New York Bill Would Boost Penalties for Financial Fraud Crimes

A New York lawmaker is introducing a bill to toughen criminal penalties for financial crimes, arguing the

state needs to step up after the Trump administration gutted the Consumer Financial Protection Bureau.

Corporations with annual revenues greater than $100 million that are convicted of a felony offense under

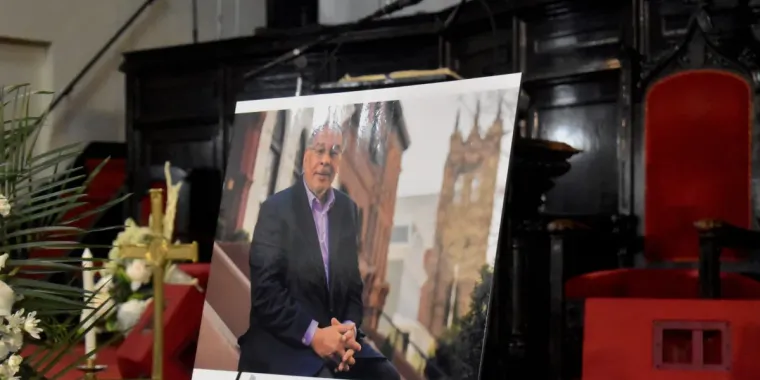

New York state laws would face stiffer penalties under the bill sponsored by state Sen. Zellnor Myrie (D),

who shared the text of the bill exclusively with Bloomberg Government. Currently, fines assessed on

companies convicted of certain criminal offenses can’t exceed $500,000.

The bill would allow state prosecutors to pursue equity fines on publicly traded companies. Through the

measure, courts could transfer a percentage of nonvoting shares to the state victim’s compensation fund.

Corporations view current penalties under state law as the “cost of doing business,” Myrie said.

The measure would also include new definitions of virtual currency as New York looks to further regulate

cryptocurrency and update its laws for a 21st century digital marketplace.

“The public expects the states to be stepping up regardless, but I think it’s particularly pronounced when

we have a federal administration that has explicitly said that they do not want to go after this type of

crime,” Myrie, who represents Brooklyn, said in an interview.