Senator Martins Announces Blueprint for Jobs - ReThink. ReVitalilze. ReBuild

Jack M. Martins

March 8, 2013

-

COMMITTEE:

- Local Government

Fiscally-Responsible Approach to Job Creation

Members of the Senate Republican conference announced a bold and sweeping job creation plan to improve New York’s business climate so it not only keeps up with other states, but surpasses them. Among other things, the “Senate Republican Blueprint for Jobs: ReThink. ReVitalize. ReBuild.” would cut taxes for one million small businesses and reduce energy costs for every business and residential ratepayer in New York, saving them $2.5 billion.

“Creating jobs remains a top priority. Improving our business climate is essential to our economic growth as a state,” said Senator Jack M. Martins. “This approach will spur job creation and will further our economic recovery as a state."

The “Senate Republican Blueprint for Jobs” plan would provide:

• A Tax Cut for One Million Small Businesses

• Tax Relief for Manufacturers

• Lower Energy Bills for Every New Yorker and Every Business

• Sweeping Reforms to Cut Red Tape and Bureaucracy

• Job Training to Help New Yorkers Secure Good, High-Paying Jobs

• Common-Sense Budget Reforms

• Investment Funding to Help Launch Start-Ups

• Incentives to Revitalize Downtowns and Main Streets

• Help for New York’s Veterans to Secure Good-Paying Jobs

• Key Reforms To Reduce the Cost of Doing Business

Heather Briccetti, President and CEO of The Business Council of New York State, Inc. said, "The budget plan put forth today by the Senate Republicans is clearly designed to control state spending and create good-paying jobs. If we are to improve the state's economy and create more private-sector jobs we need to reduce the cost of doing business in New York through tax cuts, fiscal restraint, regulatory reform, and targeted investments in our workforce. ”

Mike Durant, State Director of the National Federation of Independent Business (NFIB) said: “This job creation plan injects significant fiscal relief for small business and is a commitment to drastically changing the economic trajectory of New York. It incorporates many of the top legislative priorities for NFIB by drastically reducing taxes and providing needed regulatory reform. This is exactly what small business needs in this State.”

Manufacturer’s Association of Central New York (MACNY) President Randy Wolken stated: "This past week, manufacturers from across the State convened in Albany to let legislators know that in order to strengthen our critical sector and the economic strength we provide, a better business climate is needed, with lower costs of doing business. Senate Republicans clearly heard this message. With their proposal of a repeal to the 18a tax, in addition to elimination of the corporate franchise tax for manufactures, they are clearly proposing a budget version that is business friendly, helps create a better business climate, and creates a platform that will enable manufacturers and businesses help get our State back on track."

The state’s revenues are projected to increase by more than $200 million. Senate Republicans are recommending that, rather than spend new revenues, the additional funds should be invested in business and job growth to strengthen the state’s economy more rapidly and create new jobs at a faster pace.

By working with Governor Cuomo over the last two years, New York State has saved approximately $18.6 billion by adhering to a self-imposed spending cap of two percent.

According to the Governor’s January 2013 estimates, state operating revenue will increase by 9.5 percent from SFY 2013-14 to SFY 2016-17 with a possibility of revenue growth even higher than that. Revenue growth is expected to grow by an average of 3.1 percent over the three years following SFY 2013-14. Unfortunately, state operating spending is expected to grow by nearly 12 percent, or an average of 3.8 percent, over that same period.

Senate Republicans have repeatedly passed legislation to establish a spending cap, but the Assembly has not acted on it. Over the past two years, the state has saved $18.6 billion by adhering to a self-imposed two percent cap. By making a cap permanent going forward, New York will save $11.2 billion over the next four years.

As revenues improve, many other states are proposing bold tax cut plans. The Governors of Nebraska and Louisiana have proposed eliminating income taxes on residents and corporations. The Governor of Kansas is proposing a major personal income tax cut. Other states that have either begun to reduce income taxes or are seriously considering significant tax cuts include: Indiana, Oklahoma, Missouri, Michigan and Ohio.

The Senate Republican plan would eliminate the Corporate Tax entirely for small businesses over the next four years, saving 200,000 small businesses more than $250 million. The Blueprint for Jobs would also provide 800,000 small businesses that pay under the personal income tax (PIT) a 10- percent PIT exemption for business income, and eliminate the Corporate Tax entirely for manufacturers over the next three years, saving them $445 million. These investments will stimulate job growth, make New York more competitive and increase revenues overall.

In addition, the Senate Republican job creation plan would create a $100 million low-interest loan fund for new high-tech and small business start-ups.

New York’s business climate is currently ranked last in the country by the Tax Foundation, and, in a recent study by United Van Lines published in Forbes Magazine, New York ranked fourth in number of people moving out-of-state. The Senate Republican plan is designed to reverse those trends.

A TAX CUT FOR ONE MILLION SMALL BUSINESSES

> Eliminate Corporate Tax entirely for 200,000 small businesses over the next four years ($250 million).

> Provide a 10-percent Personal Income Tax (PIT) exemption for business income by 2016 ($120 million) for 800,000 small businesses that pay personal income taxes.

