Senate Passes Comprehensive Mandate Relief Legislation

Jeff Bishop, Communications Director

June 5, 2017

-

ISSUE:

- mandate relief

ALBANY, 06/05/17 -- State Senator James L. Seward (R/C/I/Ref – Oneonta) today announced senate passage of a comprehensive package of legislation that will reduce mandated costs and other expenses that drive up local taxes for municipalities and school districts. The mandate relief measures will reduce paperwork, promote efficiency, and help local governments save money and better serve residents.

“I am acutely aware of the painstaking measures local government and school officials take to balance their budgets, keep property taxes in check, and still provide the best possible services,” said Senator Seward. “The state must partner with our local leaders by enacting tangible mandate relief measures.”

Included in the package is senate bill 3962, sponsored by Senator Seward. The bill changes the requirement for school districts to conduct internal audit risk assessments from annually to biennially. Often, risk assessments can be costly and time-consuming and produce only general results. The intensive review of certain operations is more helpful in identifying specific areas for improvement. This bill would allow districts to have risk assessments every two years and to conduct specific in depth reviews every year – reducing costs while choosing to focus on the areas that might pose the greatest risks.

“These measures, taken together, will add up to significant savings that will allow local official to concentrate on local needs – not mandates passed down from Albany. My bill in particular, would reduce a costly, time-consuming assessment requirement for schools allowing districts to focus their resources on real student needs,” Seward added.

Additional bills in the mandate relief package include:

Fully Funding State Mandated Costs: Senate bill 2323 would require any state mandated program that is imposed on municipalities to be funded by the state. State mandated programs place local taxpayers and local officials in the position of paying for services that they do not control. State mandated programs also allow the state rather than local officials to set priorities for the locality. In turn, this forces municipalities to levy more taxes on its residents in order to pay for the mandates;

Preventing New Mandates After a School Budget has Passed: Senate bill 1020 would prevent any state mandates creating a new cost for a school district from being imposed after the adoption of that fiscal year’s school budget. While the state legislature has been particularly sensitive to school districts’ concerns regarding the imposition of unfunded state mandates in recent years, the federal government and the state Education Department continue to impose new fiscal requirements on public schools without regard to their ability to plan for the fiscal implications. Without adequate funding and time to plan for unforeseen costs, some school districts have had to reduce programs, services, and personnel to contend with new unfunded mandates, rather than adjust and plan for any new costs;

Creating Flexibility for Mandate Implementation: Senate bill 5791 promotes mandate relief and flexibility in tailoring regulatory requirements to the specific needs and capabilities of local governments. The bill restores recently expired provisions that streamlined the process for submitting petitions to request approval of an alternate method to meet a regulatory mandate. Regulatory mandates that take a “one-size-fits-all” approach can create hardships, and prevent local governments from pursuing more efficient and cost-effective solutions;

Requiring the State to Promptly Reimburse Counties: Senate bill 869 would help ensure that counties receive reimbursements from the State for mandated programs within a reasonable timeframe. The bill adds counties to the state’s existing Prompt Payment Law, requiring interest payments after a set deadline;

Reducing Schools’ Duplicative and Onerous Mandatory Internal Annual Audits: Senate bill 2641 provides that the internal audit function will be optional for school districts, unless a deficiency is found by the comptroller's office in one of their regular audits. In that case, the school district would be required to perform bi-annual internal audits until the next comptroller's audit;

Removing Application Requirements for Schools to Provide Preschool Evaluation Services: Senate bill 1694A allows school districts to provide preschool evaluation services without wasting staff time in applying for a waiver. School districts regularly provide evaluation of school-age special education students. Similar to any other public or private agency with appropriately licensed or certified professionals, a school district may apply to the commissioner of education to be an approved evaluator of preschool special education students. The extra application requirement to the commissioner is burdensome and unnecessary because school districts currently provide these evaluations for school-age students;

Eliminating Duplicative and Costly Fingerprinting Services: Senate bill 3479 allows schools to contract with third-party providers of student support services to submit and review fingerprinting and background check data, receive results of such checks and any subsequent arrest notifications of employees. These services will be conducted through a web-based portal developed by the State Education Department. Senate bill 1710 would alleviate a heavy burden on school administrators by eliminating the duplicative fingerprinting of school bus drivers and instead authorizing the Department of Motor Vehicles to provide a bus driver’s criminal history information to the commissioner of education;

