| Date of Action |

Assembly Actions -

Lowercase Senate Actions - UPPERCASE |

|---|---|

| Jan 03, 2024 |

referred to budget and revenue |

| Mar 01, 2023 |

reported and committed to finance |

| Jan 23, 2023 |

referred to budget and revenue |

Senate Bill S2556

2023-2024 Legislative Session

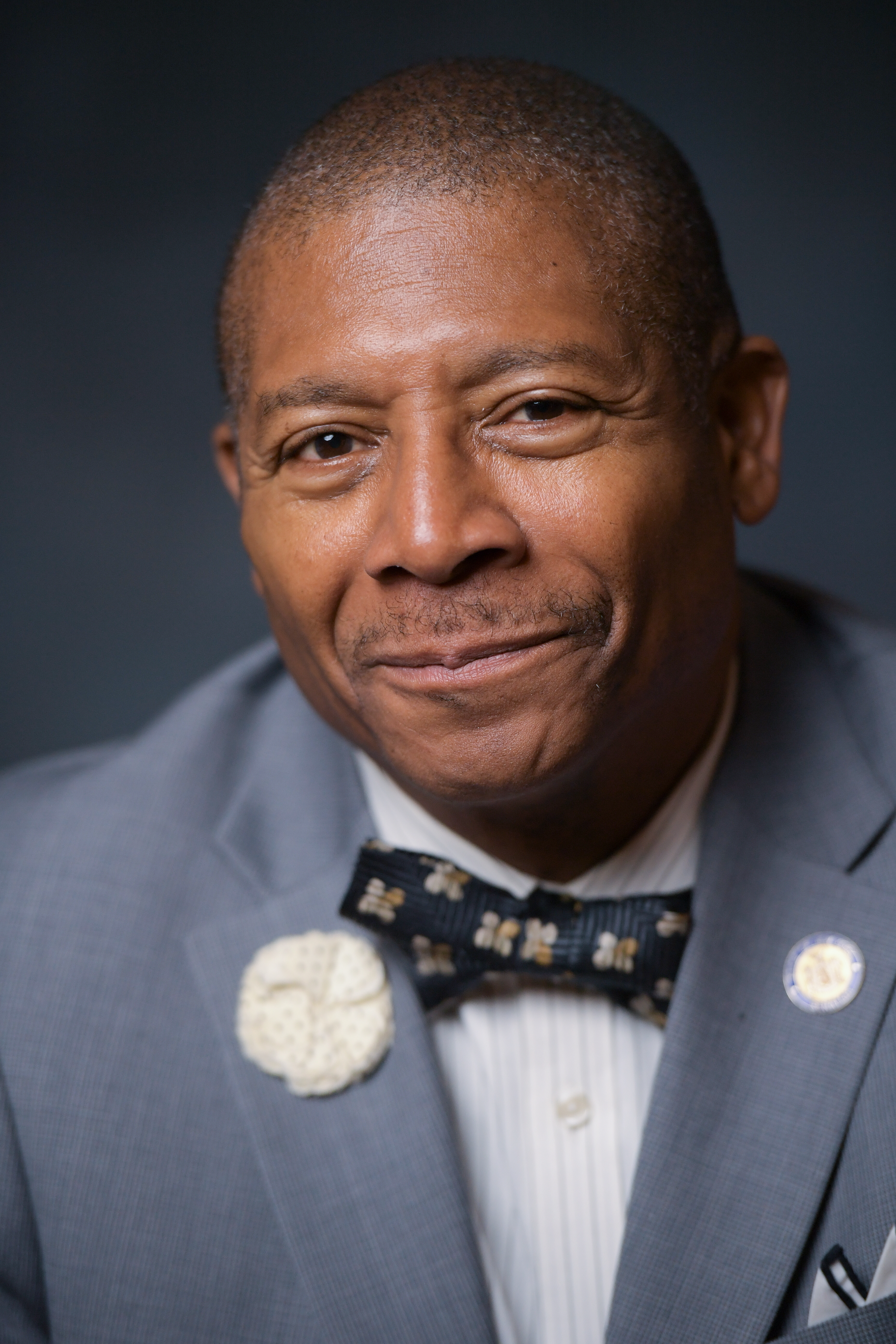

Sponsored By

(D, WF) Senate District

Archive: Last Bill Status - In Senate Committee Budget And Revenue Committee

Actions

Votes

co-Sponsors

(D, WF) 31st Senate District

(D, WF) 13th Senate District

(D, WF) 33rd Senate District

(D) 10th Senate District

2023-S2556 (ACTIVE) - Details

2023-S2556 (ACTIVE) - Sponsor Memo

BILL NUMBER: S2556

SPONSOR: HOYLMAN-SIGAL

TITLE OF BILL:

An act to amend the tax law, in relation to the imposition of sales and

compensating use taxes with respect to certain aircraft; and to repeal

paragraph 21-a of subdivision (a) of section 1115 of the tax law, relat-

ing thereto

PURPOSE OF BILL:

The purpose of this legislation is to reinstate the sales and compensat-

ing use taxes on private, non-commercial aircraft.

SUMMARY OF SPECIFIC PROVISIONS:

Section 1 of the bill amends paragraph (A) of subdivision (i) of section

1111 of the tax law ("Special rules for computing receipts and consider-

ation"), as added by section 1 of part TT of chapter 59 of the laws of

2015, to restore language pertaining to non-commercial aircraft that was

struck from this section of law in 2015.

2023-S2556 (ACTIVE) - Bill Text download pdf

S T A T E O F N E W Y O R K

________________________________________________________________________

2556

2023-2024 Regular Sessions

I N S E N A T E

January 23, 2023

___________

Introduced by Sens. HOYLMAN-SIGAL, JACKSON, RAMOS, RIVERA, SANDERS --

read twice and ordered printed, and when printed to be committed to

the Committee on Budget and Revenue

AN ACT to amend the tax law, in relation to the imposition of sales and

compensating use taxes with respect to certain aircraft; and to repeal

paragraph 21-a of subdivision (a) of section 1115 of the tax law,

relating thereto

THE PEOPLE OF THE STATE OF NEW YORK, REPRESENTED IN SENATE AND ASSEM-

BLY, DO ENACT AS FOLLOWS:

Section 1. Paragraph (A) of subdivision (i) of section 1111 of the tax

law, as added by section 1 of part TT of chapter 59 of the laws of 2015,

is amended to read as follows:

(A) Notwithstanding any contrary provisions of this article or other

law, with respect to any lease for a term of one year or more of (1) a

motor vehicle, as defined in section one hundred twenty-five of the

vehicle and traffic law, with a gross vehicle weight of ten thousand

pounds or less, [or] (2) a vessel, as defined in section twenty-two

hundred fifty of such law (including any inboard or outboard motor and

any trailer, as defined in section one hundred fifty-six of such law,

leased in conjunction with such a vessel) OR (3) NONCOMMERCIAL AIRCRAFT

HAVING A SEATING CAPACITY OF LESS THAN TWENTY PASSENGERS AND A MAXIMUM

CAPACITY OF LESS THAN SIX THOUSAND POUNDS, or an option to renew such a

lease or a similar contractual provision, all receipts due or consider-

ation given or contracted to be given for such property under and for

the entire period of such lease, option to renew or similar provision,

or combination of them, shall be deemed to have been paid or given and

shall be subject to tax, and any such tax due shall be collected, as of

the date of first payment under such lease, option to renew or similar

provision, or combination of them, or as of the date of registration of

such property with the commissioner of motor vehicles, whichever is

earlier. Notwithstanding any inconsistent provisions of subdivision (b)

EXPLANATION--Matter in ITALICS (underscored) is new; matter in brackets

[ ] is old law to be omitted.

LBD04834-01-3

Comments

Open Legislation is a forum for New York State legislation. All comments are subject to review and community moderation is encouraged.

Comments deemed off-topic, commercial, campaign-related, self-promotional; or that contain profanity, hate or toxic speech; or that link to sites outside of the nysenate.gov domain are not permitted, and will not be published. Attempts to intimidate and silence contributors or deliberately deceive the public, including excessive or extraneous posting/posts, or coordinated activity, are prohibited and may result in the temporary or permanent banning of the user. Comment moderation is generally performed Monday through Friday. By contributing or voting you agree to the Terms of Participation and verify you are over 13.

Create an account. An account allows you to sign petitions with a single click, officially support or oppose key legislation, and follow issues, committees, and bills that matter to you. When you create an account, you agree to this platform's terms of participation.