BOOSTING NEW YORK’S MANUFACTURERS

The Blueprint for Jobs includes two key provisions that will provide an enormous boost for manufacturers throughout the state, helping them compete, succeed and create thousands of new jobs. These elements include:

> Eliminating the Corporate Tax entirely for manufacturers over the next three years, saving them $445 million.

> Increasing Sales Tax Relief for Manufacturers – While the state provides certain sales tax breaks on the energy used in the manufacturing process, the current law imposes cumbersome restrictions that can actually make manufacturers less efficient. The Blueprint for Jobs would reform, broaden and improve the current law, to help manufacturers substantially increase their sales tax savings.

LOWER ENERGY BILLS FOR EVERY NEW YORKER

> To help New York’s energy intensive manufacturers, the Senate’s plan rejects the Governor’s proposal to extend the 18-a energy tax surcharge and restores the 18-a assessment back to its pre-2009 level. This would provide over $2.5 billion in relief to families and employers across New York over the next five years.

> According to figures from National Grid, the impact of the Executive’s proposed energy tax extension on a typical large business is estimated at $30,000 per year. The added cost on a typical small business would be about $540 per year. Average household utility bills would increase $55 per year.

Senator Martins said, “There’s absolutely no reason our homeowners and businesses should be paying taxes on their utilities. People are struggling and working toward ending this surcharge reinforces our commitment to ease the tax burden and get government off people’s backs.”

CUTTING RED TAPE

> Repeal 1,000 Rules

New York’s regulatory burden is notorious, containing 23 Titles and filling 83 volumes.The manual explaining New York’s rule-making process alone includes 66 single spaced pages. To address this problem, the Blueprint for Jobs includes legislation that would direct Executive State Agencies to repeal at least 1,000 job-killing rules and regulations. The legislation is modeled on a successful effort in the State of Florida that ultimately led to more than 3,000 regulations and rules being identified for repeal and/or revision.

> Industry-specific regional roundtables will be held to gather input from business leaders regarding specific rules and regulations that should be considered for revision.

> Red Tape Veto Power

The Blueprint for Jobs includes a Constitutional Amendment that would empower the Legislature to exercise veto power over any new regulations that negatively impact job creation and retention efforts. The Administrative Regulations Review Commission (ARRC) would conduct regular reviews and make recommendations to the full Legislature.

In addition to the Constitutional Amendment, a separate bill will also be introduced to ensure that Executive Agency rules and regulations do not overly burden small businesses. The measure would enable ARRC to provide greater guidance during the regulatory process and oversight of implemented rules and regulations.

> Paperwork Reduction Act:

This bill (S2313) would eliminate the burdensome and unnecessary annual wage notification requirements mandated by a 2010 law, which Senate Republicans opposed. An independent employee benefit firm has calculated that with 7.3 million people employed in New York State, more than 51 million pages of paper are needed to comply with this law -- a massive, costly mandate on every employer in the state.

> Fast-Track Permit Processing: (S.968)

For years, many small business owners have expressed concern about unresponsive state agencies – especially when it comes to the permitting process. When someone applies for a professional license or a permit, they should not be left hanging for months on end.

The Honesty in Permit Processing Act requires agencies to publicly disclose their response times, and to tell applicants how long they can expect to wait for approval. If approval takes more than 134 percent of the average processing time, applicants would get a refund. This will improve New York’s economic climate, empower taxpayers, and help break through bureaucratic logjams.

In addition, the Blueprint for Jobs package will seek to improve transparency and provide more definitive timelines in the State Environmental Quality Review (SEQR) process.

ACCESS TO JOB TRAINING OPPORTUNITIES FOR ALL NEW YORKERS

The Blueprint for Jobs includes new initiatives and increased funding to help ensure that every New Yorker -- in every region of the state -- has access to job training services that can help them succeed in a rapidly changing economy. Our Plan includes:

> Fast Start-NY: Based on the successful “ready-workforce” programs used in a number of states, this initiative will help attract and retain tens of thousands of jobs by providing comprehensive, targeted training that is specifically tailored to meet the needs of individual employers. In recent years, these types of customized, employer-specific programs have helped states such as South Carolina, Georgia, Louisiana and Alabama attract major manufacturers like Mercedes Benz, Boeing, Caterpillar, Honda, KIA and others.

> Double Funding For Workforce Training: SUNY and CUNY’s Workforce Development Initiative provides targeted training to help employers refine the skills of their new hires, and enable more experienced employees to upgrade their skills. These programs have proven highly successful, but the demand for them in some communities is currently outstripping their availability. The Blueprint For Jobs would double funding -- from $3.8 million to $7.6 million -- to increase access to the programs.

> The Workforce Development Institute is a not-for-profit that works with businesses and the AFL-CIO to provide focused training for workers, and workforce transition support to help prevent jobs from being outsourced to other states. In the 2012-13 State Budget the Senate worked to provide $2.3 million in funding for the WDI. The Blueprint For Jobs Plan would double funding levels to $4.6 million.