Providing Calendar Flexibility for Small Rural Schools: Senate bill 4538 allows school boards the discretion and flexibility, after thorough review and public comment, to implement an alternative school week schedule where school districts would have the option to maintain the required 180 days of instruction or reduce days of instruction, while attaining the equivalent number of hours of pupil instruction per year;

Offering Flexibility in Purchasing for Schools Buying Locally Grown Foods: Senate bill 5251 extends this authorization to BOCES and municipalities and provides for a multiplier threshold for municipalities to purchase New York State food purchases modeled after the way school districts purchase such products;

Reducing Local Prison Overcrowding: Senate bill 744 requires parole violators to be transferred to a state correctional facility after 10 business days in a local correctional facility. Currently, those who violate their parole are often held at local facilities while appeals and extensions on hearing the violation are granted by the court;

Allowing Counties to Keep More in DMV Fees: Senate bill 1908 increases the retention percentage collected by counties for certain motor vehicle service fees. This bill requires that 25 percent of the revenue generated from the fees collected for any motor vehicle related service shall be retained by the county clerk. Currently county clerks retain just 12.7 percent of such fees. This bill also requires county clerks retain 60 percent of the $30 fee established for non-driver identification cards. This is an increase from the current 30 percent retention percentage. In addition, Senate bill 2101 would allow county clerks to retain fees collected for motor vehicle related services through the DMV website;

Creating a New Grant Program to Reduce Municipal Paper Costs: Senate bill 2883 would reduce the amount of paper used by municipalities, and its associated supply costs. This bill provides grants up to $10,000 to reduce paperwork at the municipal and local levels of government and implement digital alternatives to using paper;

Providing Local Law Enforcement with Resources for Implementing Leandra’s Law: Senate bill 4307 provides for the necessary direction and adequate funding for the successful implementation of the ignition interlock provisions of 2009’s “Leandra's Law". This would include adding the implementation of the ignition interlock program to the functions and funding responsibilities of the County STOP-DWI coordinator and directing that mandatory surcharges imposed and collected for drunk driving be directed to the STOP-DWI Program in the county where the offense occurred;

Extending the Ability of Municipalities to Use Grid Notes in Environmental Facility Corp’s (EFC) Short-Term Financing Program: Senate bill 5384 would continue to save municipalities money on installment loans from the EFC’s Clean Water State Revolving Fund and Clean Water State Revolving Fund. The measure extends to September 30, 2020, from 2017 provisions relating to bonds or notes bonds issued to the EFC in order to obtaining financing from the two funds.

All of the bills have been sent to the assembly.

In addition to the bills passed today, the senate earlier this year passed senate bill 1347 that helps prevent possible property tax increases or cuts to existing services by requiring the state to fund mandated programs that come at an additional cost for municipalities or school districts. This measure prevents future unfunded mandates from negatively affecting local finances and driving up property taxes by requiring the state to assume the costs. It would make it easier for local governments to stay within the highly successful property tax cap and provide further relief to local taxpayers.

-30-

related legislation

Share this Article or Press Release

Newsroom

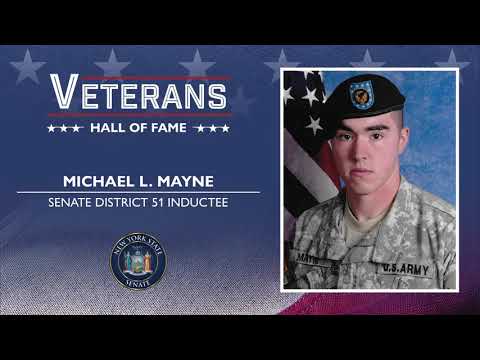

Go to NewsroomMichael L. Mayne

November 11, 2020

Statement on Remington Arms

October 26, 2020

State Highway Dedicated in Honor of Fallen Otsego County Marine

October 6, 2020

Statement on Remington Arms

October 1, 2020