O’Mara proposes amendment to expand tax relief for small businesses and farmers: Points to latest study showing NY’s tax burden the highest in the nation

March 7, 2019

-

ISSUE:

- Cutting Taxes

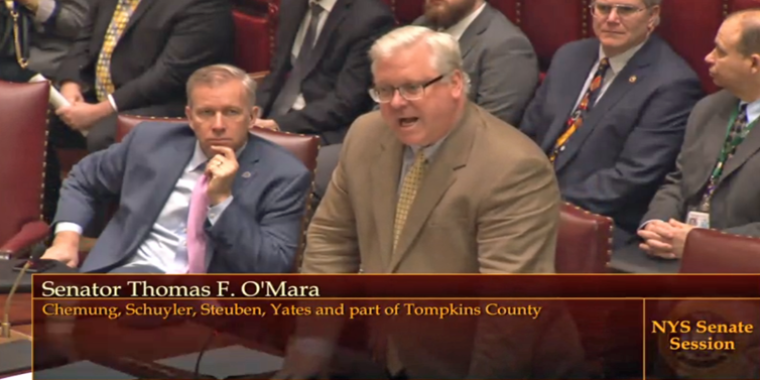

Albany, N.Y., March 7—State Senator Tom O’Mara (R,C,I-Big Flats) today proposed a legislative amendment on the floor of the state Senate to cut taxes by nearly $500 million for small businesses and farmers in New York State.

The Senate Democratic Majority rejected O’Mara’s proposed amendment.

“Studies continue to recognize New York as the state with the highest tax burden in the nation. It remains an unfair and unreasonable burden on individual taxpayers, families, farmers, employers and workers. We have to keep taking tax relief actions like these for our farmers, small business owners and every other taxpayer,” said O’Mara, noting the latest nationwide analysis released this week from 24/7 Wall Street showing that New Yorkers have the highest-in-the-nation state and local tax burden as a percentage of income.

[Watch Senator O'Mara's floor remarks]

O’Mara continues to sponsor legislation (S943) to expand the current Personal Income Tax (PIT) exemptions for small businesses and farms. Under current law, to qualify for the PIT exemptions, businesses must be a sole proprietor or farm (regardless of how the business is structured, sole proprietor, LLC, etc.), have less than $250,000 in net business income, and employ at least one employee. The current exemption is equal to five percent of net income in 2016 and beyond.

Under O’Mara’s legislation, the PIT exemption would increase from 5 percent to 20 percent for farm income. The legislation would also increase the PIT exemption from 5 percent to 15 percent for small businesses, eliminate the employee qualification, raise the income eligibility threshold from $250,000 to $500,000, and expand small business eligibility to include any business that files under the PIT (regardless of how the business is structured, sole proprietor, LLC, etc.).

The legislation would also reduce the Corporate Franchise Tax business income rate for small businesses from 6.5 percent to 2.5 percent. Additionally, it would increase the threshold for corporations to be considered small corporations from $290,000 to $400,000 and allow businesses with incomes between $400,000 and $500,000 to have a blended rate between 6.5 percent and 2.5 percent.

Share this Article or Press Release

Newsroom

Go to Newsroom