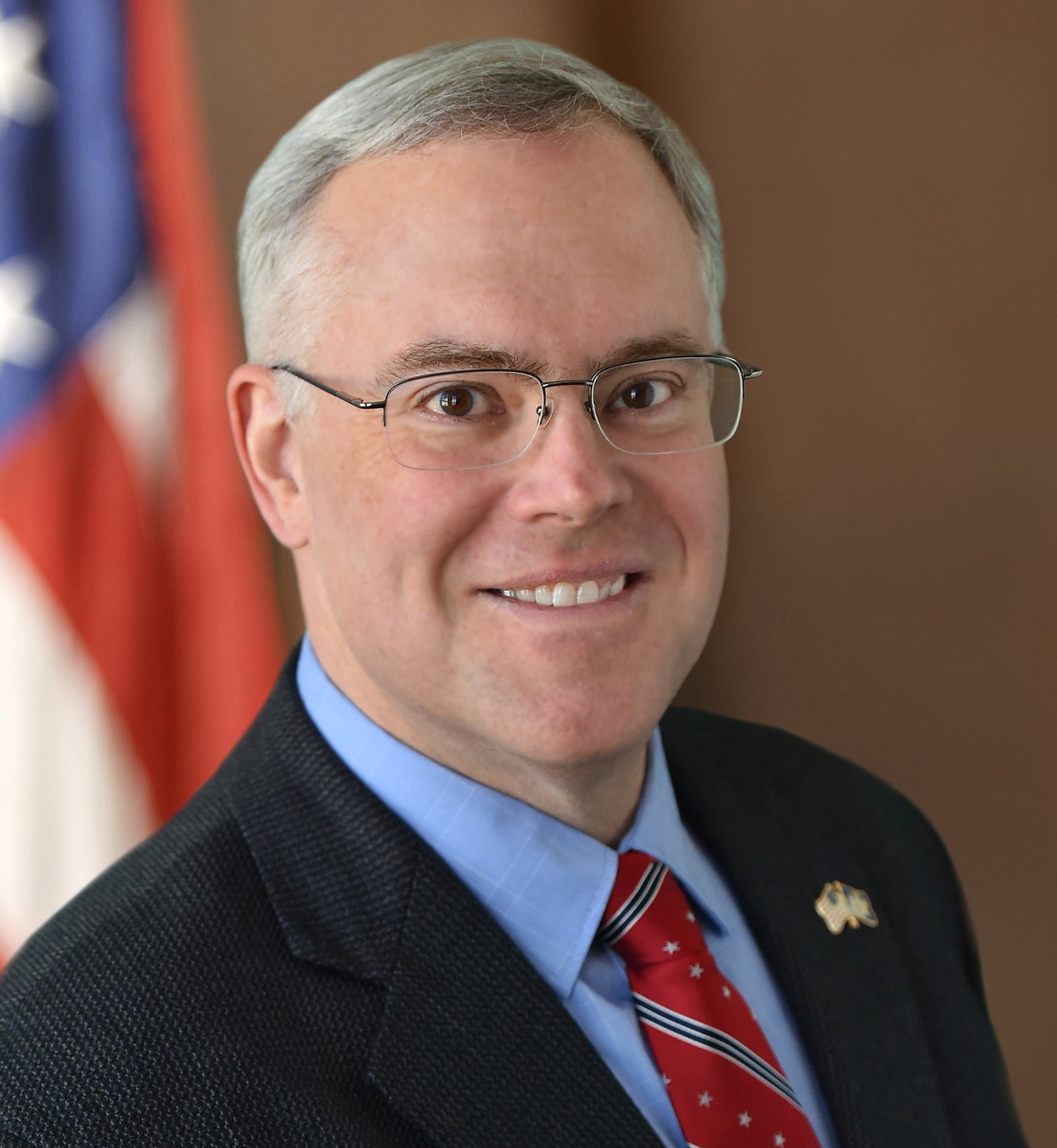

(R, C, IP) 45th Senate District

Current Bill Status - In Senate Committee Investigations And Government Operations Committee

Actions

2025-S8482 (ACTIVE) - Details

- See Assembly Version of this Bill:

- A9098

- Current Committee:

- Senate Investigations And Government Operations

- Law Section:

- Tax Law

- Laws Affected:

- Amd §1202-s, Tax L

2025-S8482 (ACTIVE) - Sponsor Memo

BILL NUMBER: S8482

SPONSOR: STEC

TITLE OF BILL:

An act to amend the tax law, in relation to the use of revenues from

hotel or motel taxes in the county of Essex

PURPOSE:

To grant Essex County greater freedom to use its hotel occupancy tax as

the board of supervisors sees fit, similarly to most counties in the

state, for the promotion of tourism and economic development.

SUMMARY OF PROVISIONS:

Section 1 - Amends subdivision 10 of section 1202-s of the tax law, as

added 2 by section 1 of part T of chapter 406 of the laws of 1999 so the

revenues from the county hotel tax would be deposited in the county's

general fund and used for the purposes of economic development and tour-

ism promotion.

2025-S8482 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

8482

2025-2026 Regular Sessions

I N S E N A T E

August 20, 2025

___________

Introduced by Sen. STEC -- read twice and ordered printed, and when

printed to be committed to the Committee on Rules

AN ACT to amend the tax law, in relation to the use of revenues from

hotel or motel taxes in the county of Essex

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Subdivision 10 of section 1202-s of the tax law, as added

by section 1 of part T of chapter 406 of the laws of 1999, is amended to

read as follows:

(10) All revenues resulting from the imposition of the tax under the

local laws shall be paid into the treasury of the county of Essex and

shall be credited and deposited into [a special tourism development and

promotion fund, thereafter to be allocated for publicizing the advan-

tages of the county of Essex pursuant to subdivision fourteen of section

two hundred twenty-four of the county law] THE GENERAL FUND OF THE COUN-

TY THEREBY TO BE ALLOCATED AT THE DISCRETION OF THE COUNTY LEGISLATURE

OF THE COUNTY OF ESSEX FOR THE PURPOSES OF ECONOMIC DEVELOPMENT, AND

TOURISM AND PROMOTION; provided, however, that [such local laws shall

provide that] the county shall[:

a.] be authorized to retain up to a maximum of [five] TEN percent of

such revenue to defer the necessary expenses of the county in adminis-

tering such tax[;

b. endeavor to expend the revenues in such fund in a manner reasonably

intended to publicize the areas within the county of Essex commensurate

with the amount of revenues generated from such areas; and

c. contract with the Lake Placid-Essex county visitors bureau, for the

expenditure of the revenues in such fund pursuant to subdivision four-

teen of section two hundred twenty-four of the county law, provided

however that the county of Essex may terminate such contract and/or

enter into other contracts in the event that the Lake Placid-Essex coun-

ty visitors bureau dissolves or [in the determination of the board of

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD13645-01-5

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.