FUNDAMENTAL FISCAL REFORMS TO CONTROL TAXES AND SPENDING

In an increasingly competitive global marketplace -- and at a time when investment dollars and jobs can quickly depart to other states and other countries -- New York State must remain on a fiscally responsible path that controls spending and avoids tax increases.

To build upon the past two consecutive State Budgets that have controlled spending and avoided tax increases, the Senate Republican Jobs Plan includes the following two fiscal reforms which are supported by the State’s leading business advocacy groups:

> Impose a two-percent cap on state spending; and

> Help prevent future tax increases by requiring a 2/3 super-majority vote for the approval of any tax increases.

These fundamental reforms would provide corporate leaders and investors with greater long-term confidence that New York State has changed the way it conducts business.

LAUNCHING START-UPS

One of the biggest problems facing small businesses today is the lack of access to capital. And with banks being more stringent on lending in response to the financial crisis, it has made things tougher for many promising small entrepreneurs. To help address this problem, the Blueprint for Jobs will:

> Provide $100 million in new low-interest loan funding to promising new high-tech and small business start-ups;

> Make improvements to the State’s current Linked Deposit Loan Program, expanding access to the program, generating additional economic activity, and stimulating more investment and more jobs across the State; and

> Strengthen the Excelsior Jobs Program, by increasing the amount of the program from $50 million to $70 million per year, enhancing the investment tax credit and the real property tax credit, and amending the job creation and retention thresholds.

> Create the New York State Incubator Program ($5 million). There are currently over 40 business incubators across the State. This program would provide operating grants to these incubators to provide support services to start up businesses, and to facilitate the transfer of technology from research and development to commercialization.

TURNING EMPTY BUILDINGS INTO NEW OPPORTUNITIES

> In order to encourage private sector investments in hometowns, downtowns and Main Streets across the state, the Blueprint for Jobs would expand the Historic Properties Tax Credit Program by incrementally increasing the cap on credits from $5 million to $12 million.

> The Blueprint for Jobs also includes legislation establishing a tax credit for the rehabilitation of distressed commercial properties.

HELPING OUR HEROES

The Senate Republican job creation plan would provide a tax credit to any business that hires a veteran returning home from military service. That credit will equal 10 percent of wages paid -- increasing to 15 percent of wages if the veteran is also disabled. New York’s heroic servicemen and women should be welcomed home with the promise of economic opportunity.

The plan will also include legislation (S.2803) to help small businesses owned by service disabled veterans by increasing their access to government contracts.

CURBING THE COST OF UNEMPLOYMENT INSURANCE AND WORKERS’ COMPENSATION

High Unemployment Insurance and Workers’ Compensation costs are frequently cited by New York employers as major barriers to new job creation. The Senate Republican Conference is committed to reducing these costs to help make our state a more attractive place to do business.

The Governor has submitted constructive proposals to help address these costs, and the Senate Republican Conference will work together with him and our legislative colleagues to reach consensus on reform legislation that can be enacted during this year’s session.

THE SENATE REPUBLICAN BLUEPRINT FOR JOBS WOULD BUILD ON TWO YEARS OF ACCOMPLISHMENTS

Over the past two years, the Senate Republican Conference has successfully taken a number of key steps to improve New York’s business climate to help create jobs. These include:

•Passing two consecutive on-time state budgets;

•Closing approximately $13 billion in budget deficits -- without raising taxes or fees in the budget;

•Reducing state spending for two consecutive years;

•Cutting taxes on small businesses;

•Enacting a landmark property tax cap;

•Approving the UB2020/SUNY 2020 economic development plan;

•Repealing the MTA payroll tax for 80 percent of the businesses that paid it;

•Enacting the Recharge NY power-for-jobs plan and the Power NY (Article X) power plant siting law;

•Cutting taxes for middle class families and reducing tax rates to the lowest level in more than half a century; and

•Helping to launch the NY Works initiative to revitalize New York’s infrastructure.

Share this Article or Press Release

Newsroom

Go to NewsroomSenator Martins' Toy Drive 2025

November 10, 2025

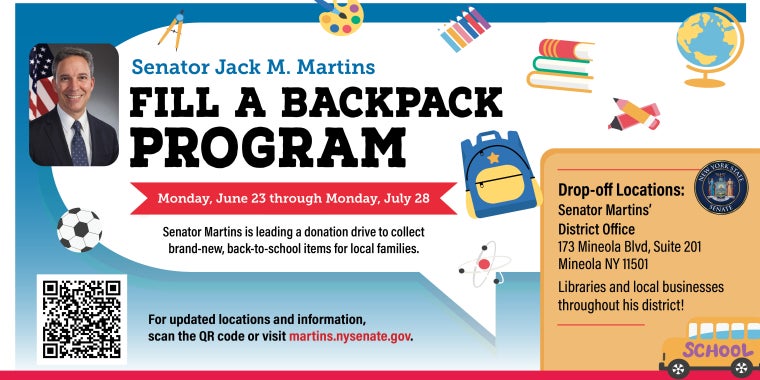

Fill a Backpack Program

June 10, 2025