On Time - for the Second Straight Year

Jack M. Martins

April 9, 2012

-

ISSUE:

- Local Government

- Budget

-

COMMITTEE:

- Local Government

It is indeed a new era in Albany. For the second straight year, the State Legislature and the Governor agreed on an on-time budget that doesn’t raise any taxes or fees while eliminating a $2 billion deficit.

“The state is in infinitely better shape now than it was two years ago when state government was is disarray. We now have passed two consecutive budgets that represent sound fiscal management. For years, the state outspent its resources and then passed the burden onto the taxpayers. Over the last two years, we sent a clear message that those days are over,” said Senator Jack M. Martins, who is in his first term in the Senate.

In addition to getting New York State back on the rights fiscal path, the Legislature and the Governor worked to make job creation a priority. The 2012-13 budget, which went into effect on April 1, creates the “NY Works” program to rebuild the state’s roads, highways and bridges and fund other critical infrastructure projects to create thousands of new jobs and get our economy back on track. The budget also includes $150 million for the second round of Regional Council economic development awards funding to continue the important work we did in last year’s budget to rebuild our regional economies.

At the same time, the Senate Republicans plans to restore the EPIC program for senior citizens to get their prescription medications and increase state aid to education were also included in the budget. Furthermore, due in large part to the efforts of Senator Martins, libraries will receive $3.6 million in state aid and are exempt from the MTA payroll tax, saving them $1.3 million.

In addition, the budget provides mandate relief for local governments by phasing in a full state takeover of the county share of growth in Medicaid spending, resulting in $1.7 billion in savings over the next five years for counties and local property taxpayers.

Within the last two years, the State Senate worked with the Governor to pass two fiscally sound budgets while not increasing taxes, enact a two percent tax cap, eliminate the MTA payroll tax for small businesses and all schools, both public and private, and amend the state tax code to the lowest rate for middle class taxpayers in 58 years.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Martins' Toy Drive 2025

November 10, 2025

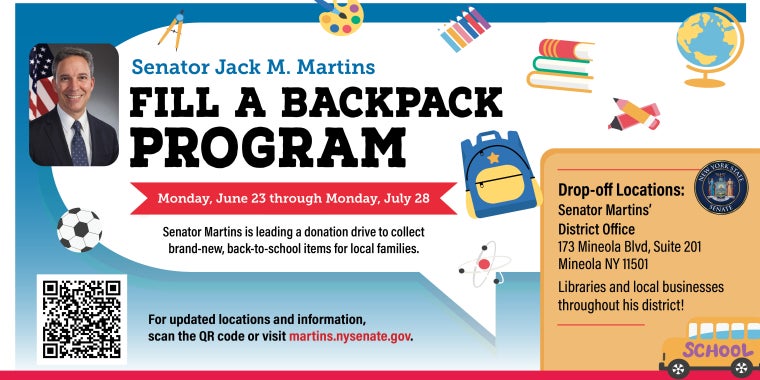

Fill a Backpack Program

June 10, 2025